Buy Now, Pay Later: Key Changes In The New Consumer Protection Rules

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buy Now, Pay Later: Key Changes in the New Consumer Protection Rules

Buy Now, Pay Later (BNPL) services have exploded in popularity, offering consumers a seemingly effortless way to purchase goods and services. However, the rapid growth of this sector has also highlighted the need for stronger consumer protections. Recent regulatory changes are designed to address concerns about debt accumulation and irresponsible lending practices. This article delves into the key changes impacting BNPL users.

What are the New Consumer Protection Rules for BNPL?

The specifics of new regulations vary by jurisdiction, but common themes include:

-

Increased Transparency: BNPL providers are now required to provide clearer and more upfront information about fees, interest rates, and repayment schedules. This includes prominently displaying the total cost of the purchase, including any interest or late fees, before the consumer commits. Ambiguous or hidden fees are being actively targeted.

-

Credit Checks & Affordability Assessments: Some jurisdictions are mandating stricter affordability assessments before approving BNPL applications. This may involve credit checks to ensure consumers can comfortably manage their repayments. This aims to prevent consumers from taking on more debt than they can handle.

-

Debt Collection Practices: Regulations are focusing on responsible debt collection practices. Aggressive or harassing tactics are being outlawed, and providers are expected to offer clear and accessible channels for consumers to manage their debts and seek assistance if needed.

-

Stronger Enforcement: Regulatory bodies are increasing oversight and enforcement of BNPL providers to ensure compliance with the new rules. Penalties for non-compliance are being strengthened to deter irresponsible lending practices.

How Do These Changes Affect Consumers?

These changes are designed to empower consumers and protect them from potential financial harm. Here's how the new rules benefit consumers:

-

Better Informed Decisions: Greater transparency allows consumers to make informed decisions about whether or not to use BNPL services and understand the full financial implications.

-

Reduced Risk of Over-Indebtedness: Affordability assessments help prevent consumers from taking on unsustainable levels of debt.

-

Fairer Treatment During Repayment: Regulations on debt collection practices ensure consumers are treated fairly and respectfully, even if they fall behind on repayments.

What Should Consumers Do?

While the new regulations offer crucial protection, consumers still need to be responsible:

-

Budget Carefully: Before using BNPL, carefully consider your budget and ensure you can comfortably afford the repayments.

-

Compare Providers: Shop around and compare different BNPL providers to find the best terms and conditions.

-

Read the Fine Print: Always carefully read the terms and conditions before using any BNPL service.

-

Seek Help If Needed: If you're struggling to make repayments, contact your BNPL provider immediately to explore options such as repayment plans. Don't ignore the problem – proactive communication is key.

The Future of BNPL Regulation:

The regulatory landscape for BNPL is constantly evolving. Expect further changes and clarifications as regulators work to strike a balance between fostering innovation and protecting consumers. Staying informed about these changes is vital for both consumers and businesses operating within the BNPL sector. For the latest updates, it is recommended to consult your local financial regulatory authority's website.

Keywords: Buy Now Pay Later, BNPL, Consumer Protection, New Regulations, Affordability Assessments, Debt Collection, Financial Regulations, Consumer Rights, Responsible Lending, Credit Checks, Financial Literacy, Debt Management.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buy Now, Pay Later: Key Changes In The New Consumer Protection Rules. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Deadly Train Collision Two Fatalities Injuries And A Missing Child On Railroad Bridge

May 21, 2025

Deadly Train Collision Two Fatalities Injuries And A Missing Child On Railroad Bridge

