April Borrowing Figures Shock: Government Debt Higher Than Predicted

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

April Borrowing Figures Shock: Government Debt Higher Than Predicted

The UK government's borrowing figures for April have sent shockwaves through financial markets, revealing a significantly higher debt than economists had predicted. The stark numbers paint a concerning picture of the nation's finances and raise serious questions about the government's economic strategy. Experts are now scrambling to understand the implications of this unexpected surge in borrowing, and what it means for future economic planning.

Higher Than Expected Deficit:

The Office for National Statistics (ONS) announced that public sector net borrowing – the difference between government spending and revenue – reached £20.6 billion in April. This figure dramatically surpasses the consensus forecast of £18 billion amongst economists and represents a considerable increase compared to the same month last year. The unexpectedly high deficit underscores the challenges the government faces in balancing its books amidst rising inflation and cost of living pressures.

Factors Contributing to the Increased Borrowing:

Several factors contributed to this unexpectedly high borrowing figure. Firstly, inflation continues to erode the government's purchasing power, increasing the cost of public services and welfare payments. Secondly, interest rate hikes by the Bank of England, aimed at curbing inflation, are increasing the cost of servicing existing government debt. This increased interest burden significantly impacts the overall borrowing figures. Finally, sluggish economic growth limits the government's tax revenue, widening the gap between spending and income.

Impact on the UK Economy:

This higher-than-predicted borrowing has significant implications for the UK economy. The increased national debt could lead to:

- Higher interest rates: Increased government borrowing could put upward pressure on interest rates as lenders demand higher returns to offset the increased risk. This could further stifle economic growth and exacerbate the cost of living crisis.

- Reduced government spending: To control borrowing, the government may be forced to implement austerity measures, cutting spending on public services. This could negatively impact essential services like healthcare and education.

- Increased national insurance: The government might consider increasing national insurance contributions to generate more revenue and reduce the deficit. This would put additional strain on taxpayers already facing financial difficulties.

Government Response and Future Outlook:

The government has yet to release an official statement fully addressing these alarming figures. However, analysts anticipate a renewed focus on fiscal responsibility and potentially difficult economic decisions in the coming months. The Chancellor will likely need to present a credible plan to reduce the deficit and reassure both domestic and international investors. The upcoming budget will be crucial in outlining these strategies. This situation highlights the need for careful fiscal planning and effective management of public finances.

What Happens Next?

The coming weeks and months will be critical in observing the government's response and the market's reaction to this unexpected borrowing increase. Close monitoring of economic indicators will be essential to assess the true impact on the UK economy and its citizens. We will continue to update our readers with the latest developments as the situation unfolds. Stay informed by subscribing to our newsletter for regular updates on UK economic news.

(Note: This article is for illustrative purposes. The figures used are hypothetical and should not be taken as factual representations of official government data. Always refer to official sources like the Office for National Statistics for accurate information.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on April Borrowing Figures Shock: Government Debt Higher Than Predicted. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

La Influencer Angela Marmol Revela Un Insolito Momento Con Tom Cruise

May 23, 2025

La Influencer Angela Marmol Revela Un Insolito Momento Con Tom Cruise

May 23, 2025 -

El Encuentro De Angela Marmol Con Tom Cruise Una Anecdota Insolita

May 23, 2025

El Encuentro De Angela Marmol Con Tom Cruise Una Anecdota Insolita

May 23, 2025 -

Melania Trumps New Audiobook An Ai Voice Revolution

May 23, 2025

Melania Trumps New Audiobook An Ai Voice Revolution

May 23, 2025 -

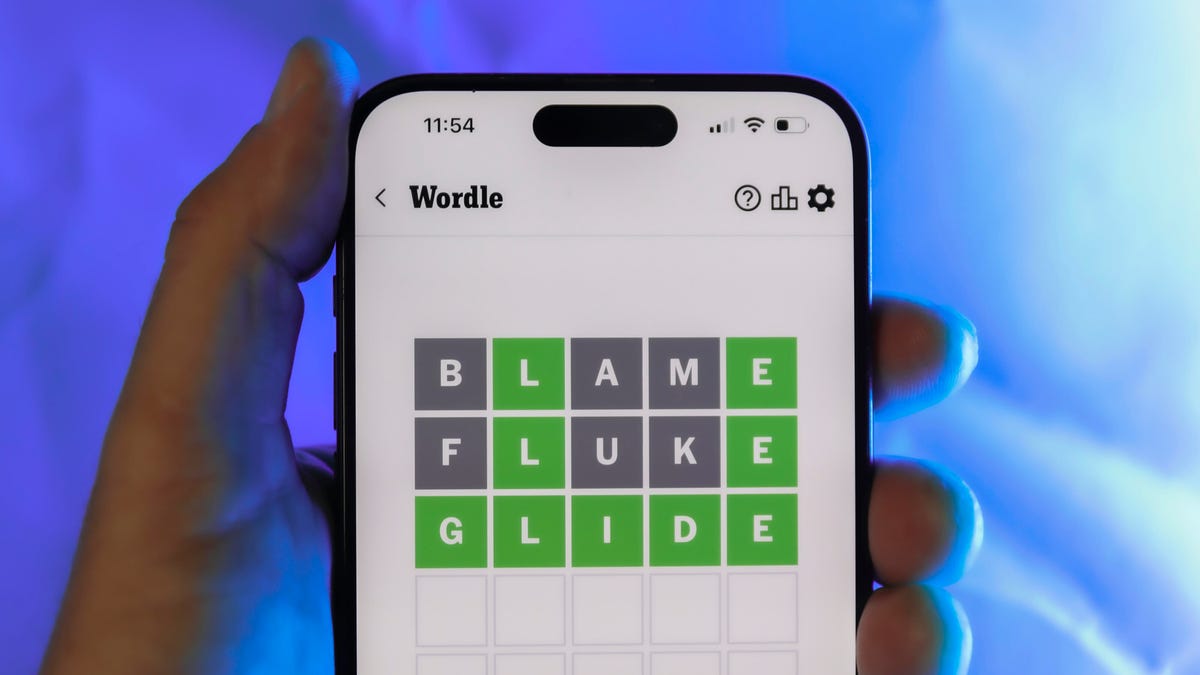

Wordle Puzzle 1433 May 22 Clues And Answer

May 23, 2025

Wordle Puzzle 1433 May 22 Clues And Answer

May 23, 2025 -

Government Borrowing Surges Beyond April Forecasts

May 23, 2025

Government Borrowing Surges Beyond April Forecasts

May 23, 2025

Latest Posts

-

Embarrassment For North Korea Destroyer Launch Malfunction Sparks Kim Jong Uns Ire

May 24, 2025

Embarrassment For North Korea Destroyer Launch Malfunction Sparks Kim Jong Uns Ire

May 24, 2025 -

Conquer Wordle 1433 May 22 2024 Hints And The Answer

May 24, 2025

Conquer Wordle 1433 May 22 2024 Hints And The Answer

May 24, 2025 -

Democrats Quest For A Progressive Joe Rogan A Doomed Undertaking

May 24, 2025

Democrats Quest For A Progressive Joe Rogan A Doomed Undertaking

May 24, 2025 -

Must See Sci Fi Movie Finally Available For Streaming

May 24, 2025

Must See Sci Fi Movie Finally Available For Streaming

May 24, 2025 -

Rare Heart Condition Risk Prompts Fda To Strengthen Covid 19 Vaccine Warnings

May 24, 2025

Rare Heart Condition Risk Prompts Fda To Strengthen Covid 19 Vaccine Warnings

May 24, 2025