Bitcoin ETF Investment Explodes: Over $5 Billion Poured In

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin ETF Investment Explodes: Over $5 Billion Poured In

The world of finance is buzzing. In a monumental surge of investor confidence, over $5 billion has poured into Bitcoin exchange-traded funds (ETFs) in a remarkably short timeframe. This unprecedented influx of capital marks a significant turning point for Bitcoin and the broader cryptocurrency market, signaling a potential mainstream acceptance previously unseen.

This massive investment isn't just a fleeting trend; it represents a fundamental shift in how institutional and individual investors perceive Bitcoin. For years, the cryptocurrency landscape was viewed with a mix of skepticism and excitement. Now, the availability of regulated Bitcoin ETFs, offering a more accessible and familiar investment vehicle, is clearly driving this explosive growth.

What's Fueling This Bitcoin ETF Boom?

Several factors contribute to this extraordinary investment surge:

-

Regulatory Approvals: The recent approval of Bitcoin ETFs in major markets like the United States has significantly boosted investor confidence. This regulatory clarity reduces perceived risk and opens the door for a wider range of investors, including those previously hesitant due to regulatory uncertainty. The SEC's approval, for example, was a pivotal moment.

-

Institutional Adoption: Large institutional investors, such as pension funds and hedge funds, are increasingly allocating assets to Bitcoin ETFs. This is a significant indicator of growing mainstream acceptance and reflects a diversification strategy into alternative assets. Their involvement legitimizes Bitcoin as a viable investment option.

-

Inflation Hedge: With persistent inflation concerns globally, Bitcoin, often viewed as a hedge against inflation, is becoming increasingly attractive to investors seeking to preserve their purchasing power. Its decentralized nature and finite supply are key factors in this perception.

-

Ease of Access: Bitcoin ETFs provide a straightforward and regulated pathway for investors to gain exposure to Bitcoin without the complexities of directly managing cryptocurrency wallets and exchanges. This accessibility lowers the barrier to entry for many potential investors.

Looking Ahead: The Future of Bitcoin ETFs

The current investment surge suggests a bright future for Bitcoin ETFs. However, it's crucial to understand that the cryptocurrency market remains volatile. While ETFs offer a degree of regulation and accessibility, inherent market risks remain.

Several key developments will shape the future landscape:

-

Further Regulatory Developments: Further regulatory approvals and clarifications in different jurisdictions will continue to influence investor confidence and participation.

-

Competition and Innovation: The growing popularity of Bitcoin ETFs will likely lead to increased competition and innovation within the market, potentially offering investors a wider range of products and services.

-

Price Volatility: Bitcoin's price remains subject to significant volatility, highlighting the inherent risk associated with investing in cryptocurrencies.

Investing in Bitcoin ETFs: A Word of Caution

While the current surge in investment is exciting, potential investors should proceed with caution. Conduct thorough research, understand the risks involved, and consider diversifying your investment portfolio. Consult with a qualified financial advisor before making any investment decisions. Never invest more than you can afford to lose.

Learn More:

For further information on Bitcoin and the cryptocurrency market, we recommend exploring resources such as [link to a reputable financial news source] and [link to a cryptocurrency educational website]. Staying informed is crucial in navigating this dynamic investment landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin ETF Investment Explodes: Over $5 Billion Poured In. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

