College Savings Plan: 9 Effective Strategies For Delayed Savers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

College Savings Plan: 9 Effective Strategies for Delayed Savers

Starting a college savings plan feels daunting, especially if you feel behind. Many parents discover the urgency of saving for their child's higher education later than ideal. But don't despair! It's never too late to start saving, and with a strategic approach, you can still significantly contribute to your child's future. This article outlines nine effective strategies for those who've experienced a delayed start to their college savings journey.

Facing the Reality of Delayed Savings:

The average cost of college continues to rise, making early saving crucial. However, life happens. Unexpected expenses, career changes, or simply a lack of awareness can lead to a delayed start. The key is to acknowledge the situation and proactively implement strategies to catch up. Don't let the feeling of being behind paralyze you; focus on what you can do now.

9 Powerful Strategies to Boost Your College Savings:

-

Assess Your Current Financial Situation: Before diving into aggressive saving, understand your current financial health. Create a realistic budget, identifying areas where you can cut back on expenses. Consider using budgeting apps like Mint or YNAB (You Need A Budget) to gain a clearer picture.

-

Maximize 529 Plan Contributions: A 529 plan offers significant tax advantages for college savings. Explore different 529 plans offered by your state, comparing fees and investment options. Even small, consistent contributions add up over time. Learn more about the benefits of 529 plans on the .

-

Explore Employer-Sponsored Programs: Many employers offer tuition assistance or matching programs for employee education. Take advantage of these valuable resources, which can significantly reduce the overall cost of college.

-

Embrace Aggressive Savings Strategies: Prioritize college savings by aggressively cutting expenses. Consider downsizing your living situation, reducing entertainment costs, or exploring side hustles to generate extra income.

-

Seek Scholarships and Grants: Research and apply for as many scholarships and grants as possible. Numerous organizations offer financial aid based on academic merit, extracurricular activities, or financial need. Websites like and can help you find suitable opportunities.

-

Consider Part-Time Jobs for Your Child: Encourage your child to take on part-time jobs to contribute to their college fund. This instills financial responsibility and reduces the overall burden on your savings.

-

Refinance High-Interest Debt: High-interest debt, such as credit card debt, can significantly impact your savings potential. Consider refinancing to lower interest rates, freeing up more funds for college savings.

-

Utilize Tax Advantages: Explore all available tax deductions and credits that can benefit your college savings strategy. Consult a tax professional for personalized advice.

-

Seek Professional Financial Advice: A financial advisor can provide personalized guidance on creating a tailored college savings plan that aligns with your financial situation and goals. They can also help you navigate investment strategies and optimize your savings potential.

Conclusion:

While starting later presents challenges, it doesn't eliminate the possibility of achieving your college savings goals. By implementing these strategies and maintaining a disciplined approach, you can significantly contribute to your child's future education, even with a delayed start. Remember, every dollar counts, and proactive planning can make a substantial difference. Start today and watch your savings grow!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on College Savings Plan: 9 Effective Strategies For Delayed Savers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Exclusive Tom Daley Speaks Out On Supporting Closeted Queer Athletes

Jun 04, 2025

Exclusive Tom Daley Speaks Out On Supporting Closeted Queer Athletes

Jun 04, 2025 -

Northwestern Energy Group Nwe Stock Hold Rating From Ladenburg Thalm Sh Sh Impacts Investors

Jun 04, 2025

Northwestern Energy Group Nwe Stock Hold Rating From Ladenburg Thalm Sh Sh Impacts Investors

Jun 04, 2025 -

Drone Warfare In Ukraine Russias Response And Western Concerns

Jun 04, 2025

Drone Warfare In Ukraine Russias Response And Western Concerns

Jun 04, 2025 -

Confirmed Glastonbury 2025 Acts Full Stage Schedule And Surprise Performances

Jun 04, 2025

Confirmed Glastonbury 2025 Acts Full Stage Schedule And Surprise Performances

Jun 04, 2025 -

Ronny Mauricio Promotion Analyzing The Mets Decision And Potential Impact

Jun 04, 2025

Ronny Mauricio Promotion Analyzing The Mets Decision And Potential Impact

Jun 04, 2025

Latest Posts

-

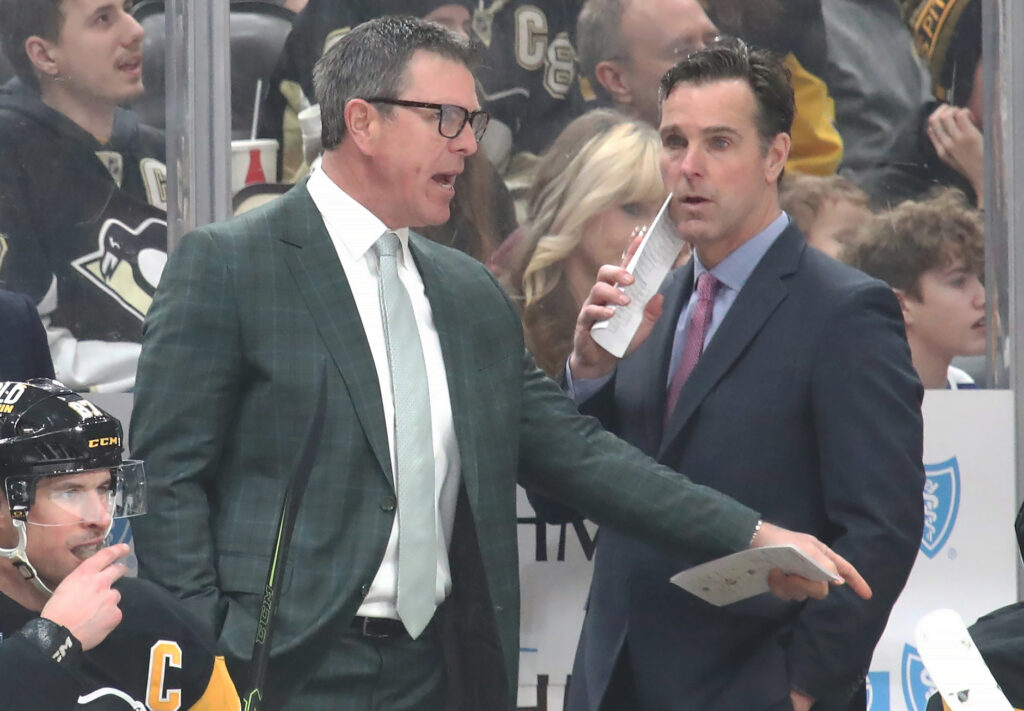

David Quinn And Joe Sacco Join Rangers Coaching Team

Jun 06, 2025

David Quinn And Joe Sacco Join Rangers Coaching Team

Jun 06, 2025 -

Harry Enten Deconstructs Mike Lindells Business And Political Career On Cnn

Jun 06, 2025

Harry Enten Deconstructs Mike Lindells Business And Political Career On Cnn

Jun 06, 2025 -

The Unique Demands Of Clay Why Roland Garros Is Different

Jun 06, 2025

The Unique Demands Of Clay Why Roland Garros Is Different

Jun 06, 2025 -

Is Coca Cola Ko Stock A Buy Analyzing The Investment Potential

Jun 06, 2025

Is Coca Cola Ko Stock A Buy Analyzing The Investment Potential

Jun 06, 2025 -

Madeleine Mc Cann Case Still Unsolved After 18 Years

Jun 06, 2025

Madeleine Mc Cann Case Still Unsolved After 18 Years

Jun 06, 2025