Bitcoin ETF Investments Exceed $5 Billion: Analyzing The Market Trend

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin ETF Investments Exceed $5 Billion: Analyzing the Market Trend

The floodgates have opened. Bitcoin exchange-traded funds (ETFs) have surpassed a monumental $5 billion in investments, marking a significant turning point in the cryptocurrency's mainstream adoption. This surge signifies a growing confidence in Bitcoin's long-term viability and its potential as a valuable asset class for institutional and retail investors alike. But what's driving this incredible growth, and what does it mean for the future of Bitcoin? Let's dive into the details.

The Rise of Bitcoin ETFs:

The launch of the first Bitcoin futures ETF in the US in 2021 paved the way for a wave of investment products designed to provide exposure to the cryptocurrency market without the complexities of direct Bitcoin ownership. These ETFs offer investors a regulated and convenient way to participate in the Bitcoin market, mitigating some of the risks associated with holding Bitcoin directly, such as security concerns and the volatility of the cryptocurrency exchanges. This accessibility is a key factor in the recent surge of investments.

Factors Fueling the $5 Billion Milestone:

Several factors contribute to the exceeding $5 billion investment mark in Bitcoin ETFs:

- Increased Institutional Adoption: Large institutional investors, including pension funds and hedge funds, are increasingly incorporating Bitcoin into their portfolios, viewing it as a potential hedge against inflation and a diversifier in a volatile market. The regulated nature of ETFs makes them a particularly attractive option for these institutions.

- Regulatory Clarity (to a degree): While global regulatory landscapes surrounding cryptocurrencies remain complex, the approval of Bitcoin futures ETFs in the US has provided a degree of regulatory clarity, encouraging greater investor participation. This signals a potential shift towards more favorable regulatory environments in the future. However, it's crucial to remember that regulatory uncertainty remains a significant risk.

- Growing Mainstream Awareness: Bitcoin is no longer a niche investment. Increased media coverage and broader public awareness have normalized the perception of Bitcoin, driving retail investor interest and participation in ETFs.

- Ease of Access and Liquidity: Investing in Bitcoin ETFs is significantly easier than navigating the complexities of cryptocurrency exchanges. The ease of access and high liquidity of these ETFs make them appealing to a wider range of investors.

What Does This Mean for the Future?

The $5 billion milestone is undoubtedly a positive sign for the future of Bitcoin. It suggests a growing level of institutional and retail investor confidence in the long-term potential of Bitcoin. However, it's crucial to remember that the cryptocurrency market remains volatile. Future growth will likely depend on several factors, including:

- Regulatory Developments: Continued clarity and potentially favorable regulations are critical for sustaining this growth trajectory.

- Market Sentiment: Broader market trends and investor sentiment will continue to influence investment flows into Bitcoin ETFs.

- Technological Advancements: Developments in Bitcoin's underlying technology and the broader cryptocurrency ecosystem will shape its future adoption.

Conclusion:

The surpassing of $5 billion in Bitcoin ETF investments is a landmark achievement that signifies a significant shift in the perception and adoption of Bitcoin. While risks remain, the trend suggests a bullish outlook for the cryptocurrency's integration into mainstream finance. This development warrants further observation and analysis as the market continues to evolve. Investors should conduct thorough research and consider their individual risk tolerance before investing in any Bitcoin-related products. Learn more about . (External Link)

Keywords: Bitcoin ETF, Bitcoin investments, cryptocurrency, ETF investments, Bitcoin futures ETF, institutional investors, regulatory clarity, market trend, cryptocurrency investment, Bitcoin price, Bitcoin adoption, volatile market, hedge against inflation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin ETF Investments Exceed $5 Billion: Analyzing The Market Trend. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Police Charge Second Individual In Connection With Fires Near Pms Home

