Buy Now, Pay Later: New Rules Designed To Safeguard Consumers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buy Now, Pay Later: New Rules Designed to Safeguard Consumers

Buy Now, Pay Later (BNPL) services have exploded in popularity, offering consumers a seemingly effortless way to purchase goods and services. However, the rapid growth has raised concerns about consumer debt and financial wellbeing. Recognizing this, regulators are stepping in with new rules designed to protect consumers from the potential pitfalls of BNPL. This article explores the new regulations and what they mean for shoppers.

The Rise of Buy Now, Pay Later and the Need for Regulation

BNPL services, offered by companies like Klarna, Affirm, and Afterpay (now owned by Square), allow consumers to split purchases into smaller, interest-free installments. This seemingly attractive option has fueled online shopping and boosted sales for retailers. But the lack of stringent regulation initially led to concerns about:

- Overspending and Debt Accumulation: The ease of use can encourage impulsive buying and lead to accumulating significant debt, particularly for those with already strained finances.

- Lack of Transparency: The initial simplicity of BNPL can mask the potential costs and consequences of missed payments. Late fees and negative impacts on credit scores can be significant.

- Predatory Lending Practices: While many BNPL providers operate responsibly, there were concerns about some engaging in practices that could be considered predatory, targeting vulnerable consumers.

New Regulations: A Focus on Consumer Protection

Responding to these concerns, several countries and regions are implementing new regulations to enhance consumer protection within the BNPL sector. These changes often include:

- Credit Checks: Some regulations mandate credit checks before approving BNPL applications, helping to prevent over-indebted individuals from taking on more debt.

- Affordability Assessments: Lenders are increasingly required to assess a consumer's ability to repay the loan before approving the application, preventing irresponsible lending.

- Increased Transparency: Clearer disclosures of fees, interest rates (where applicable), and repayment terms are becoming mandatory, ensuring consumers understand the full cost before committing.

- Debt Collection Practices: Regulations are also focusing on responsible debt collection practices, limiting aggressive tactics and protecting consumers from harassment.

- Data Protection: Strengthened data protection measures are also being introduced, safeguarding sensitive consumer information used in BNPL applications.

What These Changes Mean for Consumers

These new rules signify a significant shift towards responsible lending and greater consumer protection within the BNPL industry. For consumers, this translates to:

- Greater Financial Awareness: The increased transparency will empower consumers to make informed decisions, understanding the potential risks and costs involved.

- Reduced Risk of Over-Indebtedness: Affordability assessments and credit checks will help prevent consumers from taking on more debt than they can manage.

- Fairer Treatment: Regulations on debt collection practices will protect consumers from unfair or harassing treatment.

Looking Ahead: The Future of BNPL

The introduction of these regulations marks a crucial step in ensuring the responsible growth of the BNPL sector. While the ease and convenience of BNPL remain attractive, these changes aim to balance accessibility with consumer safety. It's important for consumers to remain vigilant, understanding the terms and conditions before using BNPL services, and to only use these services responsibly and within their financial capabilities. Further regulatory changes are likely in the future as the industry continues to evolve. Staying informed about these updates is crucial for protecting your financial wellbeing.

Keywords: Buy Now Pay Later, BNPL, Consumer Protection, Financial Regulation, Debt, Credit, Online Shopping, Klarna, Affirm, Afterpay, Responsible Lending, Consumer Rights, Financial Wellbeing, Debt Management.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buy Now, Pay Later: New Rules Designed To Safeguard Consumers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Similar To The Studio 5 Shows For Dedicated Viewers

