Bitcoin ETF Investments Exceed $5 Billion: What's Driving This Growth?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin ETF Investments Exceed $5 Billion: What's Driving This Growth?

The cryptocurrency market is buzzing! Bitcoin exchange-traded funds (ETFs) have surpassed a staggering $5 billion in investments, marking a significant milestone in the mainstream adoption of Bitcoin. This surge isn't just a fleeting trend; it reflects a confluence of factors pushing institutional and retail investors towards this innovative asset class. But what's fueling this explosive growth? Let's delve into the key drivers.

H2: The Rise of Regulated Bitcoin Exposure

One of the most significant factors contributing to the $5 billion figure is the increasing availability of regulated Bitcoin ETFs. These funds offer investors a convenient and relatively low-risk way to gain exposure to Bitcoin without the complexities and security concerns of directly holding the cryptocurrency. Unlike directly buying Bitcoin, ETFs provide a familiar and regulated investment vehicle, appealing to risk-averse investors and institutional players. The launch of the first spot Bitcoin ETF in the US, for example, is widely anticipated to further accelerate this trend.

H2: Institutional Adoption and Diversification

The growth isn't solely driven by retail investors. Large institutional investors, including pension funds and hedge funds, are increasingly allocating a portion of their portfolios to Bitcoin, viewing it as a potential hedge against inflation and diversification tool. This institutional interest brings credibility and legitimacy to Bitcoin, encouraging further investment. The growing acceptance of Bitcoin as a legitimate asset class by established financial institutions is a powerful catalyst for growth.

H3: Grayscale Bitcoin Trust's Influence

While not technically an ETF, the Grayscale Bitcoin Trust (GBTC) has played a significant role in paving the way for Bitcoin ETFs. GBTC, despite its premium/discount structure, offered early access to Bitcoin for institutional investors. Its success underscored the demand for regulated Bitcoin exposure, ultimately contributing to the push for proper ETF offerings.

H2: Growing Public Awareness and Acceptance

Public awareness and understanding of Bitcoin have steadily increased over the years. While volatility remains a concern, the narrative surrounding Bitcoin has shifted from pure speculation to a potential long-term store of value, mirroring the adoption path of other asset classes like gold. This increased understanding, coupled with improved educational resources, is driving more retail investors towards Bitcoin ETFs.

H2: Inflationary Concerns and Economic Uncertainty

Global economic uncertainty and persistent inflation are also driving investors towards alternative assets like Bitcoin. Many see Bitcoin as a potential hedge against inflation, offering a decentralized and potentially less susceptible alternative to traditional fiat currencies. This perception further fuels investment in Bitcoin ETFs, particularly during periods of economic instability.

H2: The Future of Bitcoin ETF Investments

The exceeding of $5 billion in Bitcoin ETF investments signifies a monumental shift in the financial landscape. As regulatory hurdles continue to fall and public understanding grows, we can expect further significant growth in this market segment. The potential launch of a spot Bitcoin ETF in major markets is likely to further amplify this trend, potentially attracting even more institutional capital and driving the total investment figure substantially higher.

H3: What to Watch For:

- Regulatory developments: Further regulatory clarity and approvals will significantly impact the growth trajectory.

- Spot Bitcoin ETF approvals: The approval of spot Bitcoin ETFs in key markets could be a game-changer.

- Market volatility: Bitcoin's inherent volatility remains a factor, potentially influencing investor sentiment.

- Institutional adoption: Continued institutional interest will drive further growth and legitimization.

While investing in Bitcoin ETFs carries inherent risks, the current growth trajectory is undeniably impressive. This signals a broader acceptance of Bitcoin as a viable asset class and underscores the evolving role of cryptocurrencies in the global financial system. Further research into the market and individual investment strategies is always recommended. [Link to a reputable financial news source]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin ETF Investments Exceed $5 Billion: What's Driving This Growth?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Pectra Upgrade Fuels Ethereum Investment Boom 200 Million Inflows

May 20, 2025

Pectra Upgrade Fuels Ethereum Investment Boom 200 Million Inflows

May 20, 2025 -

Russia Ukraine Peace Talks Trumps Immediate Action Announcement

May 20, 2025

Russia Ukraine Peace Talks Trumps Immediate Action Announcement

May 20, 2025 -

Sean Combs Faces Serious Charges Cassie Venturas Testimony Holds The Key

May 20, 2025

Sean Combs Faces Serious Charges Cassie Venturas Testimony Holds The Key

May 20, 2025 -

Solving The Puzzle A Large Pachyrhinosaurus Fossil Site In Canada

May 20, 2025

Solving The Puzzle A Large Pachyrhinosaurus Fossil Site In Canada

May 20, 2025 -

Conditional Fda Approval Novavax Covid 19 Vaccines Limited Rollout

May 20, 2025

Conditional Fda Approval Novavax Covid 19 Vaccines Limited Rollout

May 20, 2025

Latest Posts

-

Jon Jones Ufcs Secrecy Around Aspinall Injury Unacceptable

May 21, 2025

Jon Jones Ufcs Secrecy Around Aspinall Injury Unacceptable

May 21, 2025 -

From Olympic Gold To Broken A Swimmers Story Of Coaching Abuse And Body Image Issues

