Coinbase's Bitcoin Premium Streak At Risk: Demand Shift Concerns

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Coinbase's Bitcoin Premium Streak at Risk: Demand Shift Concerns

Coinbase's historically strong Bitcoin premium, a key indicator of investor demand, is facing headwinds, raising concerns among analysts. This premium, reflecting the difference between Coinbase's Bitcoin price and the price on other exchanges, has been a consistent feature, often exceeding the global average. However, recent market shifts suggest this trend might be reversing, sparking debate about the future of Coinbase's dominance in the retail crypto market.

For years, Coinbase has enjoyed a significant Bitcoin premium, largely attributed to its user-friendly platform, robust security measures, and strong brand recognition. This made it a preferred exchange for many retail investors, especially those new to cryptocurrency. The premium acted as a magnet, attracting users willing to pay a slightly higher price for the perceived convenience and security. However, this established advantage is now being challenged.

<h3>Shifting Sands: What's Driving the Change?</h3>

Several factors are contributing to the erosion of Coinbase's Bitcoin premium:

-

Increased Competition: The cryptocurrency exchange landscape has become increasingly competitive. New entrants and established players are vying for market share, offering lower fees, innovative features, and aggressive marketing campaigns. This heightened competition is squeezing Coinbase's pricing advantage.

-

Regulatory Uncertainty: The ongoing regulatory scrutiny of the cryptocurrency industry, particularly in the US, is creating uncertainty. This uncertainty is impacting investor sentiment and potentially driving some users towards exchanges located in jurisdictions with clearer regulatory frameworks. Learn more about the current regulatory landscape in our article on .

-

Market Maturity: As the cryptocurrency market matures, investors are becoming more sophisticated and price-sensitive. The convenience premium offered by Coinbase might be less appealing to experienced traders who prioritize price optimization above all else.

-

Decentralized Exchanges (DEXs) Rise: The growing popularity of decentralized exchanges (DEXs) offers users greater control over their funds and potentially lower fees, attracting users away from centralized exchanges like Coinbase. Understanding the differences between CEXs and DEXs is crucial for informed investment decisions. Read more about .

<h3>What Does This Mean for Coinbase?</h3>

The potential loss of its Bitcoin premium represents a significant challenge for Coinbase. It could impact revenue streams and potentially hinder user acquisition. The company will need to adapt to the changing market dynamics to maintain its competitive edge. This might involve focusing on:

- Improving its fee structure: Offering more competitive fees could attract price-sensitive users.

- Enhancing its product offerings: Introducing innovative features and services could differentiate Coinbase from competitors.

- Strengthening its brand reputation: Maintaining trust and transparency will be crucial in a volatile market.

- Investing in educational resources: Empowering users with knowledge can enhance loyalty and attract new users.

<h3>The Future of Coinbase's Premium: Uncertain but Not Hopeless</h3>

While the future of Coinbase's Bitcoin premium remains uncertain, it's premature to write off the exchange. Coinbase's strong brand recognition, user-friendly interface, and robust security features still hold considerable appeal. However, the company needs to proactively address the emerging challenges to maintain its position as a leading cryptocurrency exchange. The coming months will be crucial in determining whether Coinbase can successfully navigate these headwinds and retain its premium status or adapt to a new competitive landscape. Stay tuned for further updates and analysis on this developing story.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Coinbase's Bitcoin Premium Streak At Risk: Demand Shift Concerns. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

