Buffett's Big Move: Exiting Bank Of America, Embracing A Consumer Staple

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buffett's Big Move: Exiting Bank of America, Embracing a Consumer Staple

Warren Buffett's Berkshire Hathaway makes headlines again, this time with a significant shift in its investment portfolio. The Oracle of Omaha, known for his long-term investment strategies, has revealed a surprising move: a complete exit from Bank of America (BAC) while simultaneously increasing its stake in a major consumer staple. This strategic shift has sent ripples through the financial world, sparking intense speculation about Buffett's reasoning and the future implications for both companies.

The news, revealed in Berkshire Hathaway's latest 13F filing, shows a complete divestment of its Bank of America shares. This represents a significant departure from a long-standing investment, highlighting a potential change in Buffett's outlook on the financial sector. While the exact reasons remain unconfirmed, analysts point to several potential factors, including concerns about rising interest rates and a potential slowdown in the banking sector. [Link to reputable financial news source discussing interest rate impact on banks].

<h3>The Consumer Staple Play: A Shift in Focus?</h3>

In contrast to the Bank of America exit, Berkshire Hathaway significantly increased its holdings in [Name of Consumer Staple Company - replace with actual company name]. This move signals a renewed focus on consumer staples, a sector historically known for its resilience during economic downturns. This seemingly counterintuitive move – exiting a financial giant to embrace a consumer goods company – has ignited a heated debate among market analysts.

- Diversification Strategy: Some argue that this represents a calculated diversification strategy by Buffett, aiming to mitigate risk across various sectors. Consumer staples, with their relatively stable demand, are considered a safe haven during periods of economic uncertainty.

- Long-Term Growth Potential: Others believe Buffett sees significant long-term growth potential in [Name of Consumer Staple Company]. This could be driven by factors such as increasing market share, innovative product development, or expansion into new markets. [Link to company's investor relations page or relevant news article highlighting growth potential].

- Valuation Considerations: The decision may also be driven by differing valuations. Buffett is famously known for seeking undervalued assets, and it's possible he believes [Name of Consumer Staple Company] presents a more attractive investment opportunity currently compared to Bank of America.

<h3>What This Means for Investors</h3>

Buffett's actions are closely scrutinized by investors worldwide, and this latest move is no exception. The exit from Bank of America has prompted some investors to reconsider their own positions in the company, while the increased stake in [Name of Consumer Staple Company] has led to increased interest and potential upward pressure on its stock price.

This event underscores the importance of remaining flexible and adaptable in investment strategies. While long-term investments are crucial, unforeseen economic shifts can necessitate adjustments to maintain a diversified and resilient portfolio.

<h3>Looking Ahead</h3>

The full implications of Buffett's strategic shift will unfold over time. However, this move serves as a valuable reminder of the dynamic nature of the investment world and the importance of staying informed about market trends and the decisions of influential investors like Warren Buffett. Further analysis will be needed to fully understand the motivations behind this significant portfolio adjustment. We'll continue to monitor the situation and provide updates as they become available. What are your thoughts on Buffett's recent moves? Share your opinions in the comments below!

Keywords: Warren Buffett, Berkshire Hathaway, Bank of America, BAC, Consumer Staples, Investment Strategy, Stock Market, 13F Filing, [Name of Consumer Staple Company], Oracle of Omaha, Investment Portfolio, Economic Downturn, Diversification, Stock Prices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buffett's Big Move: Exiting Bank Of America, Embracing A Consumer Staple. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Carl Nassib More Than Football A Look At His Impact On The Nfl