May 21, 2025

From Olympic Gold To Broken A Swimmers Story Of Coaching Abuse And Body Image Issues

May 21, 2025 -

Slight Dip In Us Treasury Yields After Feds Rate Cut Outlook

May 21, 2025

Slight Dip In Us Treasury Yields After Feds Rate Cut Outlook

May 21, 2025 -

Balis Tourism Overhaul Stricter Guidelines To Curb Poor Tourist Behavior

May 21, 2025

Balis Tourism Overhaul Stricter Guidelines To Curb Poor Tourist Behavior

May 21, 2025 -

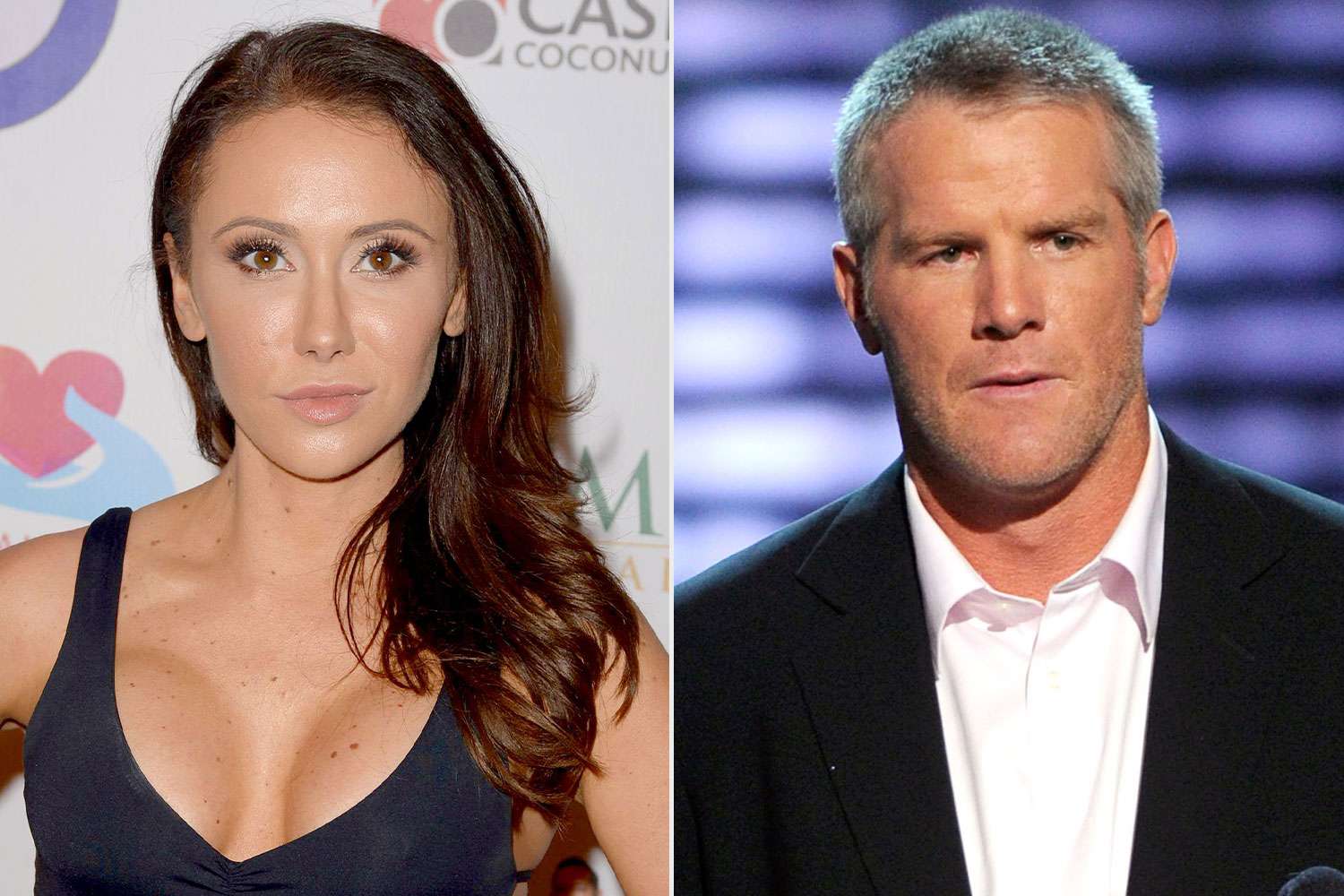

Brett Favre Sexting Scandal Jenn Sterger Speaks Out On Treatment

May 21, 2025

Brett Favre Sexting Scandal Jenn Sterger Speaks Out On Treatment

May 21, 2025