Buffett's Recent US Stock Sales: A Shift In Investment Strategy?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buffett's Recent US Stock Sales: A Shift in Investment Strategy?

Warren Buffett's Berkshire Hathaway recently revealed significant reductions in its holdings of several major US stocks, sparking widespread speculation about a potential shift in the legendary investor's long-term strategy. This move, unprecedented in its scale in recent years, has sent ripples through the financial world, leaving analysts and investors scrambling to decipher its meaning. Is this a temporary adjustment, a response to market conditions, or a fundamental change in Berkshire Hathaway's investment philosophy?

The recent filings with the Securities and Exchange Commission (SEC) revealed substantial decreases in Berkshire's positions in companies like Bank of America, US Bancorp, and Chevron. While these sales generated billions in cash, the timing and magnitude have raised eyebrows, prompting intense scrutiny of Buffett's investment playbook.

The Mystery Behind the Sales: Market Conditions or Strategic Realignment?

Several theories are circulating to explain these significant stock sales. One prominent perspective points to the current macroeconomic environment. Rising interest rates, persistent inflation, and geopolitical instability have created a challenging landscape for investors. This might have prompted Buffett to secure more cash reserves, a move consistent with his historically cautious approach during periods of economic uncertainty. This strategy allows Berkshire to capitalize on potential future investment opportunities, should they arise at more favorable valuations.

Another interpretation focuses on potential sector-specific concerns. While the banking sector has weathered recent storms relatively well, regulatory changes and economic headwinds could be prompting a reassessment of Berkshire's exposure. Similarly, fluctuations in oil prices might have influenced the decision to trim holdings in energy giants like Chevron.

However, dismissing the possibility of a more fundamental shift in Berkshire's investment strategy would be premature. Buffett, known for his long-term value investing approach, may be adapting his strategy to reflect evolving market dynamics and opportunities. This adaptation might involve a greater focus on specific sectors or a more active approach to portfolio management.

What Does This Mean for Investors?

The implications of Buffett's recent moves are multifaceted. For individual investors, it’s a reminder that even the most successful investors adjust their strategies based on market conditions. This doesn't necessarily signal an impending market crash, but it does highlight the importance of diversification and careful portfolio management. Following Buffett's every move blindly is rarely a successful investment strategy; instead, investors should focus on their own due diligence and long-term financial goals.

Key Takeaways:

- Significant Stock Sales: Berkshire Hathaway significantly reduced its holdings in several major US stocks.

- Multiple Interpretations: Analysts are debating whether this reflects temporary adjustments, responses to market conditions, or a fundamental strategic shift.

- Macroeconomic Factors: Rising interest rates, inflation, and geopolitical instability may have influenced the decisions.

- Sector-Specific Considerations: Concerns regarding specific sectors, like banking and energy, could also be contributing factors.

- Investor Implications: The events underscore the importance of diversification, careful portfolio management, and independent research for individual investors.

The unfolding situation warrants close monitoring. Future SEC filings and any public statements from Berkshire Hathaway will provide further clarity. While the exact reasoning behind Buffett’s recent moves remains a subject of debate, one thing is clear: the actions of this investing legend always command significant attention and influence within the financial markets. Stay informed and consult with a financial advisor before making any major investment decisions based on these developments.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buffett's Recent US Stock Sales: A Shift In Investment Strategy?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Solve The Nyt Spelling Bee June 3rd Puzzle Complete Guide