May 20, 2025

Similar To The Studio 5 Shows For Dedicated Viewers

May 20, 2025 -

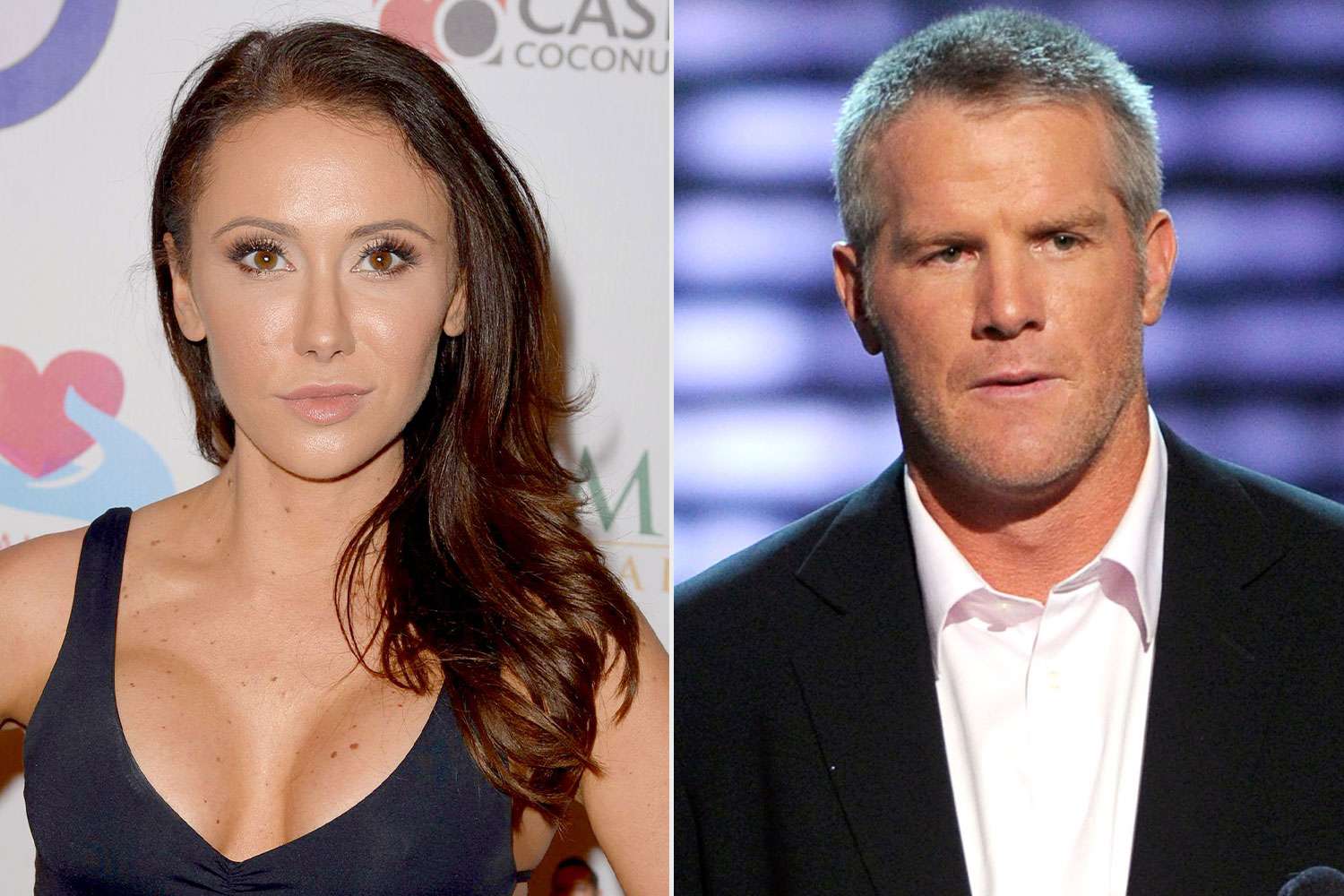

Jenn Sterger Speaks Out Fallout From Brett Favre Sexting Scandal

May 20, 2025

Jenn Sterger Speaks Out Fallout From Brett Favre Sexting Scandal

May 20, 2025 -

Lufthansa Flight Operated Without Pilot For 10 Minutes Co Pilot Medical Incident Detailed In Report

May 20, 2025

Lufthansa Flight Operated Without Pilot For 10 Minutes Co Pilot Medical Incident Detailed In Report

