Birmingham Capital Management Co. Inc. (AL) Disposes Of 20,850 Bank Of America Shares

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Birmingham Capital Management Co. Inc. (AL) Sheds Bank of America Stake: What Does It Mean?

Birmingham, AL – October 26, 2023 – Birmingham Capital Management Co. Inc. (AL), a prominent investment firm based in Alabama, recently reduced its holdings in Bank of America Corporation (BAC), according to a recent SEC filing. The firm disposed of 20,850 shares of the financial giant, sparking questions about the investment strategy and potential market implications. This move follows a period of fluctuating performance for Bank of America and the broader financial sector.

This significant divestment warrants a closer look at Birmingham Capital Management's portfolio adjustments and what it could signal for Bank of America's future prospects.

Birmingham Capital Management Co. Inc.: A Closer Look

Birmingham Capital Management Co. Inc. is a respected investment management firm with a history of strategic portfolio decisions. While the specifics of their investment philosophy aren't publicly detailed, this recent transaction highlights their active approach to managing assets. Understanding their overall investment strategy is crucial to interpreting the significance of this specific share disposal. Further research into their other holdings could provide valuable context. (Note: Further information on Birmingham Capital Management's investment strategy is unavailable through public sources at this time.)

Why the Bank of America Share Reduction?

The reasons behind Birmingham Capital Management's decision to reduce its Bank of America holdings remain unclear without an official statement from the firm. However, several potential factors could be at play:

- Profit-Taking: The firm may have decided to capitalize on potential gains, selling shares after a period of price appreciation.

- Portfolio Rebalancing: This move could be part of a broader rebalancing strategy, shifting assets to other sectors deemed more promising for future growth.

- Market Outlook: Concerns about the overall economic climate or specific challenges facing Bank of America could have prompted the sale. Rising interest rates and potential recessionary pressures are significant factors impacting the financial sector.

- Investment Opportunity Elsewhere: The firm may have identified more attractive investment opportunities elsewhere, prompting a reallocation of capital.

Implications for Bank of America

While a single firm's divestment doesn't necessarily indicate a major shift in Bank of America's overall performance, it does contribute to the broader market narrative. It's crucial to consider this alongside other market indicators and financial news related to Bank of America. Investors should consult financial experts and conduct thorough research before making any investment decisions.

What to Watch For

Following this news, investors and market analysts will be closely monitoring:

- Future SEC filings from Birmingham Capital Management: Any further adjustments to their holdings will offer additional insights into their investment strategy.

- Bank of America's Q4 earnings report: This report will provide further clarity on the bank's financial health and future projections.

- Overall market trends: The performance of the broader financial sector will also influence the perception of Bank of America's stock.

This development underscores the dynamic nature of the investment landscape and highlights the importance of staying informed about market trends and individual company performance. While we can speculate on the reasons behind Birmingham Capital Management’s decision, only time will reveal the full implications of this significant share disposal. Stay tuned for further updates as this story unfolds.

Keywords: Birmingham Capital Management, Bank of America, BAC, SEC filing, stock sale, investment strategy, portfolio rebalancing, financial news, market analysis, investment opportunities, economic outlook, stock market, Alabama

(Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult a financial professional before making any investment decisions.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Birmingham Capital Management Co. Inc. (AL) Disposes Of 20,850 Bank Of America Shares. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Photos De Macron Et Brigitte Au Vietnam Dementi Formel De L Elysee

May 27, 2025

Photos De Macron Et Brigitte Au Vietnam Dementi Formel De L Elysee

May 27, 2025 -

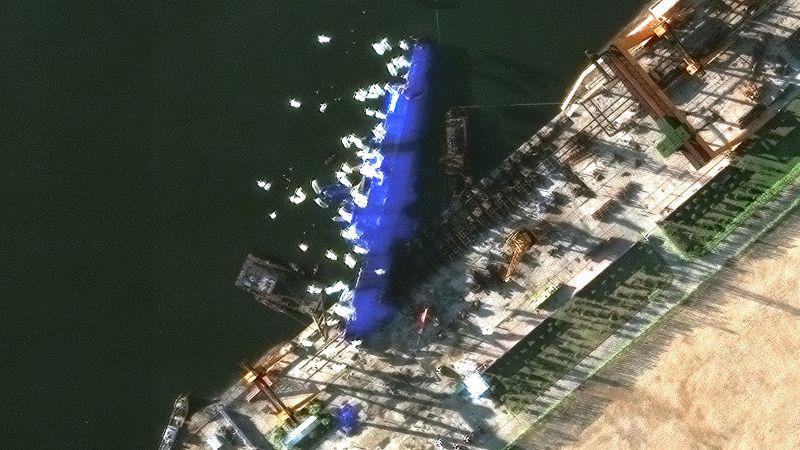

Images Reveal North Koreas Shielded Warship After Launch Failure Four Arrested

May 27, 2025

Images Reveal North Koreas Shielded Warship After Launch Failure Four Arrested

May 27, 2025 -

The Uncomfortable Truth Anson Mounts Most Difficult Star Trek Strange New Worlds Moment

