California Authorizes Double-Digit Rate Increase For State Farm Insurance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

California Authorizes Double-Digit Rate Increase for State Farm Insurance: What it Means for Policyholders

California homeowners and drivers insured by State Farm are facing a significant financial blow. The California Department of Insurance (CDI) recently approved a double-digit rate increase for State Farm's insurance policies, sparking outrage and concern among residents already struggling with the high cost of living in the Golden State. This substantial hike raises serious questions about the affordability of insurance in California and the potential impact on vulnerable communities.

A Substantial Increase: The Details

The CDI's approval allows State Farm to increase its rates by an average of 12% for homeowners insurance and 8.7% for auto insurance. While the exact percentage increase will vary depending on individual policy specifics and location, the impact on many Californians will be considerable. This is not the first significant rate hike in recent years, further exacerbating the challenges faced by policyholders. Many are questioning the justifications behind such a substantial increase.

Reasons Cited for the Increase:

State Farm attributes the necessary rate increase to several factors, primarily citing:

- Increased claims costs: The insurer highlights a rise in the cost of repairing and replacing damaged property, particularly due to inflation and the increasing frequency and severity of wildfires and other natural disasters.

- Rising inflation: The overall increase in the cost of goods and services has directly impacted the cost of insurance, from materials to labor.

- Supply chain disruptions: Delays and increased costs associated with obtaining building materials have also contributed to higher claim payouts.

The Impact on California Residents:

This double-digit increase will undoubtedly place a strain on California households. For many, insurance is already a significant portion of their monthly budget. This rate hike could force some to consider dropping coverage altogether, exposing themselves to substantial financial risks. Furthermore, this increase disproportionately affects lower-income communities who may struggle to absorb such a large expense.

What Policyholders Can Do:

Facing a significant increase in insurance premiums can be daunting, but there are steps policyholders can take:

- Shop around: Compare rates from other insurance providers to see if you can find a more affordable option. Utilize online comparison tools to streamline the process.

- Review your coverage: Examine your current policy to ensure you're not paying for unnecessary coverage. Consider increasing your deductible to lower your premiums, though this comes with increased out-of-pocket costs in the event of a claim.

- Implement preventative measures: Taking steps to mitigate risk, such as installing fire-resistant materials or upgrading your home's security system, can potentially lead to lower premiums in the future.

- Contact your insurance agent: Discuss your concerns with your State Farm agent and explore any available options for managing the increased costs.

Looking Ahead: The Future of Insurance in California

The State Farm rate increase highlights a larger issue concerning the affordability and accessibility of insurance in California. This situation underscores the need for comprehensive solutions to address the rising costs of insurance, including better disaster preparedness, affordable housing initiatives, and regulatory reforms that balance the needs of insurers and consumers. The CDI's decision warrants further scrutiny and discussion concerning the long-term implications for California residents and the insurance industry. Stay informed and advocate for fair and accessible insurance options within your community.

Keywords: State Farm, California, insurance, rate increase, homeowners insurance, auto insurance, CDI, California Department of Insurance, insurance rates, cost of living, inflation, wildfires, natural disasters, insurance affordability, insurance premiums

Related Articles: (Links to relevant articles on insurance costs in California, wildfires, etc., would be inserted here).

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on California Authorizes Double-Digit Rate Increase For State Farm Insurance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

British Citizens Could Face Trial In Japan Over Multi Million Dollar Jewellery Heist

May 18, 2025

British Citizens Could Face Trial In Japan Over Multi Million Dollar Jewellery Heist

