Birmingham Capital Management (AL) Adjusts Portfolio, Sells 20,850 Bank Of America Shares

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Birmingham Capital Management (AL) Adjusts Portfolio, Sells 20,850 Bank of America Shares

Birmingham, AL – October 26, 2023 – Birmingham Capital Management, a prominent Alabama-based investment firm, recently announced a significant adjustment to its portfolio, revealing the sale of 20,850 shares of Bank of America Corporation (BAC). This move has sparked interest within the financial community, prompting questions about the firm's investment strategy and future market outlook.

The sale, disclosed in a recent SEC filing, represents a notable shift in Birmingham Capital Management's holdings. While the exact reasons behind the divestment haven't been publicly articulated by the firm, several market analysts speculate on potential contributing factors.

Potential Reasons Behind the Sale

Several factors could have influenced Birmingham Capital Management's decision to sell its Bank of America shares. These include:

-

Profit-Taking: The recent performance of Bank of America stock might have presented a lucrative opportunity for profit-taking. If the firm purchased the shares at a lower price, selling at a higher point allows them to secure gains and reinvest elsewhere.

-

Portfolio Rebalancing: Investment firms routinely rebalance their portfolios to maintain a desired asset allocation. The sale of Bank of America shares could be part of a broader strategy to diversify holdings or adjust exposure to the financial sector.

-

Market Outlook: Changes in the broader economic landscape and predictions for the future performance of the financial sector could have prompted the firm to reduce its exposure to Bank of America. Concerns about rising interest rates, inflation, or a potential economic slowdown might play a role.

-

Investment Opportunities Elsewhere: Birmingham Capital Management may have identified more attractive investment opportunities elsewhere, leading them to reallocate capital from Bank of America. This could involve shifting to other sectors, or investing in companies perceived as having higher growth potential.

Implications for Investors

This development underscores the dynamic nature of the investment landscape and highlights the importance of diligent portfolio management. For investors, the sale serves as a reminder that even seemingly stable blue-chip stocks are subject to adjustments based on evolving market conditions and individual investment strategies. It reinforces the need to conduct thorough due diligence and potentially diversify one's own portfolio across various asset classes to mitigate risk.

Birmingham Capital Management's Investment Philosophy

While Birmingham Capital Management hasn't publicly commented on the specific reasons for the sale, understanding their overall investment philosophy can provide some context. Researching their previous investment decisions and public statements (if available) may offer further insight into their strategic thinking. Understanding their risk tolerance and long-term goals can help investors better understand their decision-making process.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Keywords: Birmingham Capital Management, Bank of America, BAC, stock sale, portfolio adjustment, investment strategy, SEC filing, Alabama investments, financial news, market analysis, investment portfolio, stock market, portfolio diversification, financial sector.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Birmingham Capital Management (AL) Adjusts Portfolio, Sells 20,850 Bank Of America Shares. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Macron Et Brigitte Au Vietnam Un Simple Differend Conjugal Selon L Entourage Presidentiel

May 27, 2025

Macron Et Brigitte Au Vietnam Un Simple Differend Conjugal Selon L Entourage Presidentiel