May 20, 2025 -

Facial Difference Discrimination A Cafes Shameful Act

May 20, 2025

Facial Difference Discrimination A Cafes Shameful Act

May 20, 2025 -

Driverless Cars Ubers Uk Launch Plans And The Challenges Ahead

May 20, 2025

Driverless Cars Ubers Uk Launch Plans And The Challenges Ahead

May 20, 2025

Latest Posts

-

Slowdown Ahead Feds Rate Cut Projection Impacts U S Treasury Yields

May 20, 2025

Slowdown Ahead Feds Rate Cut Projection Impacts U S Treasury Yields

May 20, 2025 -

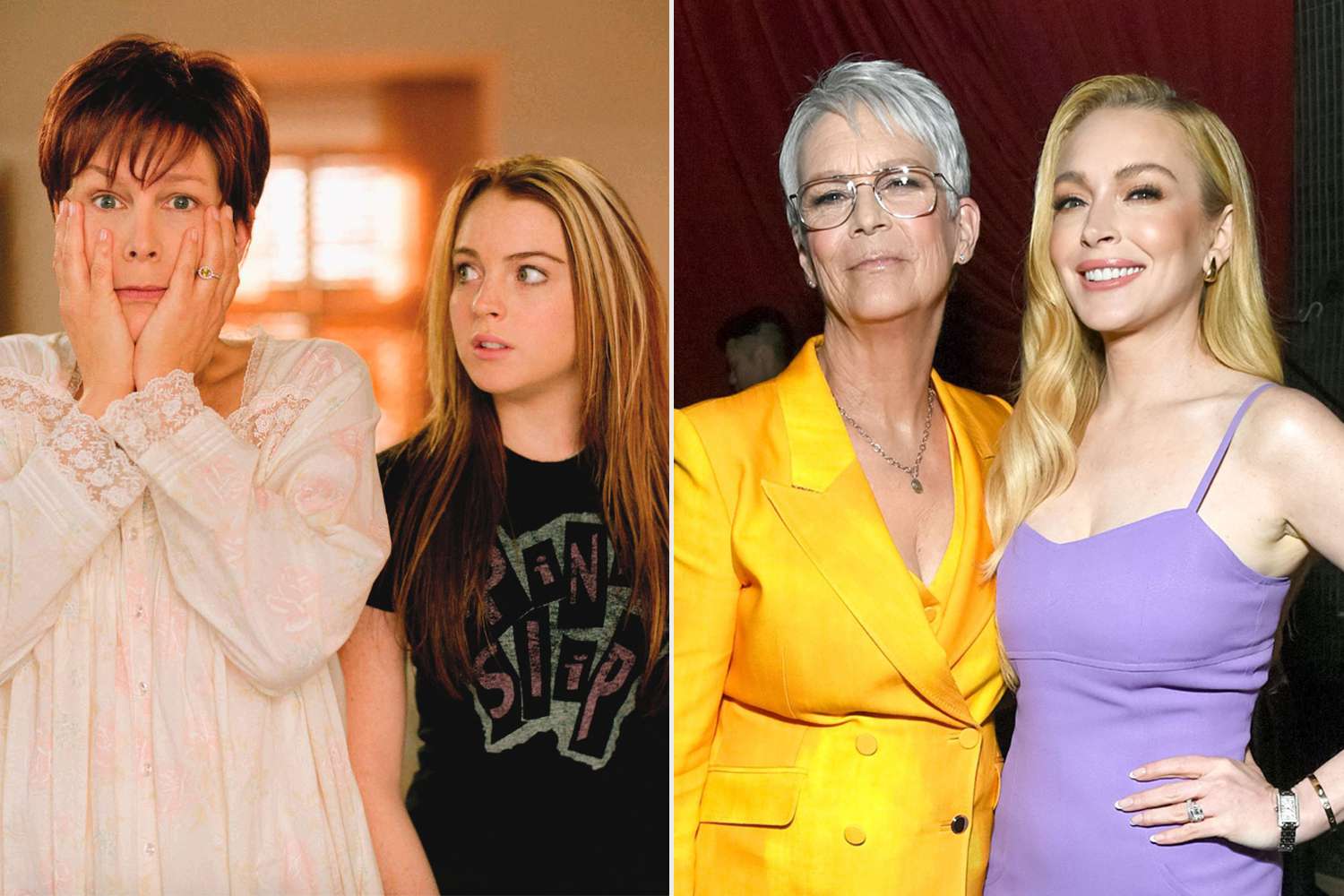

Jamie Lee Curtis Lindsay Lohan Always Kept It Real

May 20, 2025

Jamie Lee Curtis Lindsay Lohan Always Kept It Real

May 20, 2025 -

Jamie Lee Curtis Shares Insights Into Her Ongoing Friendship With Lindsay Lohan Post Freaky Friday

May 20, 2025

Jamie Lee Curtis Shares Insights Into Her Ongoing Friendship With Lindsay Lohan Post Freaky Friday

May 20, 2025 -

Stock Market Today Market Rally Persists Despite Moodys Negative Outlook

May 20, 2025

Stock Market Today Market Rally Persists Despite Moodys Negative Outlook

May 20, 2025 -

Breaking Trump Initiates Push For Immediate Russia Ukraine Peace Talks

May 20, 2025

Breaking Trump Initiates Push For Immediate Russia Ukraine Peace Talks

May 20, 2025