May 21, 2025

Police Charge Second Individual In Connection With Fires Near Pms Home

May 21, 2025 -

Balis Stricter Tourist Code Curbing Irresponsible Behavior

May 21, 2025

Balis Stricter Tourist Code Curbing Irresponsible Behavior

May 21, 2025 -

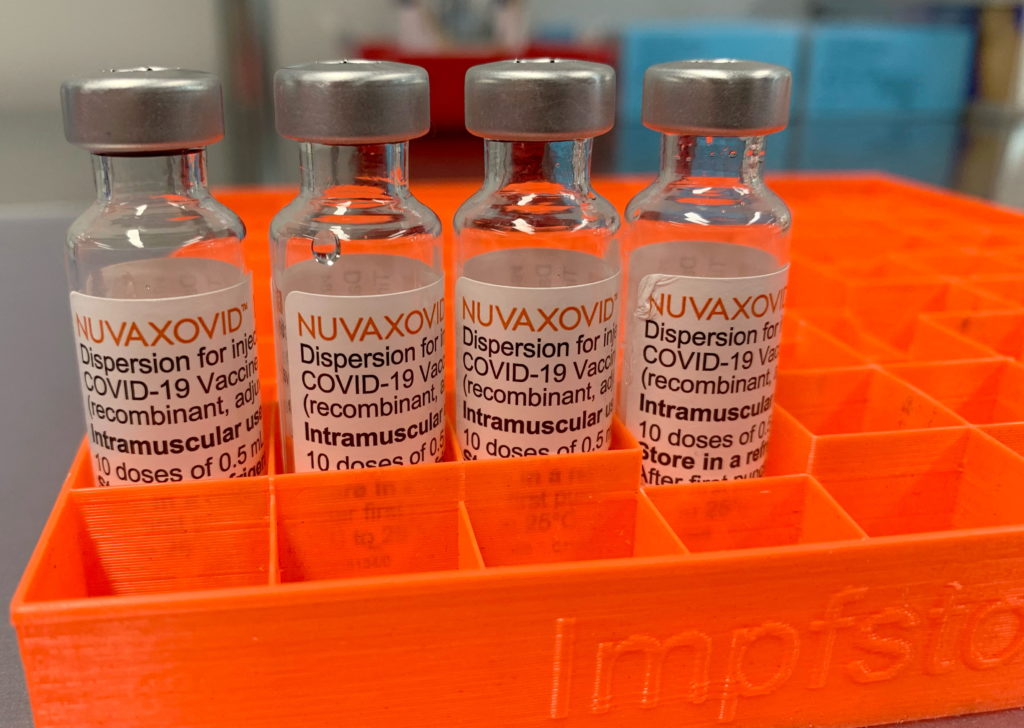

Restricted Use Fda Grants Approval To Novavax Covid 19 Vaccine

May 21, 2025

Restricted Use Fda Grants Approval To Novavax Covid 19 Vaccine

May 21, 2025 -

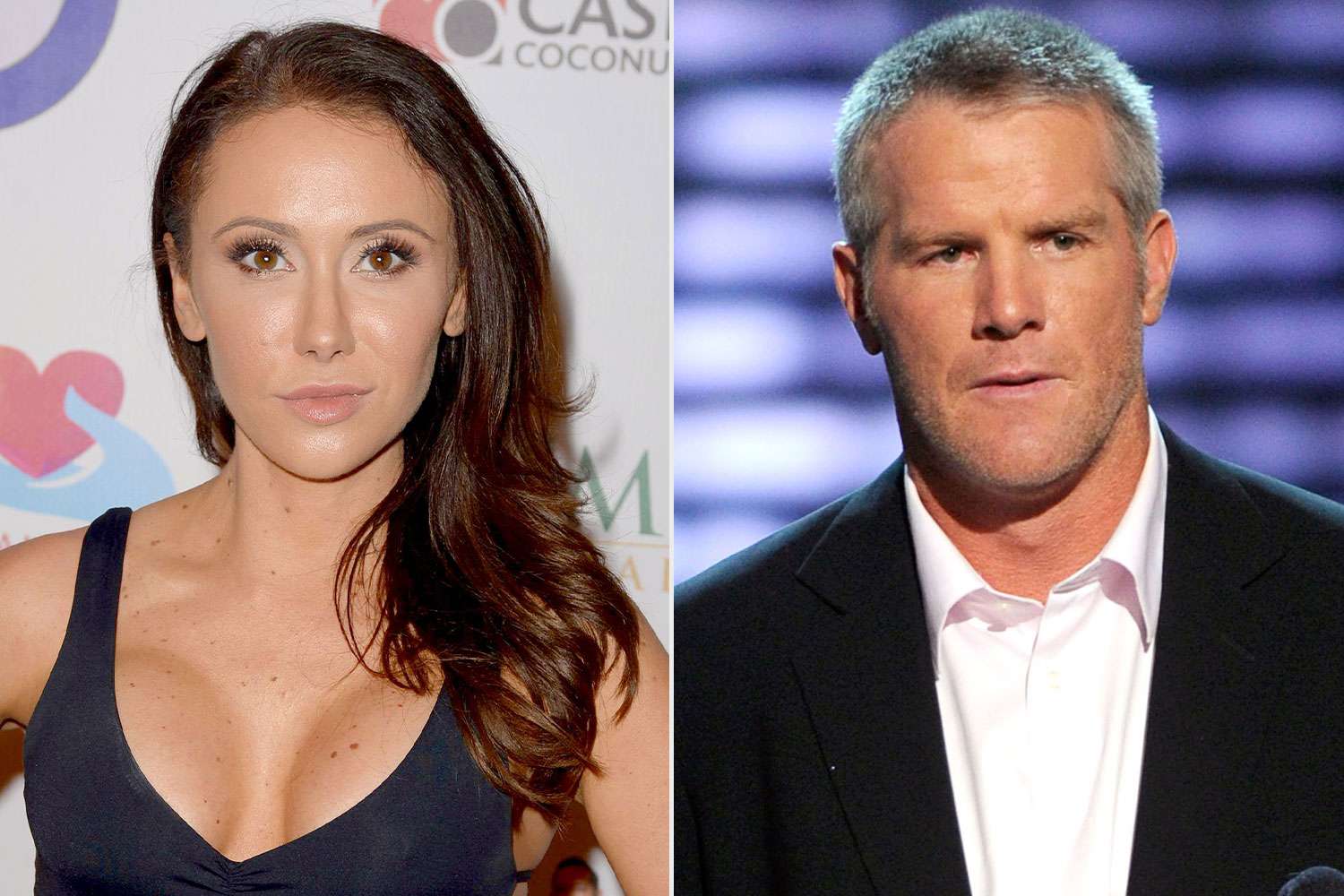

Jenn Sterger Recounts The Aftermath Of Brett Favre Sexting Scandal A Story Of Disrespect

May 21, 2025

Jenn Sterger Recounts The Aftermath Of Brett Favre Sexting Scandal A Story Of Disrespect

May 21, 2025 -

Legal Aid System Suffers Data Hack Client Criminal Records Compromised

May 21, 2025

Legal Aid System Suffers Data Hack Client Criminal Records Compromised

