Economic Crisis Looms? Billionaire CEO's Strong Fed Condemnation

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Economic Crisis Looms? Billionaire CEO's Strong Fed Condemnation Sparks Debate

Is the US economy teetering on the brink of a crisis? That's the question many are asking after a scathing condemnation of the Federal Reserve's monetary policy by a prominent billionaire CEO sent shockwaves through financial markets. The outspoken comments have ignited a fiery debate, with experts divided on the severity of the potential economic downturn.

The controversy erupted following a recent interview where [CEO's Name], CEO of [Company Name], publicly criticized the Federal Reserve's handling of inflation, arguing their actions are pushing the nation towards a recession. “[Direct quote from CEO expressing concern about Fed policies and potential economic crisis],” he stated, sparking immediate reactions across Wall Street and beyond.

The CEO's Case: A Recipe for Recession?

[CEO's Name]'s argument hinges on several key points. He contends that the Fed's aggressive interest rate hikes, aimed at curbing inflation, are squeezing businesses and consumers alike. He points to:

- Rising borrowing costs: Higher interest rates make it more expensive for businesses to invest and expand, potentially leading to job losses and slower economic growth.

- Reduced consumer spending: Increased borrowing costs also impact consumers, limiting their ability to spend, which is a crucial driver of economic activity.

- Potential for a credit crunch: The tightening monetary policy could trigger a credit crunch, making it difficult for businesses and individuals to access loans, further hindering economic growth.

He isn't alone in his concerns. Many economists are voicing similar anxieties, pointing to the inverted yield curve – a reliable, albeit not perfect, predictor of recessions – as a significant warning sign. [Link to an article about the inverted yield curve].

The Fed's Response: A Necessary Evil?

The Federal Reserve, however, maintains that its actions are necessary to combat stubbornly high inflation. They argue that allowing inflation to run rampant would inflict even greater long-term economic damage. The Fed's response often highlights:

- Inflation as the primary concern: The Fed prioritizes bringing inflation back down to its 2% target, arguing that this is crucial for long-term economic stability.

- Gradual approach: While acknowledging the potential for economic slowdown, the Fed emphasizes its commitment to a measured and data-driven approach to monetary policy adjustments.

- Avoiding a repeat of the 1970s: The Fed is determined to avoid repeating the mistakes of the 1970s, when persistent high inflation led to a prolonged period of economic instability. [Link to an article discussing the economic challenges of the 1970s].

The Debate Rages On: What Lies Ahead?

The clash between [CEO's Name]'s dire predictions and the Fed's measured response leaves investors and the public in a state of uncertainty. The coming months will be crucial in determining whether the economy can navigate these challenges without succumbing to a full-blown recession. Several factors will play a key role, including:

- The effectiveness of the Fed's policies: Whether the current monetary policy will successfully curb inflation without causing a significant economic downturn remains to be seen.

- Global economic conditions: Global factors, such as the ongoing war in Ukraine and supply chain disruptions, will also significantly impact the US economy.

- Consumer and business sentiment: Confidence in the economy plays a critical role in driving spending and investment.

While [CEO's Name]'s strong condemnation has certainly fueled anxieties, it's vital to approach predictions with caution. The economic outlook remains complex and uncertain. It's essential to monitor economic indicators closely and stay informed about developments from credible sources. What are your thoughts on the current economic situation? Share your opinions in the comments below.

Keywords: Economic crisis, recession, Federal Reserve, inflation, monetary policy, billionaire CEO, [CEO's Name], [Company Name], interest rates, economic downturn, yield curve, economic indicators, financial markets, economic stability.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Economic Crisis Looms? Billionaire CEO's Strong Fed Condemnation. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Como Assistir Franca X Islandia Pelas Eliminatorias Horarios E Escalacoes