May 18, 2025 -

Thousands Of Cracks Reported Condo Owners Sue Over Nyc Building Defects

May 18, 2025

Thousands Of Cracks Reported Condo Owners Sue Over Nyc Building Defects

May 18, 2025 -

Alarming Uk Statistics One In Ten Possess No Savings

May 18, 2025

Alarming Uk Statistics One In Ten Possess No Savings

May 18, 2025 -

Uk Economy Booms While Labour Leader Starmer Navigates Albania Controversy

May 18, 2025

Uk Economy Booms While Labour Leader Starmer Navigates Albania Controversy

May 18, 2025 -

Uk Eu Relations Signs Of A Potential Realignment

May 18, 2025

Uk Eu Relations Signs Of A Potential Realignment

May 18, 2025

Latest Posts

-

Unbeaten Streak Twins 13 Game Win Streak Fueled By Dominant Pitching

May 18, 2025

Unbeaten Streak Twins 13 Game Win Streak Fueled By Dominant Pitching

May 18, 2025 -

Tokyo Jewellery Heist Brits Could Face Extradition To Japan

May 18, 2025

Tokyo Jewellery Heist Brits Could Face Extradition To Japan

May 18, 2025 -

Sfpd Officer Arrested Dui Crash Results In Several Injuries

May 18, 2025

Sfpd Officer Arrested Dui Crash Results In Several Injuries

May 18, 2025 -

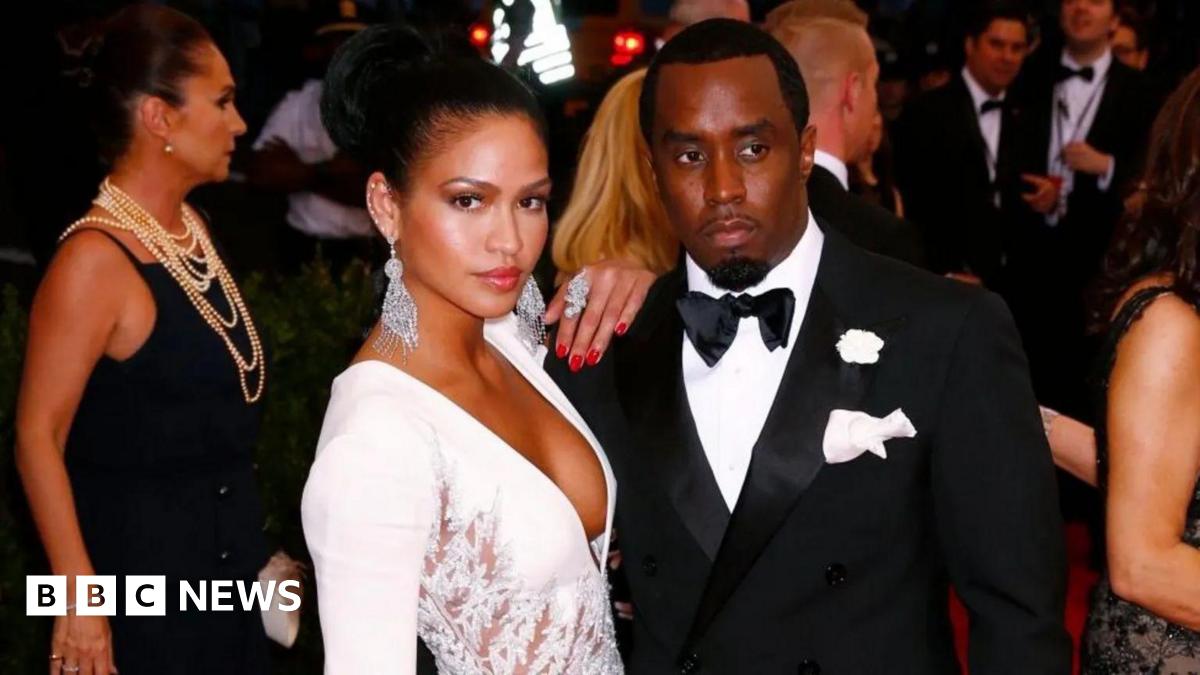

Sean Combs Trial What Role Will Ex Girlfriend Cassie Play

May 18, 2025

Sean Combs Trial What Role Will Ex Girlfriend Cassie Play

May 18, 2025 -

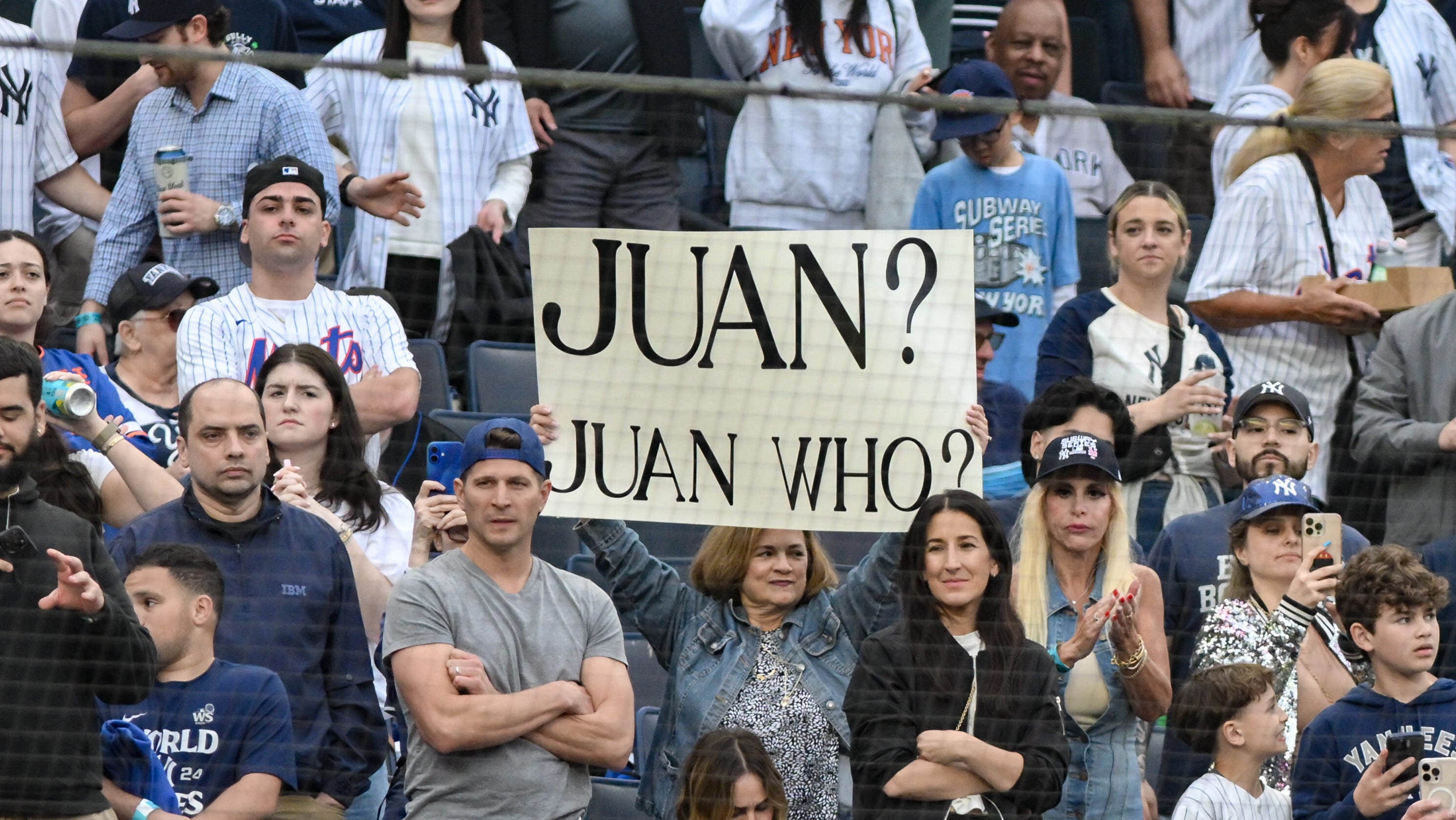

Capture The Excitement Top Photos From The 2025 Yankees Mets Subway Series

May 18, 2025

Capture The Excitement Top Photos From The 2025 Yankees Mets Subway Series

May 18, 2025