Buffett's Big Move: Bank Of America Shares Sold, Major Investment In Consumer Goods

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buffett's Big Move: Berkshire Hathaway Sells Bank of America, Invests Heavily in Consumer Goods

Warren Buffett's Berkshire Hathaway made headlines this week with a significant shift in its investment strategy. The Oracle of Omaha, known for his long-term, value-oriented approach, surprised many by significantly reducing its stake in Bank of America while simultaneously making a substantial investment in the consumer goods sector. This bold move has sent ripples through the financial world, prompting analysts to dissect the motivations behind this strategic shift.

The Bank of America Sell-Off: A Sign of Changing Times?

Berkshire Hathaway's holdings in Bank of America (BAC) have been a cornerstone of its portfolio for years. However, recent filings reveal a significant reduction in its shares. While the exact reasons remain undisclosed, several factors could be at play. Rising interest rates, a potential economic slowdown, and the increasing regulatory scrutiny faced by the banking sector are all possible contributing factors. This move signifies a departure from Berkshire's traditional reliance on the financial sector, suggesting a reevaluation of risk profiles in the current economic climate. Is this a sign that Buffett sees storm clouds on the horizon for the banking industry?

A Bet on Consumer Resilience: Investment in Consumer Goods

In contrast to the Bank of America divestment, Berkshire Hathaway has dramatically increased its investments in consumer goods companies. This strategic shift indicates a belief in the resilience of consumer spending, even amid economic uncertainty. While the specific companies haven't been fully disclosed, analysts speculate that the investment focuses on established brands with strong market positions and a proven track record of weathering economic downturns. This approach reflects Buffett's classic value investing philosophy, focusing on businesses with durable competitive advantages and predictable cash flows.

What Does This Mean for Investors?

Buffett's actions are always closely watched by investors worldwide. This recent move underscores the dynamic nature of the market and the need for adaptability even for the most seasoned investors. The sell-off in Bank of America shares has raised questions about the future performance of the banking sector, while the significant investment in consumer goods suggests a positive outlook for this segment. For individual investors, this highlights the importance of diversification and staying informed about market trends.

Analyzing the Implications:

- Reduced Risk: The move away from the banking sector could be viewed as a risk-mitigation strategy by Buffett, given the current economic uncertainties.

- Long-Term Vision: The investment in consumer goods suggests a long-term bet on the enduring demand for essential goods and services.

- Market Sentiment: Buffett's actions often influence market sentiment, and these recent moves could impact investor confidence in both the banking and consumer goods sectors.

Further Reading:

Conclusion:

Buffett's recent investment decisions represent a significant strategic shift for Berkshire Hathaway. The sale of Bank of America shares and the substantial investment in consumer goods reflect a nuanced understanding of the current economic landscape and a forward-looking approach to long-term value creation. This bold move will undoubtedly continue to be analyzed and debated by financial experts for months to come. What are your thoughts on this significant shift in investment strategy? Share your opinion in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buffett's Big Move: Bank Of America Shares Sold, Major Investment In Consumer Goods. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Disillusioned Americans Seeking A New Home After Trump Era

Jun 05, 2025

Disillusioned Americans Seeking A New Home After Trump Era

Jun 05, 2025 -

420 000 Less In Retirement Examining The Republican Plans Effect On Those In Their 30s

Jun 05, 2025

420 000 Less In Retirement Examining The Republican Plans Effect On Those In Their 30s

Jun 05, 2025 -

Former Nfl And Penn State Greats Jersey A New Exhibit At The Smithsonian

Jun 05, 2025

Former Nfl And Penn State Greats Jersey A New Exhibit At The Smithsonian

Jun 05, 2025 -

Evaluating Robinhood Stock Risks And Rewards For Investors

Jun 05, 2025

Evaluating Robinhood Stock Risks And Rewards For Investors

Jun 05, 2025 -

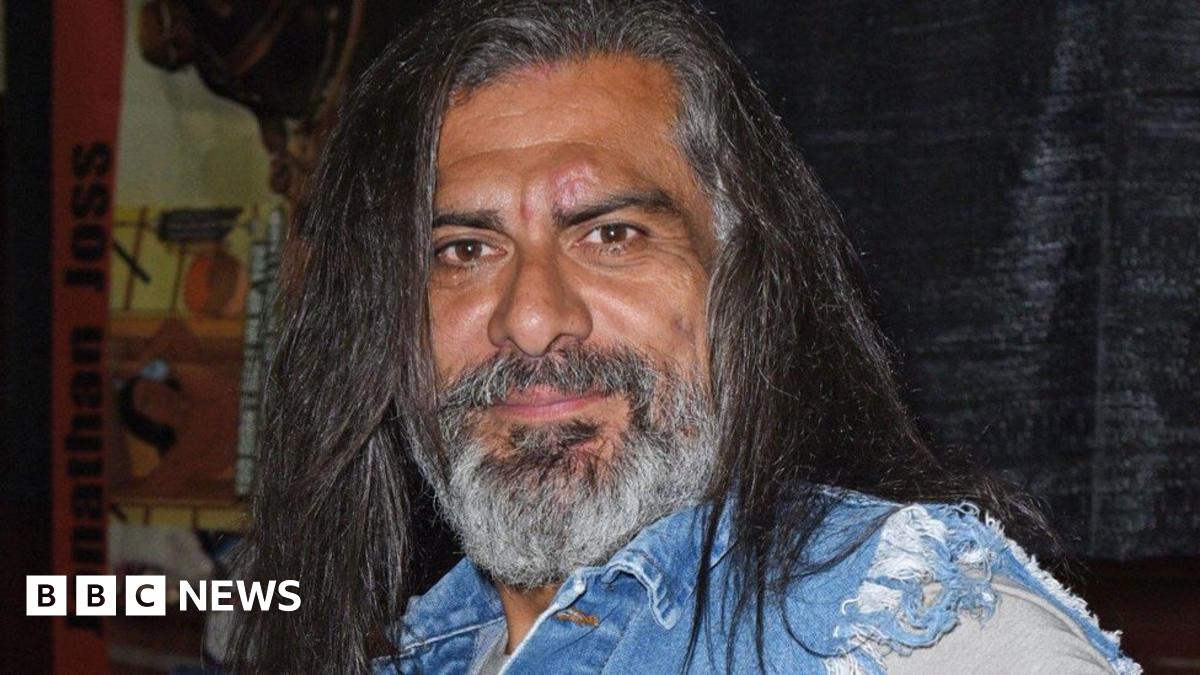

Tragic News Jonathan Joss Beloved King Of The Hill Actor Fatally Shot

Jun 05, 2025

Tragic News Jonathan Joss Beloved King Of The Hill Actor Fatally Shot

Jun 05, 2025

Latest Posts

-

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025 -

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025 -

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025 -

The Untold Story Of A Wwii Veteran A Vj Day Memory That Moved Queen Camilla

Aug 17, 2025

The Untold Story Of A Wwii Veteran A Vj Day Memory That Moved Queen Camilla

Aug 17, 2025 -

Battlefield 6 Map Size Controversy Players React To Latest Mini Map

Aug 17, 2025

Battlefield 6 Map Size Controversy Players React To Latest Mini Map

Aug 17, 2025