May 21, 2025 -

Helping Your Child Stop Thumb Sucking Or Pacifier Use

May 21, 2025

Helping Your Child Stop Thumb Sucking Or Pacifier Use

May 21, 2025 -

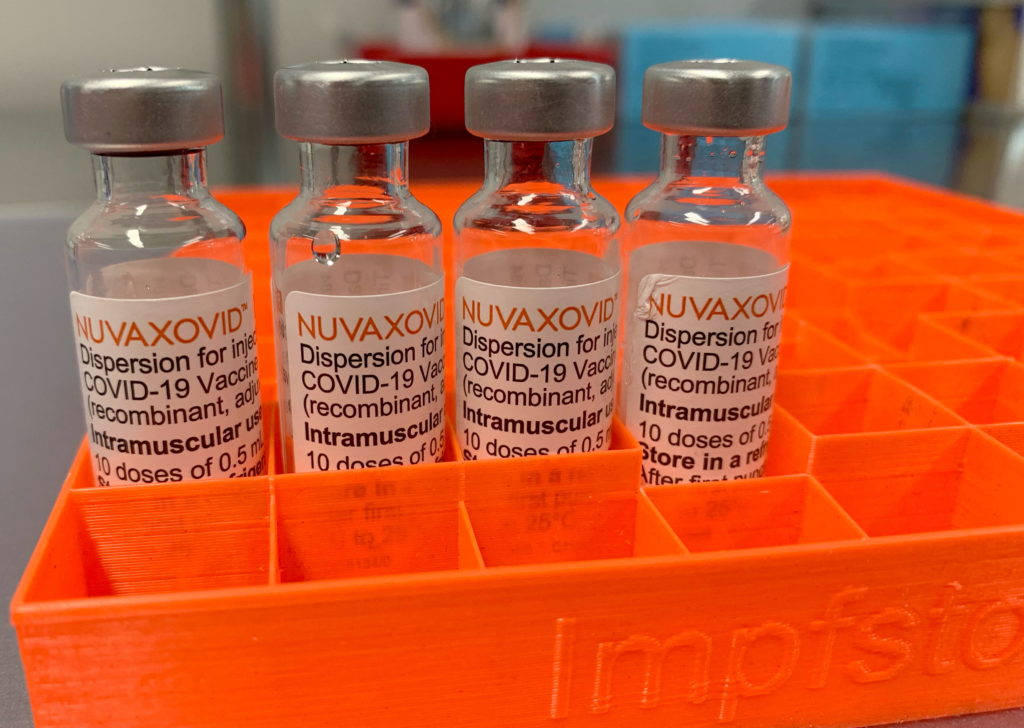

Fda Approval For Novavax Covid 19 Vaccine Comes With Unusual Restrictions

May 21, 2025

Fda Approval For Novavax Covid 19 Vaccine Comes With Unusual Restrictions

May 21, 2025 -

Exclusive Jamie Lee Curtis Reveals How She Stays Connected To Lindsay Lohan

May 21, 2025

Exclusive Jamie Lee Curtis Reveals How She Stays Connected To Lindsay Lohan

May 21, 2025 -

Did The Ufc Mislead Fans About Tom Aspinalls Injury Jones Weighs In

May 21, 2025

Did The Ufc Mislead Fans About Tom Aspinalls Injury Jones Weighs In

May 21, 2025

Latest Posts

-

Report Reveals Lufthansa Flight Flew Unpiloted After Co Pilots Collapse

May 21, 2025

Report Reveals Lufthansa Flight Flew Unpiloted After Co Pilots Collapse

May 21, 2025 -

New Rules For Tourists In Bali Curbing Misbehavior And Protecting The Island

May 21, 2025

New Rules For Tourists In Bali Curbing Misbehavior And Protecting The Island

May 21, 2025 -

Untold Brett Favre Controversy Producer A J Perez Speaks Out

May 21, 2025

Untold Brett Favre Controversy Producer A J Perez Speaks Out

May 21, 2025 -

What Is Femicide Exploring The Factors Behind The Growing Global Crisis

May 21, 2025

What Is Femicide Exploring The Factors Behind The Growing Global Crisis

May 21, 2025 -

The Price Of Gold An Olympic Swimmers Story Of Abuse And Recovery

May 21, 2025

The Price Of Gold An Olympic Swimmers Story Of Abuse And Recovery

May 21, 2025