Sep 10, 2025

Como Assistir Franca X Islandia Pelas Eliminatorias Horarios E Escalacoes

Sep 10, 2025 -

World Cup Qualifiers Follow Armenia Vs Republic Of Ireland Group F Match Live

Sep 10, 2025

World Cup Qualifiers Follow Armenia Vs Republic Of Ireland Group F Match Live

Sep 10, 2025 -

Armenia Vs Republic Of Ireland Live Updates From World Cup Qualifying Group F

Sep 10, 2025

Armenia Vs Republic Of Ireland Live Updates From World Cup Qualifying Group F

Sep 10, 2025 -

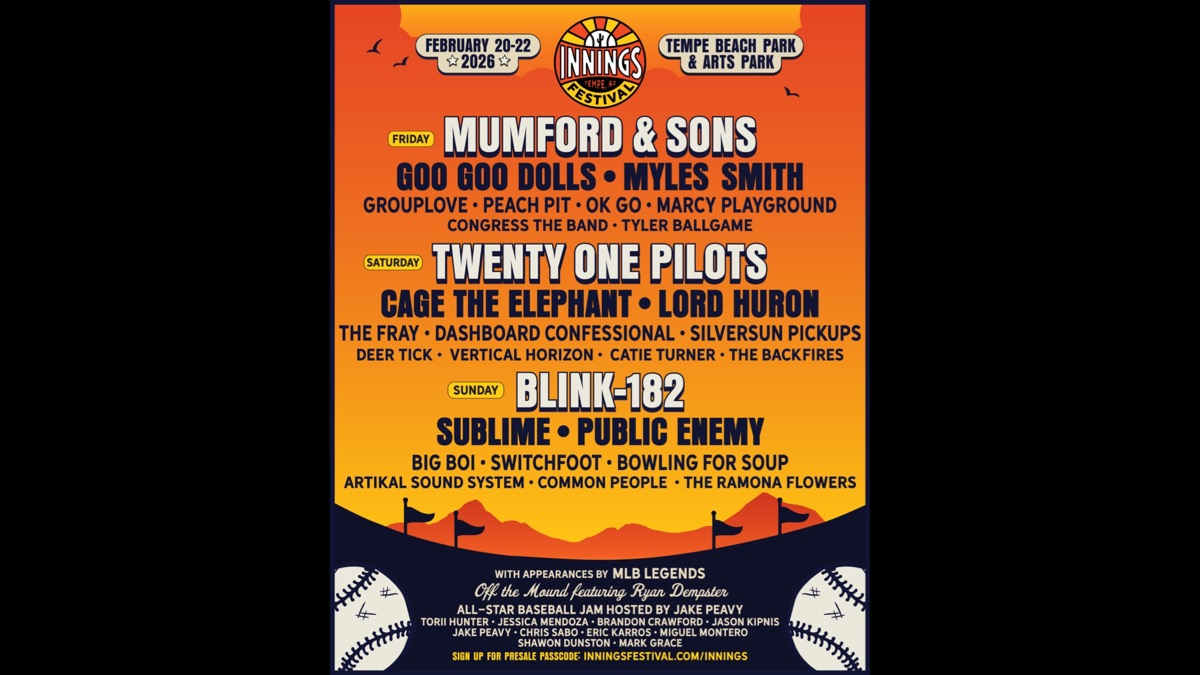

Blink 182 Twenty One Pilots And Mumford And Sons To Headline Innings Festival 2026

Sep 10, 2025

Blink 182 Twenty One Pilots And Mumford And Sons To Headline Innings Festival 2026

Sep 10, 2025 -

Frances Political Turmoil Whats Next For Macron And The Nation

Sep 10, 2025

Frances Political Turmoil Whats Next For Macron And The Nation

Sep 10, 2025

Latest Posts

-

Billionaire Ceo Feds Monetary Policy Is A Dangerous Attack

Sep 10, 2025

Billionaire Ceo Feds Monetary Policy Is A Dangerous Attack

Sep 10, 2025 -

Analyzing Tuchels World Cup Game Plan A Focus On Aerial Play

Sep 10, 2025

Analyzing Tuchels World Cup Game Plan A Focus On Aerial Play

Sep 10, 2025 -

Supreme Court To Decide On Trumps Plan For Massive Foreign Aid Cuts

Sep 10, 2025

Supreme Court To Decide On Trumps Plan For Massive Foreign Aid Cuts

Sep 10, 2025 -

World Cup 2023 Deconstructing Thomas Tuchels Playing Style

Sep 10, 2025

World Cup 2023 Deconstructing Thomas Tuchels Playing Style

Sep 10, 2025 -

Usmnt Vs Japan Kickoff Time Live Stream Details And Preview

Sep 10, 2025

Usmnt Vs Japan Kickoff Time Live Stream Details And Preview

Sep 10, 2025