Coinbase's Bitcoin Premium Streak Ends: What's Next For BTC Demand?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Coinbase's Bitcoin Premium Streak Ends: What's Next for BTC Demand?

Coinbase, a leading cryptocurrency exchange, has seen its Bitcoin (BTC) premium disappear, marking a significant shift in the market dynamics. This development raises crucial questions about the future trajectory of Bitcoin demand and its overall market sentiment. For months, Coinbase's BTC price consistently traded above other major exchanges, indicating strong buying pressure and potentially high demand within the US market. But this premium, a key indicator of investor appetite, has now vanished. What does this mean for Bitcoin's future?

The End of the Coinbase Premium: A Detailed Look

The Coinbase premium, a phenomenon where BTC traded at a higher price on Coinbase compared to other exchanges like Binance or Kraken, was largely attributed to several factors. These include:

- Higher US Regulatory Scrutiny: The relatively stricter regulatory environment in the US, compared to some other regions, potentially led to higher demand on Coinbase, as US-based investors sought a regulated platform.

- Limited Liquidity on Other Exchanges: Access to Bitcoin on certain international exchanges could be restricted for US users, further driving demand towards Coinbase.

- Strong US Dollar: A strong US dollar can sometimes lead to increased investment in dollar-denominated assets like Bitcoin, boosting demand on US-based exchanges.

However, the recent erosion of this premium suggests a potential shift in these dynamics. Several contributing factors are likely at play:

- Increased Global Liquidity: Greater availability of Bitcoin across various exchanges globally has likely reduced the reliance on Coinbase as the primary source for many investors.

- Easing Regulatory Concerns (Potentially): While the regulatory landscape remains complex, recent developments might be lessening anxieties among investors, leading them to explore alternative platforms.

- Shifting Market Sentiment: Overall market sentiment towards Bitcoin and cryptocurrencies plays a significant role. A period of less bullish sentiment could contribute to reduced demand on all exchanges, including Coinbase.

What Does This Mean for Bitcoin's Future Demand?

The disappearance of the Coinbase premium doesn't automatically signal a bearish trend for Bitcoin. It's crucial to consider this event within a broader context. While the premium's disappearance might indicate a slight cooling-off of US-specific demand, it doesn't necessarily reflect a global decrease in Bitcoin's overall appeal.

Several factors will continue to influence future demand:

- Macroeconomic Conditions: Global economic uncertainty and inflation rates significantly impact investor appetite for Bitcoin as a hedge against inflation.

- Regulatory Developments: Clearer regulatory frameworks in various jurisdictions can positively or negatively influence investor confidence and market participation.

- Technological Advancements: Innovations within the Bitcoin ecosystem, such as the Lightning Network, can improve scalability and transaction speeds, potentially driving further adoption.

- Institutional Investment: Continued institutional adoption of Bitcoin remains a significant driver of long-term demand.

Conclusion: A Shifting Landscape

The end of Coinbase's Bitcoin premium represents a notable shift in the market. While it might reflect a nuanced change in investor behavior and market liquidity, it’s crucial not to overinterpret this single data point. The future of Bitcoin demand remains tied to various interconnected factors, requiring careful monitoring of macroeconomic conditions, regulatory developments, and technological progress. The cryptocurrency market remains dynamic, and continuous assessment is key to understanding its evolving landscape.

Further Reading:

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies carries significant risk.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Coinbase's Bitcoin Premium Streak Ends: What's Next For BTC Demand?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

58 Sydney Out Of School Care Centers Linked To Alleged Paedophile

Aug 01, 2025

58 Sydney Out Of School Care Centers Linked To Alleged Paedophile

Aug 01, 2025 -

Child Abuse Allegations Rock Sydneys Out Of School Care System 58 Centers Implicated

Aug 01, 2025

Child Abuse Allegations Rock Sydneys Out Of School Care System 58 Centers Implicated

