Creative 529 Plan Strategies For Ohio Families Facing Higher Education Expenses

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Creative 529 Plan Strategies for Ohio Families Facing Higher Education Expenses

The rising cost of higher education is a significant concern for Ohio families. Tuition fees, room and board, and other expenses continue to climb, making saving for college a daunting task. However, understanding and utilizing Ohio's 529 plan effectively can significantly alleviate this financial burden. This article explores creative strategies to maximize your 529 plan contributions and navigate the complexities of funding your child's higher education.

Understanding the Ohio 529 Plan: A Powerful Savings Tool

The Ohio 529 Plan, officially known as the Ohio Tuition Trust Authority (OTTA) program, offers tax-advantaged savings for qualified education expenses. Contributions grow tax-deferred, and withdrawals used for eligible expenses are generally tax-free at the federal level. This makes it a powerful tool for long-term college savings.

Creative Strategies to Maximize Your 529 Plan:

-

Early Contributions: Starting early is crucial. Even small, regular contributions can accumulate significantly over time due to the power of compounding. Consider automating monthly contributions to make saving consistent and effortless.

-

Gift-Giving Strategies: Grandparents, aunts, uncles, and other family members can contribute to your child's 529 plan, making it an excellent gift option for birthdays or holidays. Utilize the annual gift tax exclusion to maximize contributions without tax implications. Learn more about .

-

State Tax Deductions: Ohio offers state income tax deductions for contributions to the Ohio 529 Plan. This can substantially reduce your taxable income and further enhance your savings. Check the current limits and requirements on the .

-

Consider a Custodial Account: For younger children, establishing a custodial account alongside your 529 plan could offer additional flexibility and allow for earlier savings accumulation.

-

Utilizing 529 Plan for K-12 Expenses: While primarily designed for college, many 529 plans allow withdrawals for qualified K-12 expenses, including tuition, fees, and books. This added flexibility can ease the financial burden of private school education.

-

Diversification within the Plan: The Ohio 529 plan offers various investment options, allowing you to tailor your portfolio to your risk tolerance and time horizon. Consider consulting a financial advisor to determine the best investment strategy for your family's needs.

Beyond the Basics: Addressing Specific Challenges

-

Multiple Children: If you have multiple children, you can open separate 529 accounts for each child, allowing for personalized savings and investment strategies based on their individual needs and college goals.

-

Uncertain College Plans: If your child's college plans are still uncertain, maintaining a more conservative investment strategy within the 529 plan might be advisable. This reduces the risk of significant losses closer to college enrollment.

Frequently Asked Questions (FAQs):

-

What are qualified education expenses? This includes tuition, fees, books, room and board, and other educational expenses.

-

What happens if my child doesn't go to college? While there are penalties for non-qualified withdrawals, you can change the beneficiary to another family member.

-

Can I withdraw funds before college? Withdrawals for non-qualified expenses are subject to income tax and a 10% penalty.

Conclusion:

Planning for higher education requires proactive and strategic saving. By understanding and creatively utilizing the Ohio 529 Plan's features, Ohio families can significantly increase their chances of affording their children's college education without undue financial strain. Remember to consult with a financial advisor to develop a personalized savings plan that aligns with your family's unique circumstances and goals. Start planning today and secure your child's future!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Creative 529 Plan Strategies For Ohio Families Facing Higher Education Expenses. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Supreme Court To Decide Fate Of Illinois Congressmans Absentee Ballot

Jun 04, 2025

Supreme Court To Decide Fate Of Illinois Congressmans Absentee Ballot

Jun 04, 2025 -

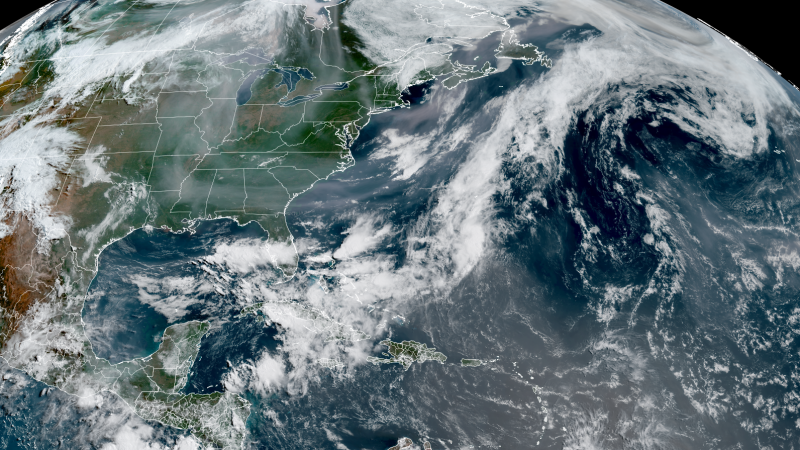

Forecast Canadian Wildfire Smoke And African Dust Plume To Impact Southern Us Air Quality

