US Treasury Yields Dip As Federal Reserve Hints At Single 2025 Rate Cut

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Treasury Yields Dip as Federal Reserve Hints at Single 2025 Rate Cut

Market reaction to Fed's cautious outlook sends ripples through the bond market.

The US Treasury market experienced a notable shift on [Date of news], with yields on benchmark bonds dipping following the Federal Reserve's latest pronouncements on interest rates. The central bank's suggestion of a single rate cut in 2025, rather than the multiple cuts some analysts had predicted, prompted a reassessment by investors, leading to a decline in yields. This development carries significant implications for borrowing costs, inflation expectations, and overall economic outlook.

A Cautious Approach to Monetary Policy

The Federal Reserve's decision to signal a more measured approach to future rate adjustments reflects a careful balancing act. While inflation has shown signs of cooling, it remains above the Fed's target. The central bank is clearly prioritizing a sustained return to price stability, even if it means maintaining higher interest rates for a longer period. This cautious stance contrasts with some market expectations that anticipated more aggressive rate cuts to stimulate economic growth.

The subtle shift in the Fed's communication regarding rate cuts is crucial. Instead of projecting multiple cuts, the implied single reduction in 2025 underscores the Fed's commitment to combating inflation and its belief that current interest rates are appropriate to manage economic growth while controlling price increases. This nuanced messaging is what has caused the noticeable dip in Treasury yields.

Impact on Treasury Yields and the Bond Market

The decreased likelihood of multiple rate cuts in 2025 has led to a decrease in Treasury yields. Investors, anticipating less aggressive monetary easing, have adjusted their expectations accordingly. This resulted in a rise in demand for Treasury bonds, pushing prices up and consequently lowering yields. The 10-year Treasury yield, a key benchmark, experienced a [Percentage]% drop, reflecting this market shift. This movement in yields has wider implications for the broader bond market, potentially affecting corporate bond yields and other fixed-income investments.

- Lower Yields: Mean lower borrowing costs for the government and businesses, potentially stimulating economic activity.

- Increased Bond Prices: Higher demand for bonds leads to increased prices, offering attractive returns for investors.

- Market Volatility: While the dip is significant, market volatility remains a possibility as investors continue to assess the implications of the Fed's announcement.

What This Means for the Future

The Federal Reserve's strategy underscores a commitment to price stability, even at the cost of slower economic growth in the short term. This measured approach could provide a more sustainable path to long-term economic health, avoiding potential pitfalls associated with overly aggressive monetary policy. However, the single rate cut projection does not completely eliminate the risk of future economic downturns. The Fed's actions will continue to be closely monitored by market participants and economists alike.

The coming months will be crucial in observing the actual effects of this policy on inflation and economic growth. Further analysis is needed to fully understand the long-term implications of this revised outlook on the US economy and global financial markets.

Disclaimer: This article provides general information and should not be considered financial advice. Consult a financial professional before making any investment decisions. The information presented here is based on publicly available data at the time of writing and is subject to change.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Treasury Yields Dip As Federal Reserve Hints At Single 2025 Rate Cut. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Lufthansa Co Pilots Fainting Flight Continues Pilotless For 10 Minutes

May 21, 2025

Lufthansa Co Pilots Fainting Flight Continues Pilotless For 10 Minutes

May 21, 2025 -

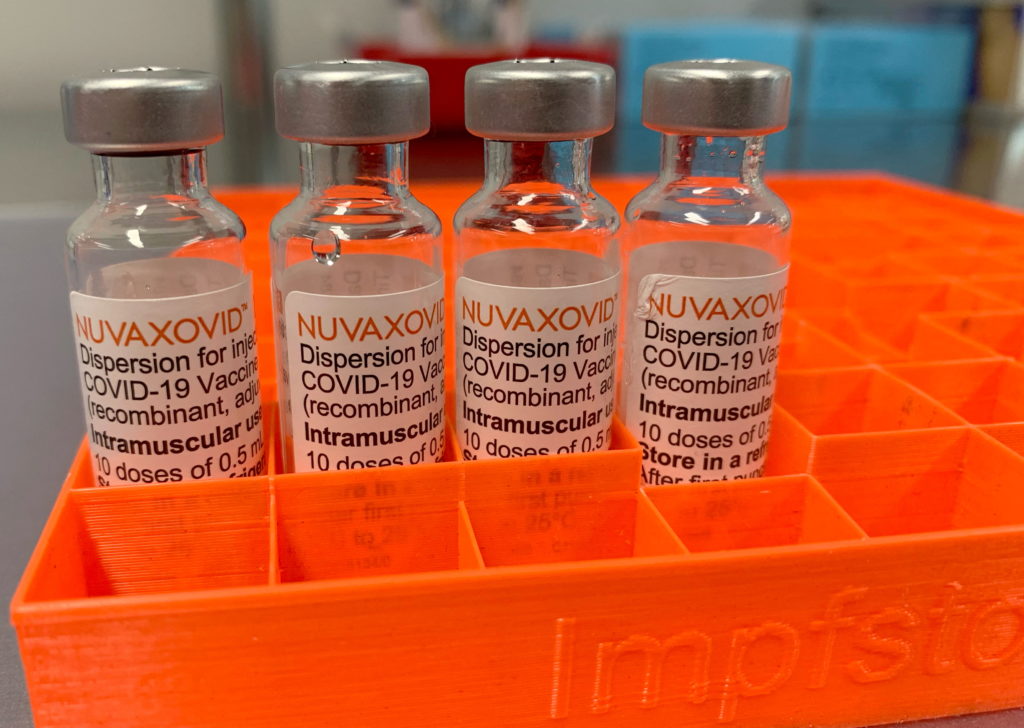

Novavax Covid 19 Vaccine Fda Grants Approval But With Key Restrictions

May 21, 2025

Novavax Covid 19 Vaccine Fda Grants Approval But With Key Restrictions

May 21, 2025 -

The Rise Of Femicide Exploring The Factors Contributing To The Global Increase

May 21, 2025

The Rise Of Femicide Exploring The Factors Contributing To The Global Increase

May 21, 2025 -

Ubisoft Milan Seeks Talent For Aaa Rayman Game Development

May 21, 2025

Ubisoft Milan Seeks Talent For Aaa Rayman Game Development

May 21, 2025 -

Jamie Lee Curtis And Lindsay Lohan A Candid Look At Their Relationship

May 21, 2025

Jamie Lee Curtis And Lindsay Lohan A Candid Look At Their Relationship

May 21, 2025

Latest Posts

-

The Photographer Of Napalm Girl World Press Photos Review Of A Historic Vietnam War Photograph

May 21, 2025

The Photographer Of Napalm Girl World Press Photos Review Of A Historic Vietnam War Photograph

May 21, 2025 -

Charlotte Weather Alert Overnight Storms And Temperature Drop Incoming

May 21, 2025

Charlotte Weather Alert Overnight Storms And Temperature Drop Incoming

May 21, 2025 -

Parental Rights For Paedophiles Familys Scathing Critique Of Legal Changes

May 21, 2025

Parental Rights For Paedophiles Familys Scathing Critique Of Legal Changes

May 21, 2025 -

The Loss That Broke Ellen De Generes Heart Family Tragedy Revealed

May 21, 2025

The Loss That Broke Ellen De Generes Heart Family Tragedy Revealed

May 21, 2025 -

Emotional Return Ellen De Generes Addresses Fans After Personal Loss

May 21, 2025

Emotional Return Ellen De Generes Addresses Fans After Personal Loss

May 21, 2025