May 27, 2025

The Uncomfortable Truth Anson Mounts Most Difficult Star Trek Strange New Worlds Moment

May 27, 2025 -

Birmingham Capital Management Offloads Bank Of America Shares A Detailed Look

May 27, 2025

Birmingham Capital Management Offloads Bank Of America Shares A Detailed Look

May 27, 2025 -

Giancarlo Stanton Injury Latest Update From The Yankees

May 27, 2025

Giancarlo Stanton Injury Latest Update From The Yankees

May 27, 2025

Latest Posts

-

Jerusalem Explodes Ultra Nationalist March Triggers Violent Confrontations

May 28, 2025

Jerusalem Explodes Ultra Nationalist March Triggers Violent Confrontations

May 28, 2025 -

Propane Leak Causes Truck Explosion Multiple Homes Damaged

May 28, 2025

Propane Leak Causes Truck Explosion Multiple Homes Damaged

May 28, 2025 -

Trumps Furious Attack On Harvard Dissecting The Maga Fundraising Fraud

May 28, 2025

Trumps Furious Attack On Harvard Dissecting The Maga Fundraising Fraud

May 28, 2025 -

Liverpool Fc Parade Key Facts And Ongoing Investigations

May 28, 2025

Liverpool Fc Parade Key Facts And Ongoing Investigations

May 28, 2025 -

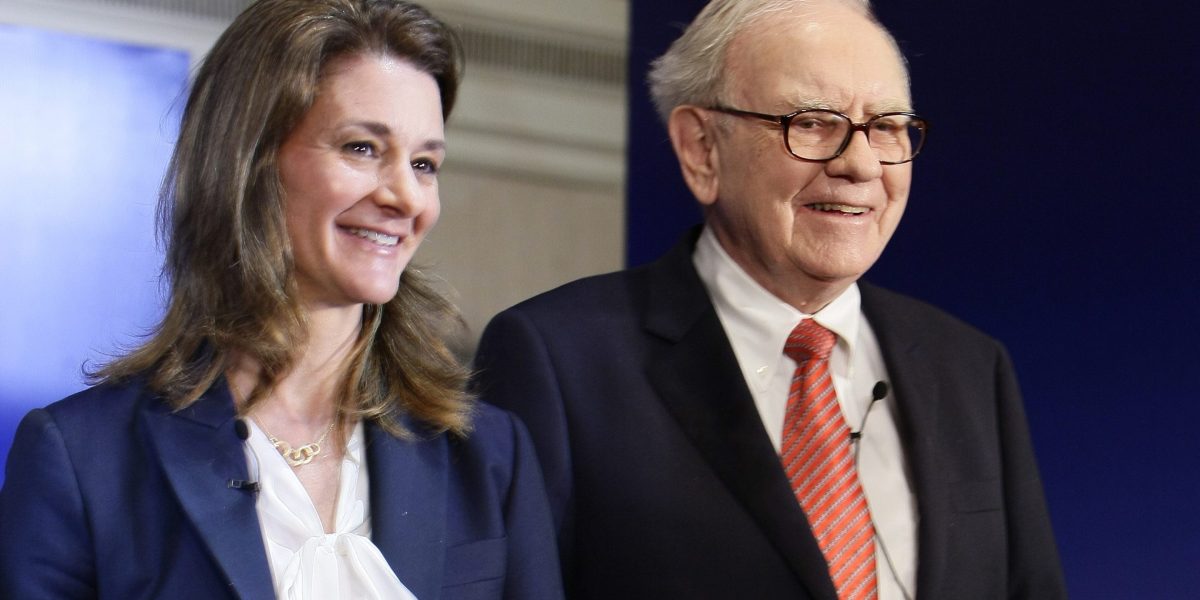

600 Billion Pledge The Future Of Billionaire Philanthropy After Gates And Buffett

May 28, 2025

600 Billion Pledge The Future Of Billionaire Philanthropy After Gates And Buffett

May 28, 2025