Aug 01, 2025 -

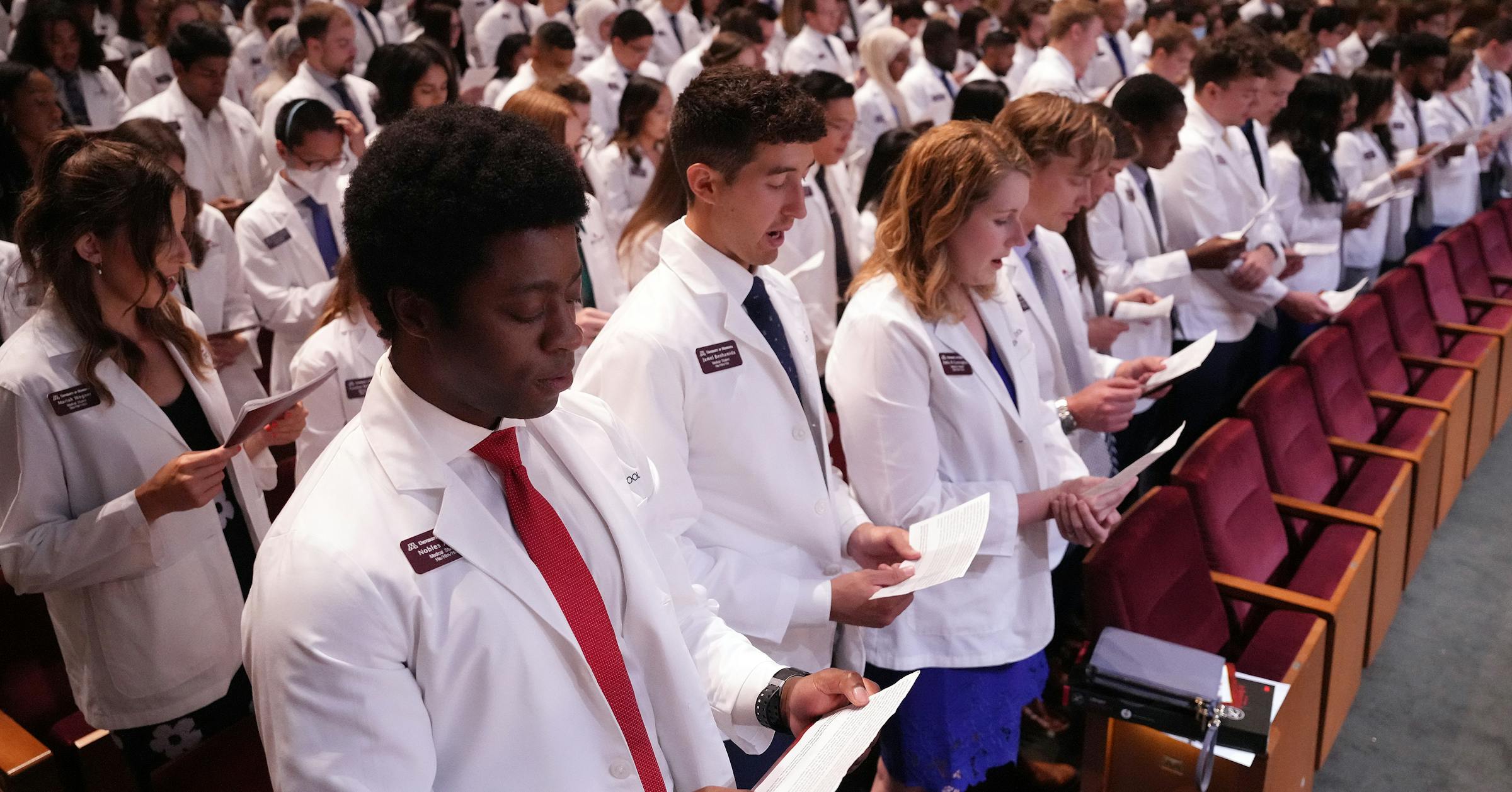

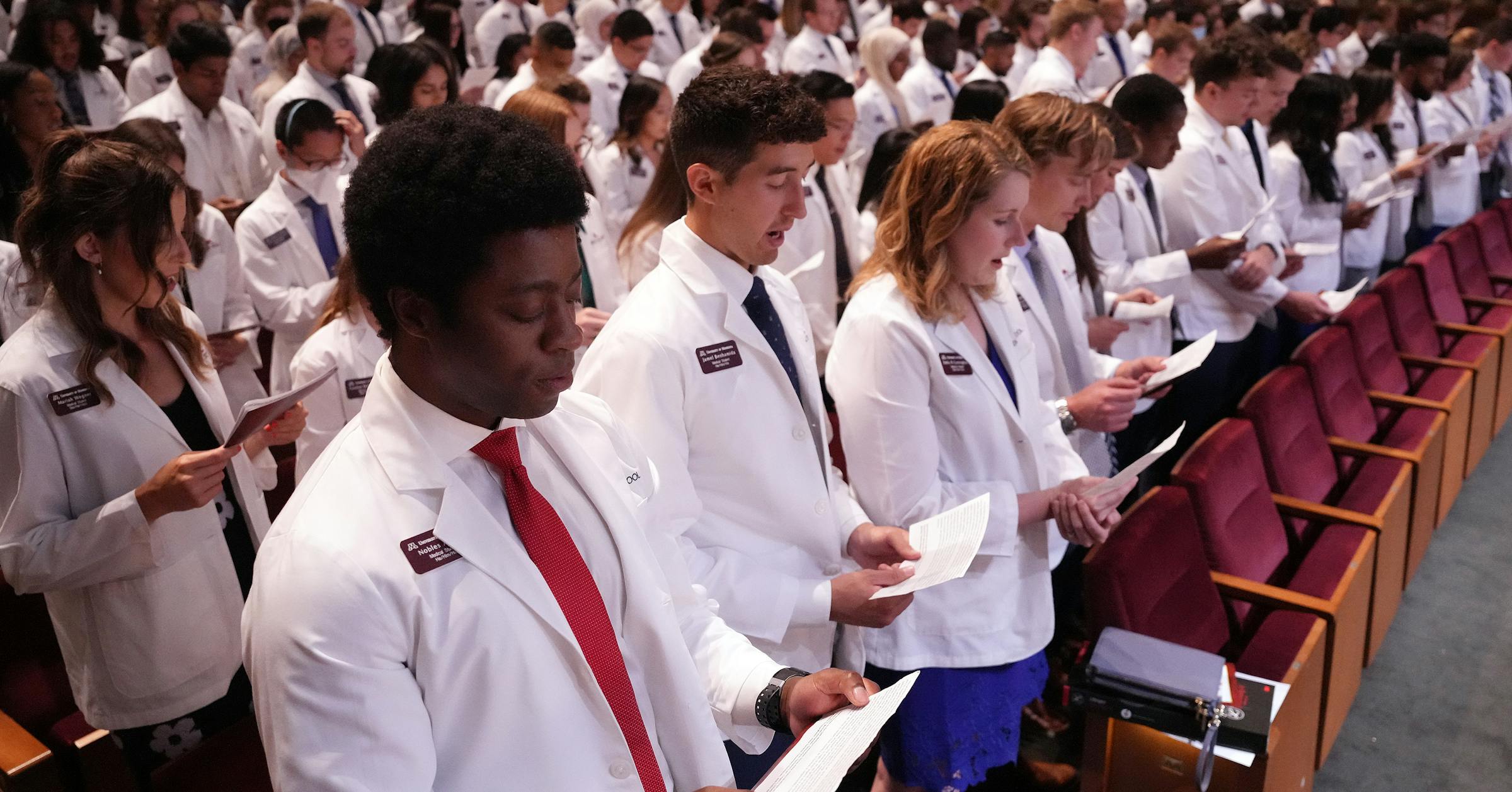

Are Law And Medical School Becoming Unaffordable The Impact Of New Federal Loan Limits

Aug 01, 2025

Are Law And Medical School Becoming Unaffordable The Impact Of New Federal Loan Limits

Aug 01, 2025 -

Impact Of Reduced Federal Loan Limits On Aspiring Doctors And Lawyers

Aug 01, 2025

Impact Of Reduced Federal Loan Limits On Aspiring Doctors And Lawyers

Aug 01, 2025 -

60 Day Run Ends Examining The Shift In Bitcoin Demand Affecting Coinbase

Aug 01, 2025

60 Day Run Ends Examining The Shift In Bitcoin Demand Affecting Coinbase

Aug 01, 2025

Latest Posts

-

Reggiana Training Center Preparing For The Future Of Italian Football

Aug 02, 2025

Reggiana Training Center Preparing For The Future Of Italian Football

Aug 02, 2025 -

Gym And Tactical Training Center Build Strength Agility And Skill

Aug 02, 2025

Gym And Tactical Training Center Build Strength Agility And Skill

Aug 02, 2025 -

49 Billion Heathrow Expansion Impact And Implications

Aug 02, 2025

49 Billion Heathrow Expansion Impact And Implications

Aug 02, 2025 -

Tuesday July 29 2025 Mega Millions Results Check Your Tickets

Aug 02, 2025

Tuesday July 29 2025 Mega Millions Results Check Your Tickets

Aug 02, 2025 -

Live Updates F1 Hungarian Grand Prix Fp 3 And Qualifying

Aug 02, 2025

Live Updates F1 Hungarian Grand Prix Fp 3 And Qualifying

Aug 02, 2025