Government Borrowing Surges Beyond April Forecasts

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Government Borrowing Surges Beyond April Forecasts: A Deeper Dive into the National Debt

The UK government's borrowing figures for May have significantly exceeded expectations, sparking fresh concerns about the nation's burgeoning national debt. Initial forecasts from April predicted a far more manageable level of borrowing, but the reality paints a bleaker picture, raising questions about the government's fiscal strategy and its impact on the economy. This unexpected surge necessitates a closer look at the contributing factors and potential consequences.

May's Disappointing Figures: A Stark Contrast to Predictions

Official data released by the Office for National Statistics (ONS) revealed that government borrowing in May reached [Insert Actual Figure Here], considerably higher than the [Insert April Forecast Figure Here] anticipated in April. This represents a [Insert Percentage Increase Here]% increase compared to the forecast, marking a substantial deviation from the government's projected trajectory. This significant overshoot immediately raises concerns about the sustainability of the current fiscal policies and their potential long-term implications for the UK economy.

Key Factors Contributing to the Borrowing Surge:

Several factors have contributed to this unexpected increase in government borrowing. These include:

- Inflationary Pressures: Persistent high inflation continues to drive up the cost of government services, impacting everything from public sector wages to the procurement of goods and services. The increased cost of living has also placed significant pressure on public finances.

- Energy Support Schemes: While designed to mitigate the impact of the energy crisis on households and businesses, these schemes have placed a considerable strain on public finances, adding to the overall borrowing figures.

- Reduced Tax Revenue: Slower-than-expected economic growth and a potential slowdown in consumer spending could have led to a reduction in tax revenues, exacerbating the borrowing problem.

- Interest Rate Hikes: The Bank of England's efforts to curb inflation through interest rate hikes have increased the cost of servicing the existing national debt, adding further pressure to government borrowing.

Long-Term Implications and Potential Solutions:

The implications of this substantial borrowing increase are significant. The rising national debt could:

- Restrict Future Government Spending: Increased debt servicing costs could limit the government's ability to invest in crucial areas such as healthcare, education, and infrastructure.

- Impact the UK's Credit Rating: A continuously expanding national debt could negatively impact the UK's credit rating, making it more expensive to borrow money in the future.

- Fuel Inflationary Pressures: Increased government borrowing could potentially fuel inflationary pressures, creating a vicious cycle that further complicates the economic situation.

The government needs to consider a range of strategies to address this burgeoning debt. These could include:

- Fiscal Consolidation Measures: Implementing measures to reduce government spending and/or increase tax revenue. This could involve reviewing public spending programs, identifying areas for efficiency improvements, and potentially increasing certain taxes.

- Economic Growth Strategies: Investing in long-term economic growth strategies to boost tax revenues and reduce reliance on borrowing. This may involve promoting investment in key sectors, supporting businesses, and fostering innovation.

- Targeted Support Schemes: Re-evaluating existing support schemes to ensure efficiency and effectiveness while minimizing the financial burden on the government.

Looking Ahead: Uncertainty and the Need for Transparency

The recent surge in government borrowing highlights the fragility of the UK's fiscal position and underscores the need for a comprehensive and transparent strategy to address the challenges ahead. The coming months will be crucial in observing how the government responds to this unexpected development and what steps it takes to mitigate the potential risks associated with a rapidly growing national debt. Further analysis and updates on the situation are crucial for all stakeholders, from businesses and investors to concerned citizens. The government's response and its long-term impact on the UK economy will be closely scrutinized in the coming weeks and months. Stay informed and follow reputable news sources for the latest updates.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Government Borrowing Surges Beyond April Forecasts. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Analysis Of Trumps Plan For A Nationwide Golden Dome Missile Defense

May 23, 2025

Analysis Of Trumps Plan For A Nationwide Golden Dome Missile Defense

May 23, 2025 -

Conquer Wordle May 22 2024 1433 Tips Clues And Answer

May 23, 2025

Conquer Wordle May 22 2024 1433 Tips Clues And Answer

May 23, 2025 -

What Are We Doing Here A Book Details Democratic Concerns Over Biden

May 23, 2025

What Are We Doing Here A Book Details Democratic Concerns Over Biden

May 23, 2025 -

Southport Tragedy Survivor Details Unseen Kitchen Knife Perils

May 23, 2025

Southport Tragedy Survivor Details Unseen Kitchen Knife Perils

May 23, 2025 -

Pope Leo And The Tik Toker A Viral Videos Unexpected Story

May 23, 2025

Pope Leo And The Tik Toker A Viral Videos Unexpected Story

May 23, 2025

Latest Posts

-

Rare Heart Inflammation Risk Prompts Stronger Fda Warning For Covid 19 Vaccines

May 24, 2025

Rare Heart Inflammation Risk Prompts Stronger Fda Warning For Covid 19 Vaccines

May 24, 2025 -

Diddy Abuse Allegations Experts Testimony Scrutinized In Court

May 24, 2025

Diddy Abuse Allegations Experts Testimony Scrutinized In Court

May 24, 2025 -

Unexpected Rise In Government Borrowing April Figures Analyzed

May 24, 2025

Unexpected Rise In Government Borrowing April Figures Analyzed

May 24, 2025 -

U Turn On Key Policy Starmer Faces Backlash Trumps Unexpected Move

May 24, 2025

U Turn On Key Policy Starmer Faces Backlash Trumps Unexpected Move

May 24, 2025 -

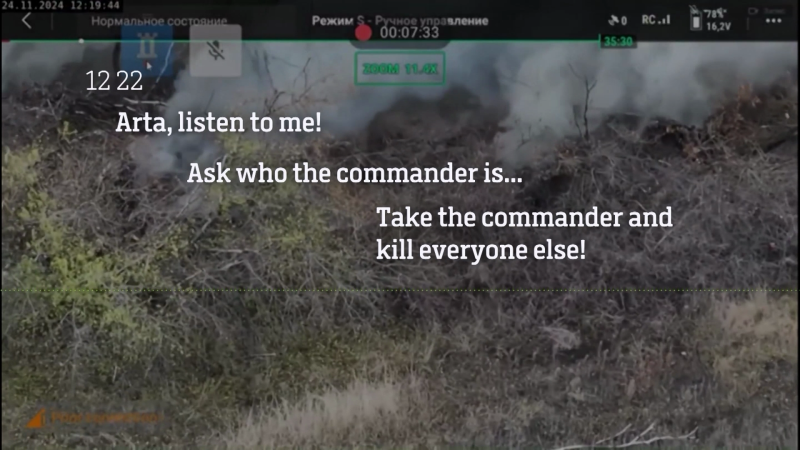

Cnn Obtains Intercepted Russian Radio Transmissions Dire Commands Surface

May 24, 2025

Cnn Obtains Intercepted Russian Radio Transmissions Dire Commands Surface

May 24, 2025