Jun 04, 2025

Solve The Nyt Spelling Bee June 3rd Puzzle Complete Guide

Jun 04, 2025 -

Saving For College How A 529 Account Can Help

Jun 04, 2025

Saving For College How A 529 Account Can Help

Jun 04, 2025 -

Controversy Erupts After Spanish Broadcast Of Ross Monaghan Shooting Video

Jun 04, 2025

Controversy Erupts After Spanish Broadcast Of Ross Monaghan Shooting Video

Jun 04, 2025 -

Inflation Tariffs And The Rise Of Discount Retailers Like Dollar General

Jun 04, 2025

Inflation Tariffs And The Rise Of Discount Retailers Like Dollar General

Jun 04, 2025 -

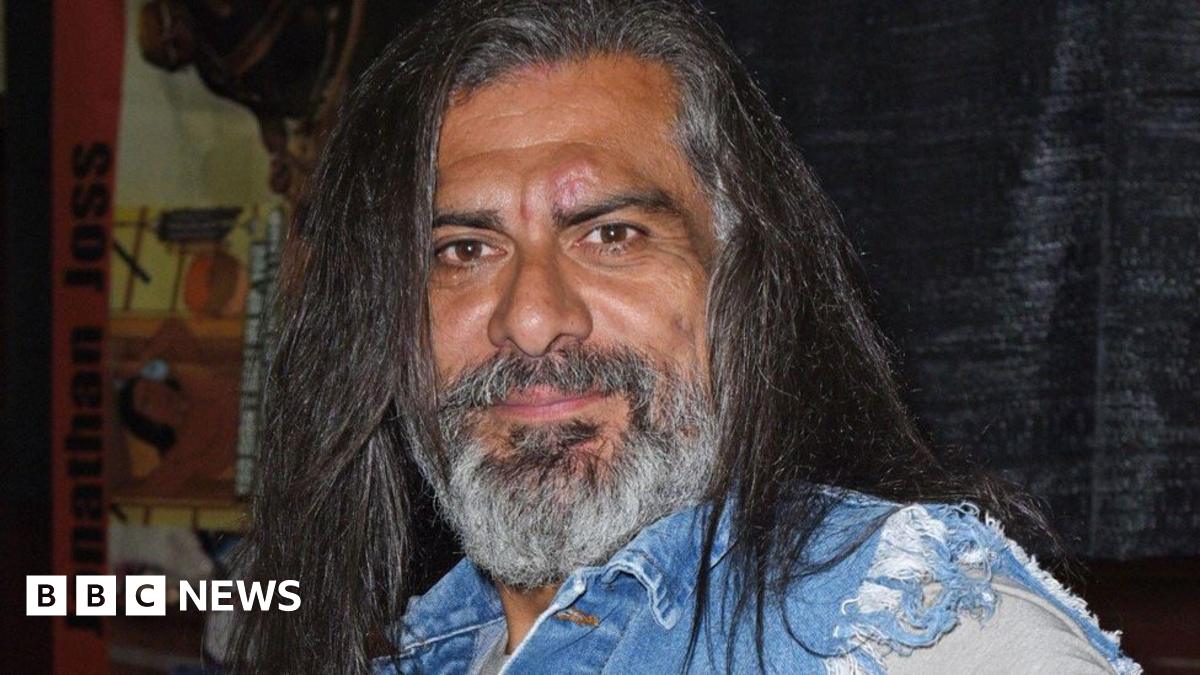

Tragic News Jonathan Joss King Of The Hill Actor Dies In Shooting Incident

Jun 04, 2025

Tragic News Jonathan Joss King Of The Hill Actor Dies In Shooting Incident

Jun 04, 2025

Latest Posts

-

Federal Charges Chinese Researchers Accused Of Biological Pathogen Smuggling In Michigan

Jun 06, 2025

Federal Charges Chinese Researchers Accused Of Biological Pathogen Smuggling In Michigan

Jun 06, 2025 -

Coca Cola Ko Stock Performance And Future Outlook

Jun 06, 2025

Coca Cola Ko Stock Performance And Future Outlook

Jun 06, 2025 -

Supreme Court Ruling Heterosexual Plaintiff Prevails In Reverse Discrimination Dispute

Jun 06, 2025

Supreme Court Ruling Heterosexual Plaintiff Prevails In Reverse Discrimination Dispute

Jun 06, 2025 -

Hood Stock Soars Robinhood Markets Inc Shares Surge 6 46 June 3rd

Jun 06, 2025

Hood Stock Soars Robinhood Markets Inc Shares Surge 6 46 June 3rd

Jun 06, 2025 -

Supreme Court Delivers Unanimous Decision In Favor Of Ohio Woman Facing Workplace Discrimination

Jun 06, 2025

Supreme Court Delivers Unanimous Decision In Favor Of Ohio Woman Facing Workplace Discrimination

Jun 06, 2025