Jun 04, 2025

Forecast Canadian Wildfire Smoke And African Dust Plume To Impact Southern Us Air Quality

Jun 04, 2025 -

Supreme Court Agrees To Review Absentee Ballot Case From Illinois

Jun 04, 2025

Supreme Court Agrees To Review Absentee Ballot Case From Illinois

Jun 04, 2025 -

Paul And Tiafoe A New Era For American Tennis At Roland Garros

Jun 04, 2025

Paul And Tiafoe A New Era For American Tennis At Roland Garros

Jun 04, 2025 -

Rising College Costs Ohio Parents Share Clever 529 Plan Hacks

Jun 04, 2025

Rising College Costs Ohio Parents Share Clever 529 Plan Hacks

Jun 04, 2025

Latest Posts

-

Steve Guttenbergs Kidnapped By A Killer A Look At The New Movie

Jun 06, 2025

Steve Guttenbergs Kidnapped By A Killer A Look At The New Movie

Jun 06, 2025 -

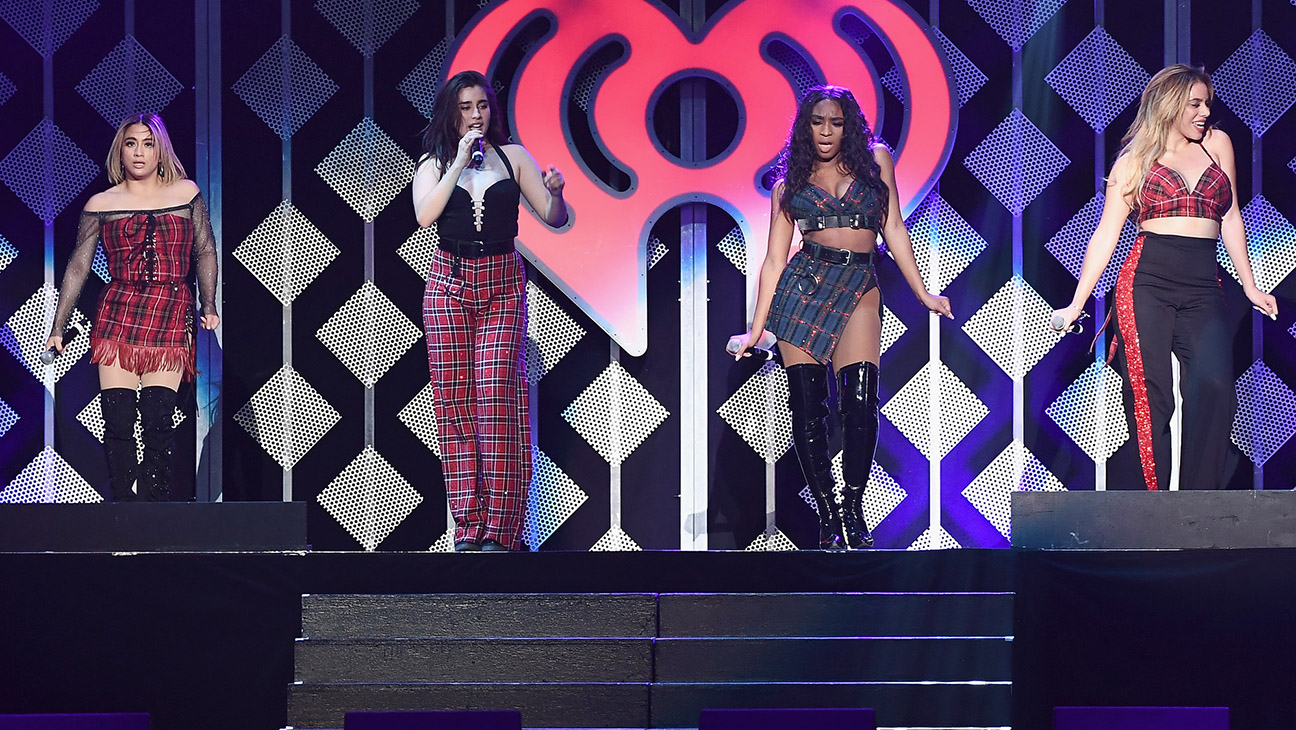

Is A Fifth Harmony Reunion Happening Details On Talks Without Camila

Jun 06, 2025

Is A Fifth Harmony Reunion Happening Details On Talks Without Camila

Jun 06, 2025 -

Steve Guttenbergs New Lifetime Movie Kidnapped By A Killer

Jun 06, 2025

Steve Guttenbergs New Lifetime Movie Kidnapped By A Killer

Jun 06, 2025 -

Peter De Boer Out Dallas Stars Playoff Failure Costs Coach His Job

Jun 06, 2025

Peter De Boer Out Dallas Stars Playoff Failure Costs Coach His Job

Jun 06, 2025 -

Ni Product Launch Creates 15 Hour Overnight Queue For Teens

Jun 06, 2025

Ni Product Launch Creates 15 Hour Overnight Queue For Teens

Jun 06, 2025