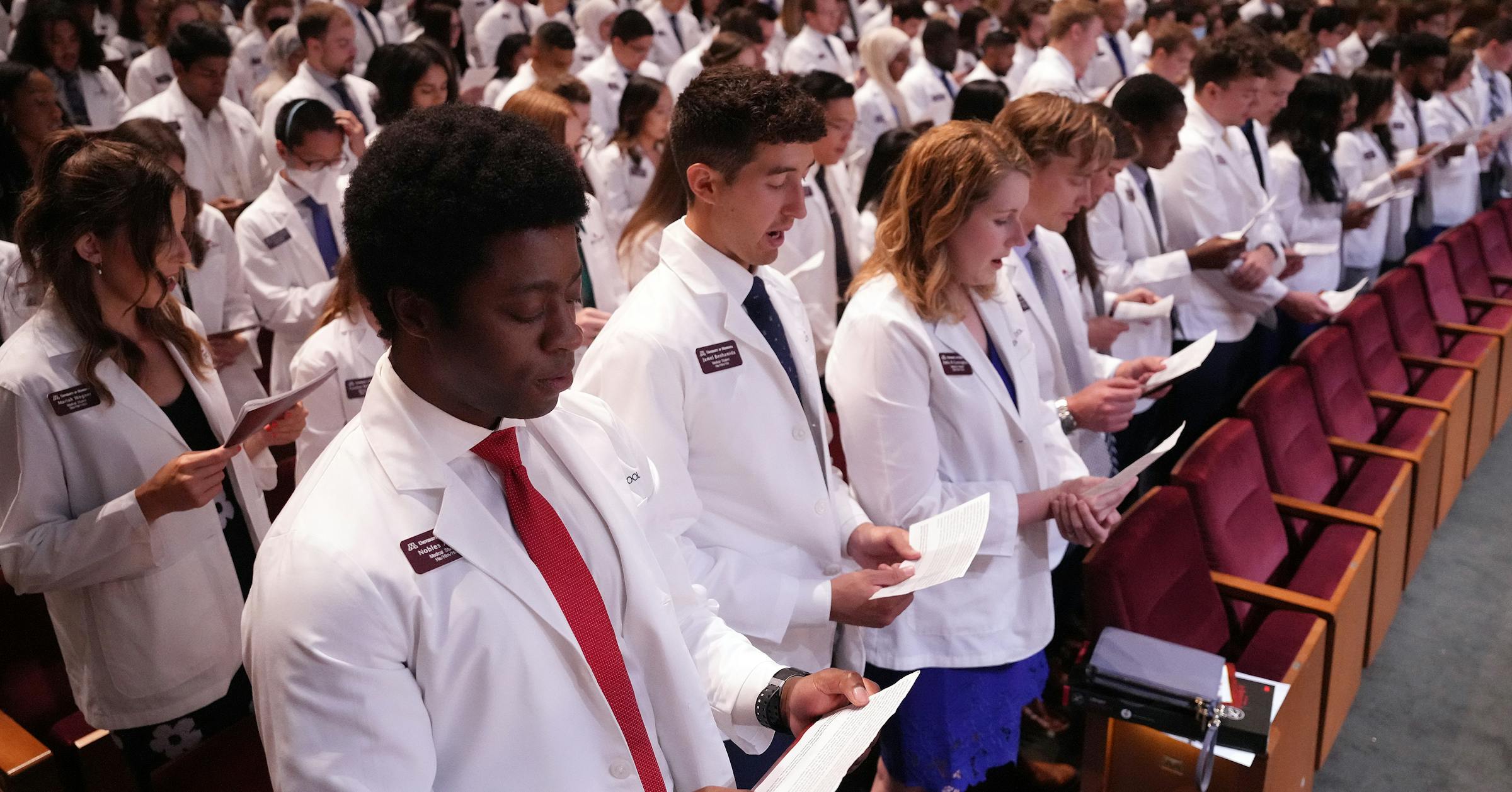

Are Law And Medical School Becoming Unaffordable The Impact Of New Federal Loan Limits

Aug 01, 2025

Are Law And Medical School Becoming Unaffordable The Impact Of New Federal Loan Limits