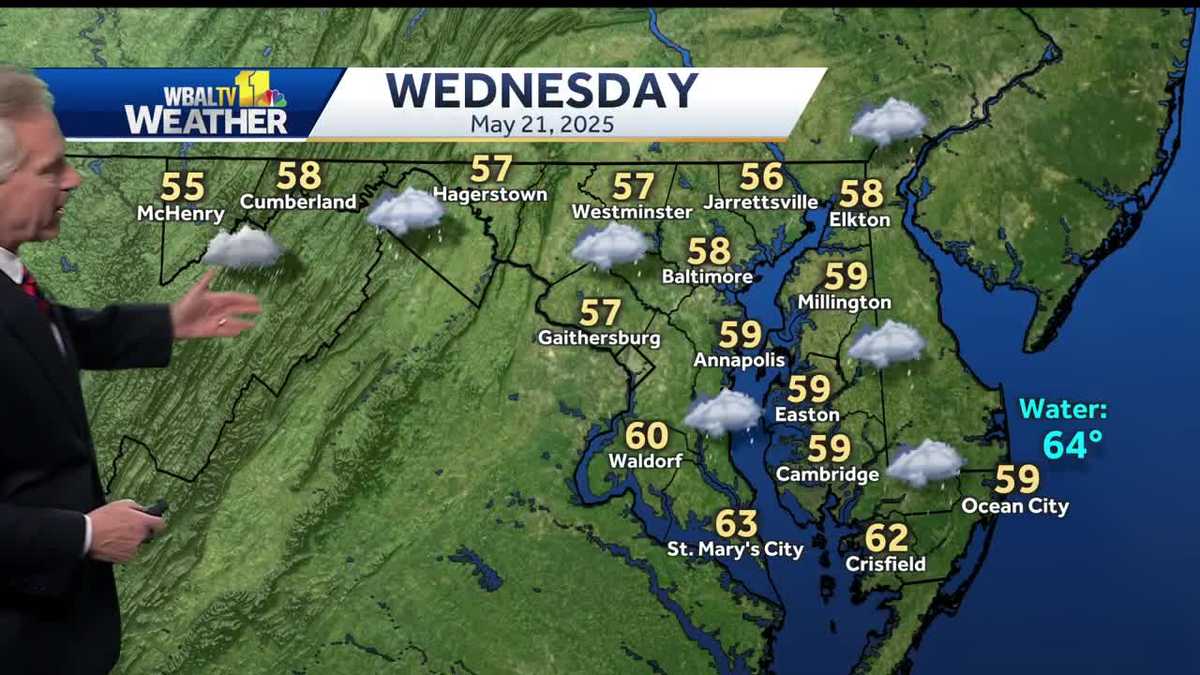

Rain And Chilly Temperatures Sweep Through Region Wednesday

May 21, 2025

Rain And Chilly Temperatures Sweep Through Region Wednesday

May 21, 2025 -

Moodys Downgrade Unfazed S And P 500 Dow And Nasdaq Post Strong Gains

May 21, 2025

Moodys Downgrade Unfazed S And P 500 Dow And Nasdaq Post Strong Gains

May 21, 2025 -

Two Dead Children Injured In Train Family Collision On Bridge

May 21, 2025

Two Dead Children Injured In Train Family Collision On Bridge

May 21, 2025 -

Buy Now Pay Later Rules Tightened What Consumers Need To Know

May 21, 2025

Buy Now Pay Later Rules Tightened What Consumers Need To Know

May 21, 2025 -

Harsh Coaching Weight Criticism An Olympic Gold Medalists Struggle For Recovery

May 21, 2025

Harsh Coaching Weight Criticism An Olympic Gold Medalists Struggle For Recovery

May 21, 2025

Latest Posts

-

Letitia Jamess Strategy Balancing Trump Litigation And Doj Investigation

May 21, 2025

Letitia Jamess Strategy Balancing Trump Litigation And Doj Investigation

May 21, 2025 -

Ellen De Generes Back On Social Media Following Heartbreaking Loss

May 21, 2025

Ellen De Generes Back On Social Media Following Heartbreaking Loss

May 21, 2025 -

Ice Facility Assault Federal Charges Filed Against A Congresswoman

May 21, 2025

Ice Facility Assault Federal Charges Filed Against A Congresswoman

May 21, 2025 -

Solo Leveling Garners Prestigious Award More Nominations Expected

May 21, 2025

Solo Leveling Garners Prestigious Award More Nominations Expected

May 21, 2025 -

De Generes Return To Social Media A Heartfelt Message To Fans

May 21, 2025

De Generes Return To Social Media A Heartfelt Message To Fans

May 21, 2025