Jun 04, 2025

Carl Nassib More Than Football A Look At His Impact On The Nfl

Jun 04, 2025 -

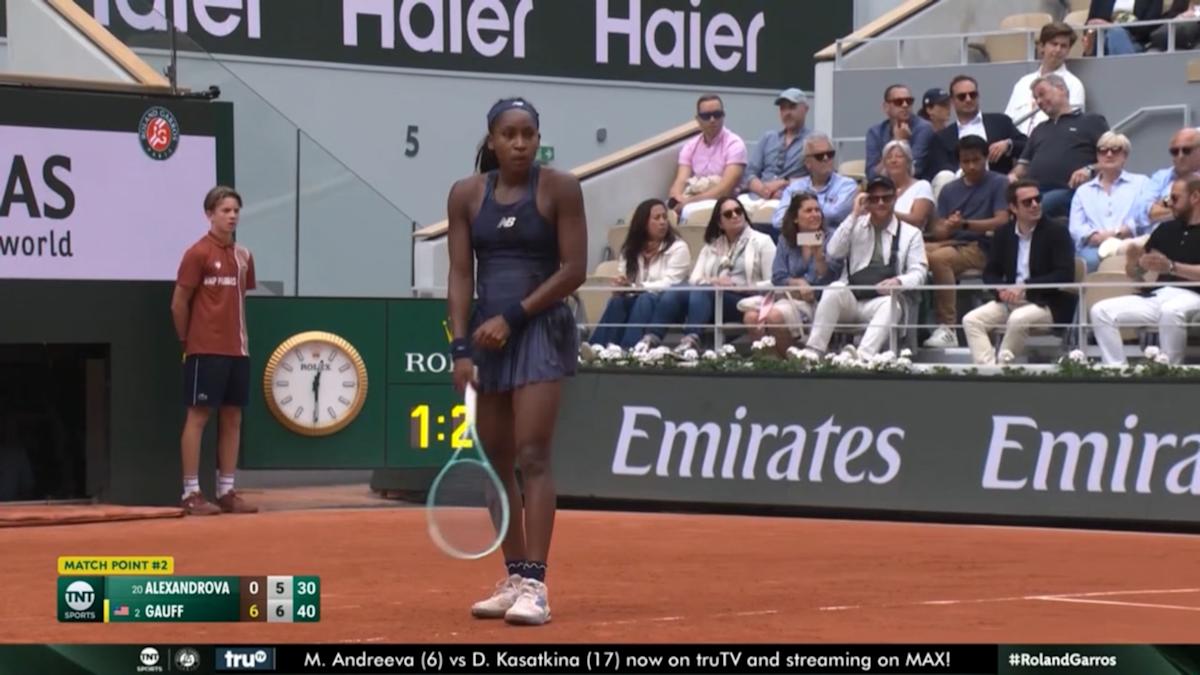

Strong Us Showing Eight Americans Move On At Roland Garros

Jun 04, 2025

Strong Us Showing Eight Americans Move On At Roland Garros

Jun 04, 2025 -

Secure Your Childs Education A Comprehensive Guide To 529 Plans

Jun 04, 2025

Secure Your Childs Education A Comprehensive Guide To 529 Plans

Jun 04, 2025 -

French Open 2025 Bubliks Resurgence Leads To Quarter Final Clash With Sinner

Jun 04, 2025

French Open 2025 Bubliks Resurgence Leads To Quarter Final Clash With Sinner

Jun 04, 2025 -

Hailee Steinfelds Wedding To Josh Allen The Story Behind The Headlines

Jun 04, 2025

Hailee Steinfelds Wedding To Josh Allen The Story Behind The Headlines

Jun 04, 2025

Latest Posts

-

Investigation Underway Into Cardiac Surgery Fatalities At Nhs Hospital

Jun 06, 2025

Investigation Underway Into Cardiac Surgery Fatalities At Nhs Hospital

Jun 06, 2025 -

Winter Fuel Payment Government Reverses Course Affecting Millions

Jun 06, 2025

Winter Fuel Payment Government Reverses Course Affecting Millions

Jun 06, 2025 -

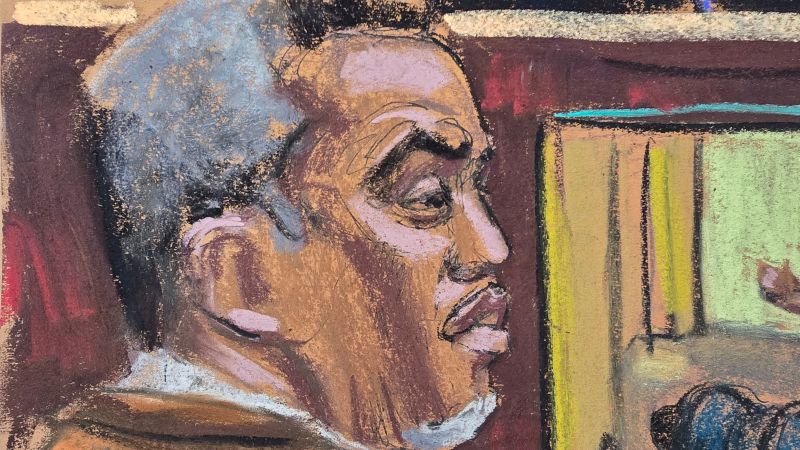

Sean Combs Trial Key Testimony From Forensic Video Analyst

Jun 06, 2025

Sean Combs Trial Key Testimony From Forensic Video Analyst

Jun 06, 2025 -

Robinhood Stock Performance A Bullish Outlook For Investors

Jun 06, 2025

Robinhood Stock Performance A Bullish Outlook For Investors

Jun 06, 2025 -

Coca Cola Company Ko Investor Interest A Detailed Analysis

Jun 06, 2025

Coca Cola Company Ko Investor Interest A Detailed Analysis

Jun 06, 2025