AVGO Stock Outlook: Analyst And Trader Expectations After Earnings Report

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

AVGO Stock Outlook: Analyst and Trader Expectations After Earnings Report

Broadcom (AVGO) surged after its latest earnings report, but what's the outlook for investors? Analysts and traders have differing opinions, making this a crucial time for anyone holding or considering AVGO stock. The semiconductor giant exceeded expectations, fueling a significant price jump, but will this momentum continue? Let's delve into the post-earnings analysis and explore the potential future of AVGO.

The recent earnings report showcased Broadcom's strong performance across its key segments, solidifying its position as a dominant player in the semiconductor industry. However, the market's reaction isn't always a clear indicator of long-term performance. While the immediate post-earnings surge is encouraging, understanding the nuances of analyst forecasts and trader sentiment is vital for informed investment decisions.

Analyst Predictions: A Mixed Bag

Following the earnings release, analysts have offered a range of opinions on AVGO's future trajectory. Some maintain a bullish outlook, citing Broadcom's robust financial results and strategic acquisitions as drivers for continued growth. They highlight the company's diversification across various sectors, minimizing reliance on any single market segment. These analysts often point to the growing demand for semiconductors in key areas like 5G infrastructure, artificial intelligence, and data centers as key growth catalysts.

However, other analysts express a more cautious approach. Concerns linger about potential economic slowdowns and the cyclical nature of the semiconductor industry. Furthermore, the intensifying competition within the sector presents a challenge. These analysts often suggest that while the current performance is impressive, investors should remain vigilant and consider the broader macroeconomic landscape.

Key Analyst Takeaways:

- Bullish analysts emphasize strong financials, diversification, and robust demand in key growth sectors.

- Bearish analysts highlight potential economic headwinds, industry competition, and cyclical market risks.

- Consensus: While opinions diverge, the overall sentiment leans towards positive, but with a cautious approach.

Trader Sentiment: Short-Term Volatility Expected

Trader sentiment following the earnings report is characterized by a mix of excitement and uncertainty. Short-term price volatility is anticipated, with some traders looking to capitalize on the immediate post-earnings rally, while others may adopt a wait-and-see approach. Technical analysis plays a significant role in short-term trading strategies, with key support and resistance levels being closely monitored.

The options market provides further insight into trader sentiment. Implied volatility, a measure of expected price swings, often increases following significant earnings announcements. This suggests that traders anticipate further price fluctuations in the near term.

Trader Considerations:

- Short-term gains: Some traders aim to profit from the immediate price movements.

- Volatility trading: Others focus on exploiting price swings through options strategies.

- Long-term holding: Many long-term investors remain confident in AVGO's long-term potential.

The Bottom Line: A Cautiously Optimistic Outlook

While the recent earnings report painted a positive picture for Broadcom, investors should approach AVGO stock with a balanced perspective. The combination of strong fundamentals and potential market risks creates a scenario ripe for both significant gains and potential losses. Thorough due diligence, including considering both analyst predictions and trader sentiment, is essential before making any investment decisions. Stay informed by following reputable financial news sources and consulting with a qualified financial advisor.

Disclaimer: This article provides general information and should not be considered financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on AVGO Stock Outlook: Analyst And Trader Expectations After Earnings Report. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jannik Sinner Opens Up About His Alcaraz Losses Before Potential French Open Meeting

Jun 05, 2025

Jannik Sinner Opens Up About His Alcaraz Losses Before Potential French Open Meeting

Jun 05, 2025 -

Us Job Growth Stalls Private Sector Adds Only 37 000 Jobs In May

Jun 05, 2025

Us Job Growth Stalls Private Sector Adds Only 37 000 Jobs In May

Jun 05, 2025 -

Why This Former Nfl And Penn State Stars Jersey Is At The Smithsonian

Jun 05, 2025

Why This Former Nfl And Penn State Stars Jersey Is At The Smithsonian

Jun 05, 2025 -

Villanova Wildcats Football Joins Patriot League In 2026

Jun 05, 2025

Villanova Wildcats Football Joins Patriot League In 2026

Jun 05, 2025 -

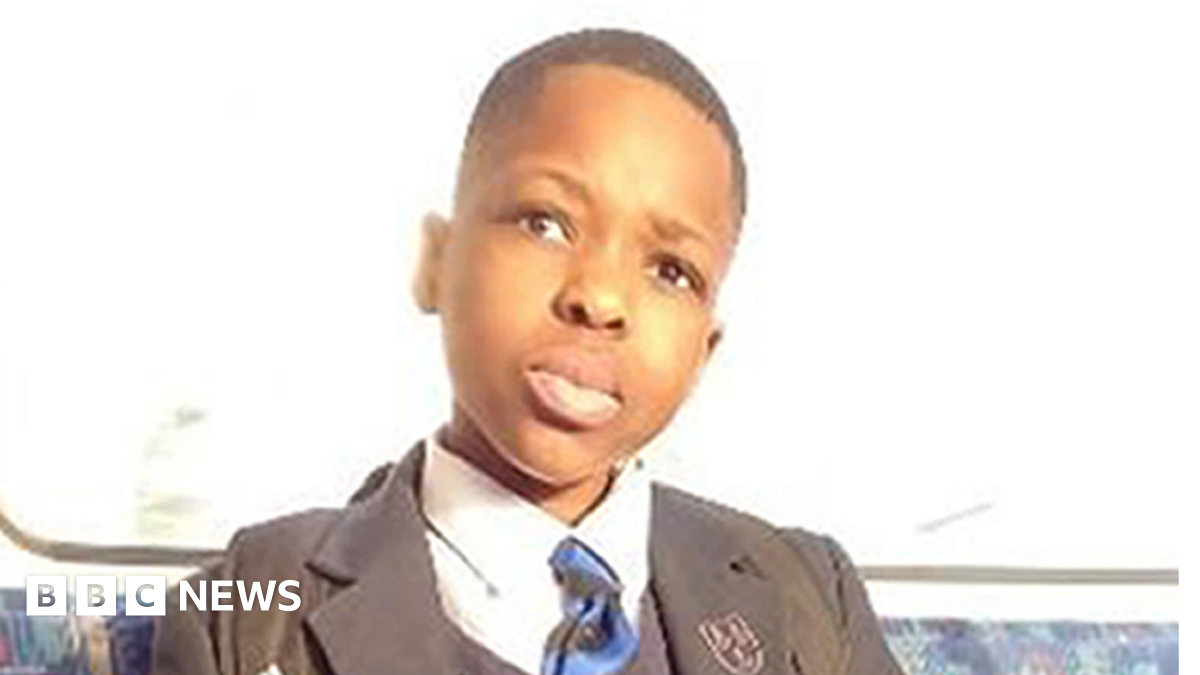

Daniel Anjorin Murder Case Prosecution Presents Evidence Of Monzos Intent

Jun 05, 2025

Daniel Anjorin Murder Case Prosecution Presents Evidence Of Monzos Intent

Jun 05, 2025

Latest Posts

-

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025 -

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025 -

The Untold Story Of A Wwii Veteran A Vj Day Memory That Moved Queen Camilla

Aug 17, 2025

The Untold Story Of A Wwii Veteran A Vj Day Memory That Moved Queen Camilla

Aug 17, 2025 -

Battlefield 6 Map Size Controversy Players React To Latest Mini Map

Aug 17, 2025

Battlefield 6 Map Size Controversy Players React To Latest Mini Map

Aug 17, 2025 -

Smaller Maps Spark Outrage In Battlefield 6s Rush Mode

Aug 17, 2025

Smaller Maps Spark Outrage In Battlefield 6s Rush Mode

Aug 17, 2025