Aug 01, 2025 -

Accidental Admission Trump Official Exposes Budget Programs Reality

Aug 01, 2025

Accidental Admission Trump Official Exposes Budget Programs Reality

Aug 01, 2025 -

Cnn Politics Examining The Maga Medias Support For Trump On Epstein Issue

Aug 01, 2025

Cnn Politics Examining The Maga Medias Support For Trump On Epstein Issue

Aug 01, 2025 -

The Devastating Impact Of Nhs Delays A Mans Story

Aug 01, 2025

The Devastating Impact Of Nhs Delays A Mans Story

Aug 01, 2025 -

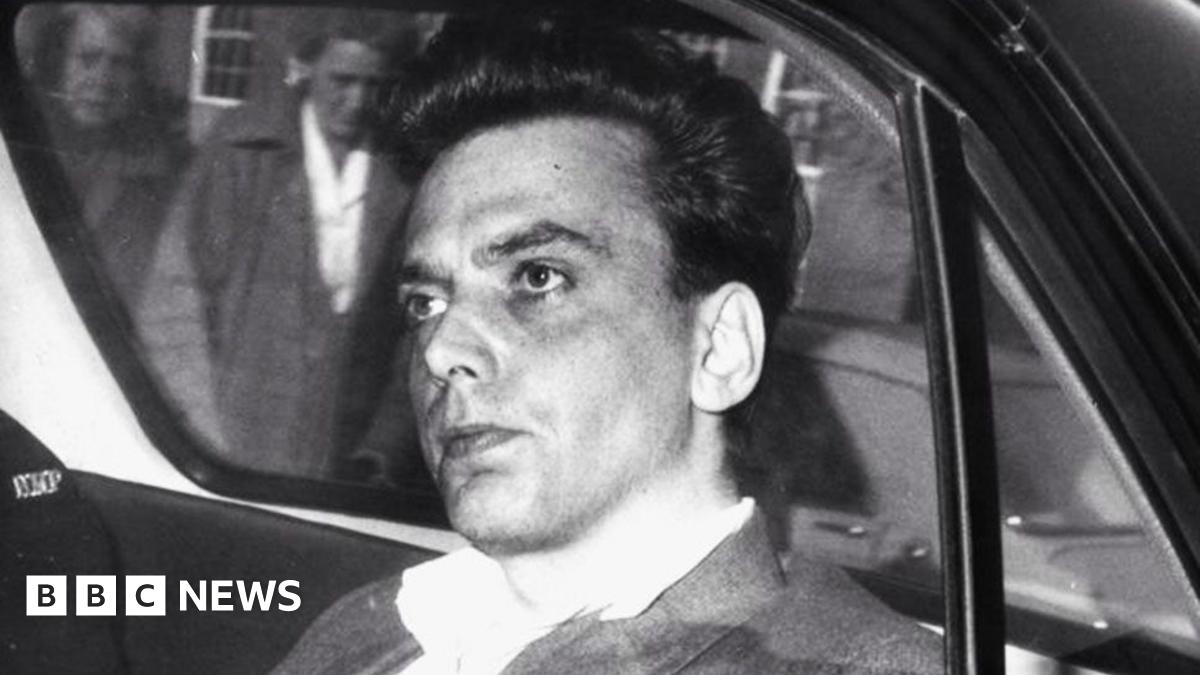

Brady Memoirs Disappearance Potential Clues To Unsolved Burial Site

Aug 01, 2025

Brady Memoirs Disappearance Potential Clues To Unsolved Burial Site

Aug 01, 2025

Latest Posts

-

September Start Date Announced For Trumps 200 Million White House Ballroom

Aug 03, 2025

September Start Date Announced For Trumps 200 Million White House Ballroom

Aug 03, 2025 -

Pattinson Out James Gunn Clarifies Dcu Batman Casting Speculation

Aug 03, 2025

Pattinson Out James Gunn Clarifies Dcu Batman Casting Speculation

Aug 03, 2025 -

Norris Fastest In Hungarian Gp Practice A Strong Start For Mc Laren

Aug 03, 2025

Norris Fastest In Hungarian Gp Practice A Strong Start For Mc Laren

Aug 03, 2025 -

White House Ballroom Renovation 200 Million Project Begins This September

Aug 03, 2025

White House Ballroom Renovation 200 Million Project Begins This September

Aug 03, 2025 -

X Qc Vs Kai Cenat Who Reigns Supreme In Streaming Net Worth

Aug 03, 2025

X Qc Vs Kai Cenat Who Reigns Supreme In Streaming Net Worth

Aug 03, 2025