May 21, 2025

Latest Posts

-

New Arrests In Investigation Into Fires Near Prime Ministers House

May 21, 2025

New Arrests In Investigation Into Fires Near Prime Ministers House

May 21, 2025 -

Family Sun Safety Top Sunscreen Picks For 2025

May 21, 2025

Family Sun Safety Top Sunscreen Picks For 2025

May 21, 2025 -

Parental Rights For Convicted Paedophiles A Familys Battle Against The Law

May 21, 2025

Parental Rights For Convicted Paedophiles A Familys Battle Against The Law

May 21, 2025 -

Letitia James Attacks Doj Probe Celebrates Trump Legal Victories

May 21, 2025

Letitia James Attacks Doj Probe Celebrates Trump Legal Victories

May 21, 2025 -

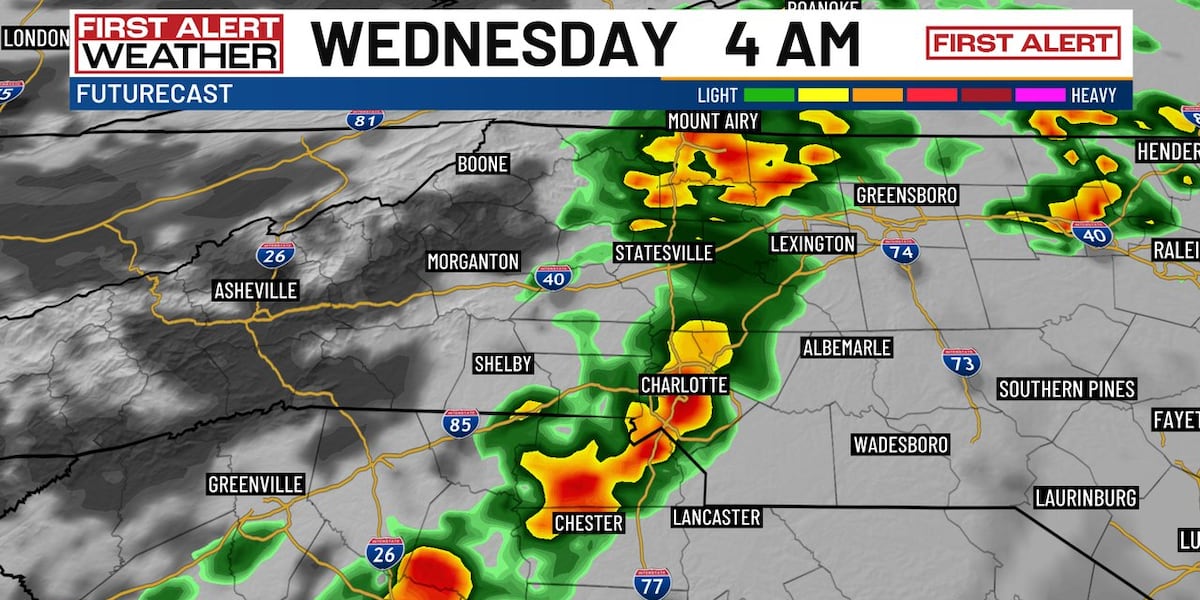

Expect Overnight Storms And Cooler Temperatures In Charlotte

May 21, 2025

Expect Overnight Storms And Cooler Temperatures In Charlotte

May 21, 2025