California Insurance Rates: State Farm Gets Green Light For Major Hike

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

California Insurance Rates Skyrocket: State Farm Wins Approval for Massive Premium Increase

California homeowners are bracing for a significant blow to their wallets as State Farm, one of the state's largest insurers, receives approval for a substantial increase in insurance rates. This move comes amidst a backdrop of escalating wildfire risk and increasingly challenging economic conditions for insurers operating in the Golden State. The implications are far-reaching, impacting not only State Farm customers but potentially setting a precedent for other insurers to follow suit.

State Farm's Rate Hike: A Closer Look

State Farm's requested rate hike, recently green-lighted by the California Department of Insurance (CDI), represents a substantial percentage increase across various policy types. While the exact figures vary by region and policy specifics, reports indicate increases averaging in the double digits, impacting thousands of California homeowners. This decision follows months of intense scrutiny and public debate, with consumer advocates raising concerns about the affordability and accessibility of home insurance in the state.

The Driving Forces Behind the Increase

Several factors contributed to State Farm's justification for the dramatic rate increase:

- Increased Wildfire Risk: California's increasingly severe wildfire seasons, fueled by climate change and drought conditions, pose an enormous financial risk to insurers. The devastating costs associated with wildfire damage, including property losses and liability claims, are directly driving up premiums. This is a major concern for insurers statewide, impacting rates beyond just State Farm.

- Rising Reinsurance Costs: Reinsurance, which protects insurance companies against catastrophic losses, has become significantly more expensive. This increased cost of risk mitigation is inevitably passed on to consumers through higher premiums.

- Construction Costs and Inflation: The soaring cost of building materials and labor is adding to the expense of repairing and rebuilding homes after damage, further impacting insurance premiums.

What This Means for California Homeowners

The State Farm rate hike represents a significant challenge for many California homeowners, particularly those already struggling with the high cost of living. This could lead to:

- Increased financial burden: Many homeowners will face considerably higher monthly insurance payments, potentially impacting their household budgets.

- Policy cancellations: Some homeowners may be forced to cancel their policies due to unaffordability, leaving them uninsured and vulnerable.

- Limited insurance options: The potential for other insurers to follow State Farm's lead could further restrict the availability of affordable home insurance in California.

Looking Ahead: Potential Solutions and Advocacy

The situation highlights the urgent need for comprehensive solutions to address the affordability and accessibility of home insurance in California. Possible approaches include:

- Increased investment in wildfire mitigation: Proactive measures such as forest management, community fire safety programs, and building code improvements can help reduce wildfire risk and associated insurance costs.

- Government subsidies and assistance programs: Targeted support for low- and moderate-income homeowners could help ensure access to affordable insurance.

- Legislative reforms: Policy changes could address the regulatory environment for insurers, potentially promoting greater competition and affordability.

Consumer advocacy groups are urging California residents to contact their elected officials and express concerns about the rising cost of home insurance. Understanding your rights as a policyholder and exploring alternative insurance options are crucial steps in navigating this challenging landscape. Stay informed and engage in the discussion to ensure the long-term affordability and accessibility of home insurance for all Californians.

Keywords: California insurance rates, State Farm, insurance increase, home insurance, wildfire risk, California Department of Insurance (CDI), reinsurance, inflation, construction costs, homeowner insurance, California wildfires, insurance affordability, consumer advocacy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on California Insurance Rates: State Farm Gets Green Light For Major Hike. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Gazas Expanding Infrastructure New Sites Amidst Rejected Un Aid Plan

May 17, 2025

Gazas Expanding Infrastructure New Sites Amidst Rejected Un Aid Plan

May 17, 2025 -

An Intimate Look At Italy Through Stanley Tuccis Eyes

May 17, 2025

An Intimate Look At Italy Through Stanley Tuccis Eyes

May 17, 2025 -

Beyond Cannes Wes Anderson Discusses The Phoenician Scheme And The Art Of Rewatching His Films

May 17, 2025

Beyond Cannes Wes Anderson Discusses The Phoenician Scheme And The Art Of Rewatching His Films

May 17, 2025 -

Roberts Smith Defamation Case Appeal Court Ruling And Its Implications

May 17, 2025

Roberts Smith Defamation Case Appeal Court Ruling And Its Implications

May 17, 2025 -

Los Angeles Dodgers Cruise Past Oakland Athletics Behind Ohtanis Power And Rushings Debut

May 17, 2025

Los Angeles Dodgers Cruise Past Oakland Athletics Behind Ohtanis Power And Rushings Debut

May 17, 2025

Latest Posts

-

Wes Anderson Cannes The Phoenician Scheme And The Art Of The Second Viewing

May 18, 2025

Wes Anderson Cannes The Phoenician Scheme And The Art Of The Second Viewing

May 18, 2025 -

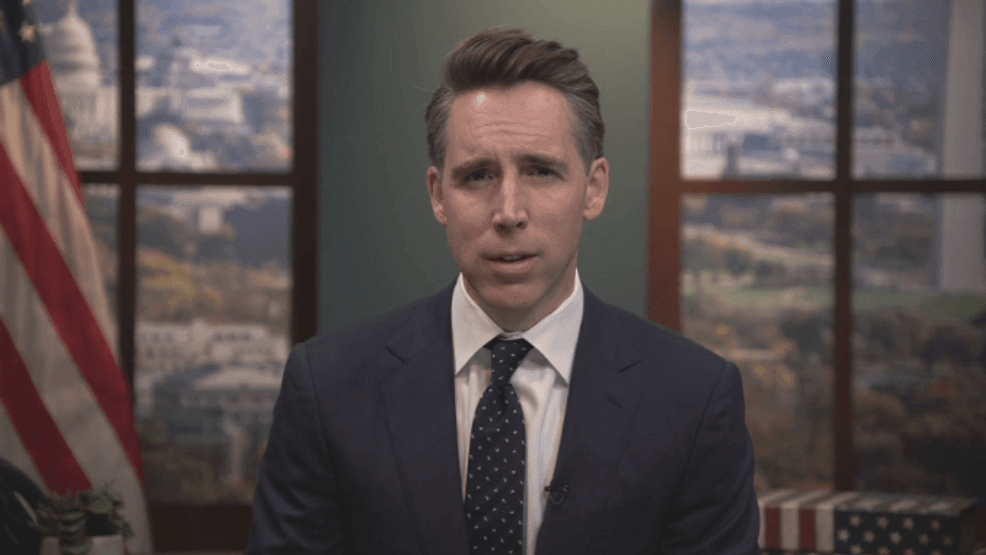

Hawley Led Hearing Probes Top Insurers State Farm And Allstate To Testify

May 18, 2025

Hawley Led Hearing Probes Top Insurers State Farm And Allstate To Testify

May 18, 2025 -

Friendship Sister Midnight The Old Woman With The Knife New Film Previews And Box Office Success

May 18, 2025

Friendship Sister Midnight The Old Woman With The Knife New Film Previews And Box Office Success

May 18, 2025 -

Jansen Gives Up Walk Off Blast Dodgers Suffer Devastating Loss

May 18, 2025

Jansen Gives Up Walk Off Blast Dodgers Suffer Devastating Loss

May 18, 2025 -

How Will State Farms Emergency Rate Increase Impact Your Premiums

May 18, 2025

How Will State Farms Emergency Rate Increase Impact Your Premiums

May 18, 2025