Buy Now, Pay Later Rules Tightened: What Consumers Need To Know

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buy Now, Pay Later Rules Tightened: What Consumers Need to Know

Buy Now, Pay Later (BNPL) services exploded in popularity, offering a seemingly effortless way to purchase goods and services. However, the ease of access also led to concerns about consumer debt and financial vulnerability. Now, regulators are stepping in, tightening the rules surrounding BNPL. This means significant changes for consumers, and understanding these changes is crucial to avoiding financial hardship.

What are the New Regulations?

The specifics of the tightened regulations vary by country and region, but several common themes emerge. Many jurisdictions are focusing on:

- Increased transparency: BNPL providers are now required to provide clearer information about fees, interest rates, and repayment schedules upfront. This includes highlighting potential late payment fees and the impact on credit scores.

- Credit checks: Previously, many BNPL services operated without a full credit check. New regulations are pushing for more rigorous credit assessments to ensure consumers can afford their repayments. This helps prevent consumers from taking on more debt than they can handle.

- Debt collection practices: Stricter rules are being implemented around debt collection methods, aiming to protect consumers from aggressive or unfair practices. This includes limitations on the frequency and manner of contact from collection agencies.

- Affordability assessments: Providers are now expected to conduct more thorough affordability assessments before approving applications. This involves verifying income and existing debt levels to determine repayment capability.

- Limits on borrowing: Some jurisdictions are introducing limits on the total amount a consumer can borrow through BNPL services within a specific timeframe. This aims to curb impulsive spending and over-indebtedness.

How Will This Affect Consumers?

The tightened regulations are designed to protect consumers, but they also mean changes to how BNPL services operate. You can expect:

- More stringent application processes: Getting approved for BNPL may become more challenging as providers conduct more thorough credit checks and affordability assessments.

- Higher borrowing costs: Increased regulatory scrutiny and stricter risk assessments might lead to higher interest rates or fees for some consumers.

- Reduced borrowing limits: You might find that you can borrow less through BNPL than before, limiting your purchasing power.

- Greater clarity on repayment terms: You will receive more detailed information about fees, repayment schedules, and the potential consequences of late payments.

What Consumers Should Do

Navigating the changes in BNPL regulations requires proactive steps:

- Understand the terms and conditions: Before using any BNPL service, carefully review the terms and conditions, paying close attention to fees, interest rates, and repayment schedules.

- Budget carefully: Only use BNPL for purchases you can comfortably afford to repay on time. Create a budget to ensure you can manage your repayments without impacting other financial commitments.

- Monitor your credit score: BNPL services now increasingly affect your credit score. Regularly monitor your score to stay informed about your financial health.

- Explore alternative payment methods: Consider using traditional credit cards or debit cards if you're concerned about the potential risks associated with BNPL.

- Seek professional advice: If you're struggling to manage your BNPL debt, seek professional financial advice. Many organizations offer free or low-cost counseling to help you navigate financial difficulties.

The Future of Buy Now, Pay Later

The tightening of regulations signifies a shift towards greater responsibility and transparency within the BNPL industry. While these changes may limit accessibility for some, they ultimately aim to protect consumers from the potential pitfalls of unsecured debt. By understanding these new rules and taking proactive steps to manage your finances, you can continue to benefit from the convenience of BNPL while minimizing the risks. Staying informed and responsible is key to navigating this evolving financial landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buy Now, Pay Later Rules Tightened: What Consumers Need To Know. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Prostate Cancer Diagnosis For President Joe Biden What We Know

May 21, 2025

Prostate Cancer Diagnosis For President Joe Biden What We Know

May 21, 2025 -

Harsh Coaching And Weight Comments Left Olympic Gold Swimmer Traumatized

May 21, 2025

Harsh Coaching And Weight Comments Left Olympic Gold Swimmer Traumatized

May 21, 2025 -

Emotional Return Ellen De Generes Addresses Fans After Personal Loss

May 21, 2025

Emotional Return Ellen De Generes Addresses Fans After Personal Loss

May 21, 2025 -

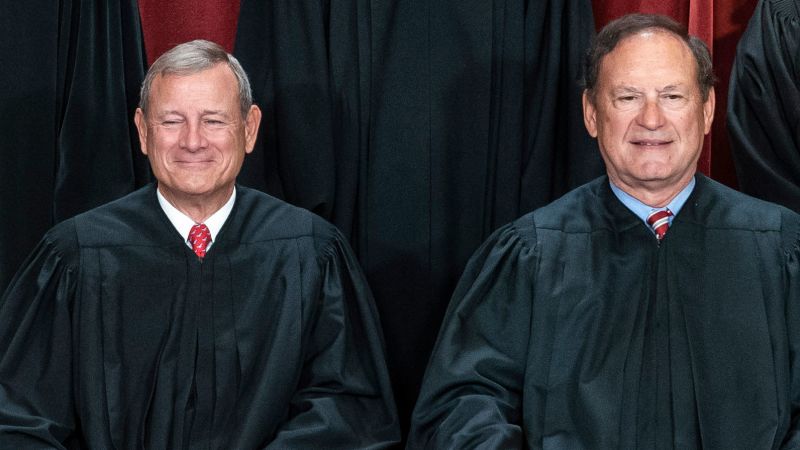

Alito And Roberts Supreme Court Service A Look Back At Two Decades

May 21, 2025

Alito And Roberts Supreme Court Service A Look Back At Two Decades

May 21, 2025 -

Us Treasury Yields Dip As Federal Reserve Hints At Single 2025 Rate Cut

May 21, 2025

Us Treasury Yields Dip As Federal Reserve Hints At Single 2025 Rate Cut

May 21, 2025

Latest Posts

-

The Photographer Of Napalm Girl World Press Photos Review Of A Historic Vietnam War Photograph

May 21, 2025

The Photographer Of Napalm Girl World Press Photos Review Of A Historic Vietnam War Photograph

May 21, 2025 -

Charlotte Weather Alert Overnight Storms And Temperature Drop Incoming

May 21, 2025

Charlotte Weather Alert Overnight Storms And Temperature Drop Incoming

May 21, 2025 -

Parental Rights For Paedophiles Familys Scathing Critique Of Legal Changes

May 21, 2025

Parental Rights For Paedophiles Familys Scathing Critique Of Legal Changes

May 21, 2025 -

The Loss That Broke Ellen De Generes Heart Family Tragedy Revealed

May 21, 2025

The Loss That Broke Ellen De Generes Heart Family Tragedy Revealed

May 21, 2025 -

Emotional Return Ellen De Generes Addresses Fans After Personal Loss

May 21, 2025

Emotional Return Ellen De Generes Addresses Fans After Personal Loss

May 21, 2025