May 27, 2025 -

Is Sirius Xm Holdings Stock Right For Your Portfolio

May 27, 2025

Is Sirius Xm Holdings Stock Right For Your Portfolio

May 27, 2025 -

Investing In Sirius Xm Holdings Weighing The Potential For Future Gains

May 27, 2025

Investing In Sirius Xm Holdings Weighing The Potential For Future Gains

May 27, 2025 -

Ai Sentience A Technological And Philosophical Exploration

May 27, 2025

Ai Sentience A Technological And Philosophical Exploration

May 27, 2025 -

Two Sigma Investments Holds 236 55 Million In Bank Of America Bac Stock

May 27, 2025

Two Sigma Investments Holds 236 55 Million In Bank Of America Bac Stock

May 27, 2025

Latest Posts

-

Fake Text Message From Ga Department Of Driver Services Is It A Scam

May 28, 2025

Fake Text Message From Ga Department Of Driver Services Is It A Scam

May 28, 2025 -

Thames Valley Police Man Charged In Crash That Injured Officer

May 28, 2025

Thames Valley Police Man Charged In Crash That Injured Officer

May 28, 2025 -

See Through Style Alexandra Daddarios Daring Dress Choice

May 28, 2025

See Through Style Alexandra Daddarios Daring Dress Choice

May 28, 2025 -

Are Americans Still Welcome In Canada Canadians Weigh In

May 28, 2025

Are Americans Still Welcome In Canada Canadians Weigh In

May 28, 2025 -

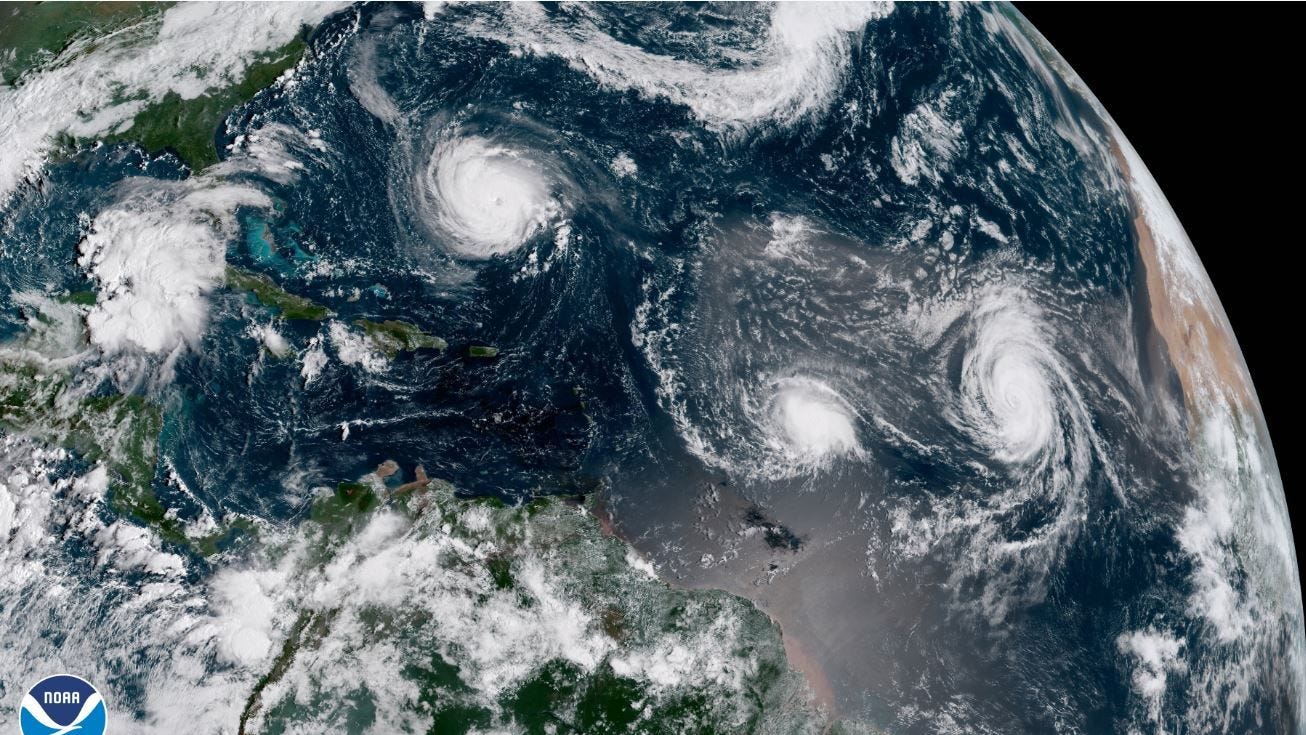

Preparing For The 2025 Hurricane Season Answers To Key Questions

May 28, 2025

Preparing For The 2025 Hurricane Season Answers To Key Questions

May 28, 2025