Billionaire CEO: Fed's Monetary Policy Is A Dangerous Attack

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Billionaire CEO Slams Fed's Monetary Policy: A Dangerous Attack on the Economy?

The CEO of [Company Name], [CEO Name], has launched a scathing attack on the Federal Reserve's monetary policy, calling it a dangerous gamble with potentially devastating consequences for the US economy. His comments, made during a recent interview on [News Outlet Name], have sent shockwaves through financial markets and sparked a heated debate among economists. The billionaire's outspoken criticism highlights growing concerns about the Fed's aggressive interest rate hikes and their impact on inflation and economic growth.

The core of [CEO Name]'s argument centers around the perceived disconnect between the Fed's actions and the reality on the ground. He argues that the current tightening monetary policy, aimed at curbing inflation, is unnecessarily harsh and risks triggering a significant economic downturn. He points to [mention specific economic indicators, e.g., rising unemployment claims, slowing GDP growth] as evidence that the Fed's strategy is already showing signs of strain.

<h3>The Fed's Tightrope Walk: Inflation vs. Recession</h3>

The Federal Reserve is navigating a complex and delicate situation. Its primary mandate is to maintain price stability and maximum employment. However, the current inflationary environment, fueled by factors like supply chain disruptions and increased energy prices, presents a formidable challenge. The Fed's aggressive interest rate hikes aim to cool down the overheated economy by making borrowing more expensive, thus reducing consumer spending and investment.

However, critics like [CEO Name] argue that this approach is overly simplistic and ignores the potential for collateral damage. Raising interest rates too aggressively, they contend, could stifle economic growth, leading to job losses and a potential recession. This is a classic example of the central bank's difficult task of balancing inflation control with the need to avoid a significant economic contraction. The risk, as [CEO Name] highlights, is that the cure could be worse than the disease.

<h3>Beyond Interest Rates: A Broader Critique</h3>

[CEO Name]'s criticism isn't solely focused on interest rates. He also expressed concerns about the lack of transparency and communication from the Fed, suggesting that its actions lack a clear, coherent strategy. He argues for a more nuanced approach that considers the multifaceted nature of the current economic challenges, moving beyond the singular focus on interest rate adjustments.

"The Fed's current approach is akin to using a sledgehammer to crack a nut," [CEO Name] stated in the interview. He advocates for a more targeted and less drastic approach, suggesting that the Fed should consider other tools in its arsenal, perhaps focusing on measures to address supply-side bottlenecks and other underlying inflationary pressures.

<h3>The Market's Reaction and What Lies Ahead</h3>

[CEO Name]'s comments have understandably fueled market volatility. Investors are grappling with the uncertainty surrounding the Fed's future actions and the potential for a significant economic slowdown. The stock market's reaction to his statements reflects this anxiety. [Mention specific market reactions, e.g., stock market dips, bond yield changes].

The coming months will be crucial in determining the effectiveness of the Fed's current strategy. The impact of the recent interest rate hikes will continue to unfold, and the Fed will need to carefully monitor economic data to assess the need for further adjustments. [CEO Name]'s outspoken criticism serves as a stark reminder of the high stakes involved and the potential for significant economic consequences depending on the course the Fed chooses.

What are your thoughts on the Federal Reserve's monetary policy? Share your opinions in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Billionaire CEO: Fed's Monetary Policy Is A Dangerous Attack. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bbcs Master Chef Gets New Judging Duo Dent And Haugh Take Over

Sep 10, 2025

Bbcs Master Chef Gets New Judging Duo Dent And Haugh Take Over

Sep 10, 2025 -

Unexpected Findings How Gut Health Impacts Sugar Consumption Habits

Sep 10, 2025

Unexpected Findings How Gut Health Impacts Sugar Consumption Habits

Sep 10, 2025 -

Usmnt Vs Japan Friendly Kickoff Time Tv Channel And Streaming Info

Sep 10, 2025

Usmnt Vs Japan Friendly Kickoff Time Tv Channel And Streaming Info

Sep 10, 2025 -

Kelleher And Ferguson Cant Salvage Subpar Ireland Performance Match Analysis

Sep 10, 2025

Kelleher And Ferguson Cant Salvage Subpar Ireland Performance Match Analysis

Sep 10, 2025 -

Update Trumps Position On Sending Troops To Chicago

Sep 10, 2025

Update Trumps Position On Sending Troops To Chicago

Sep 10, 2025

Latest Posts

-

Will Trump Send National Guard To Chicago Latest News And Analysis

Sep 10, 2025

Will Trump Send National Guard To Chicago Latest News And Analysis

Sep 10, 2025 -

Thunder Secure Giddeys Future Impact On Okcs Roster And Playoff Hopes

Sep 10, 2025

Thunder Secure Giddeys Future Impact On Okcs Roster And Playoff Hopes

Sep 10, 2025 -

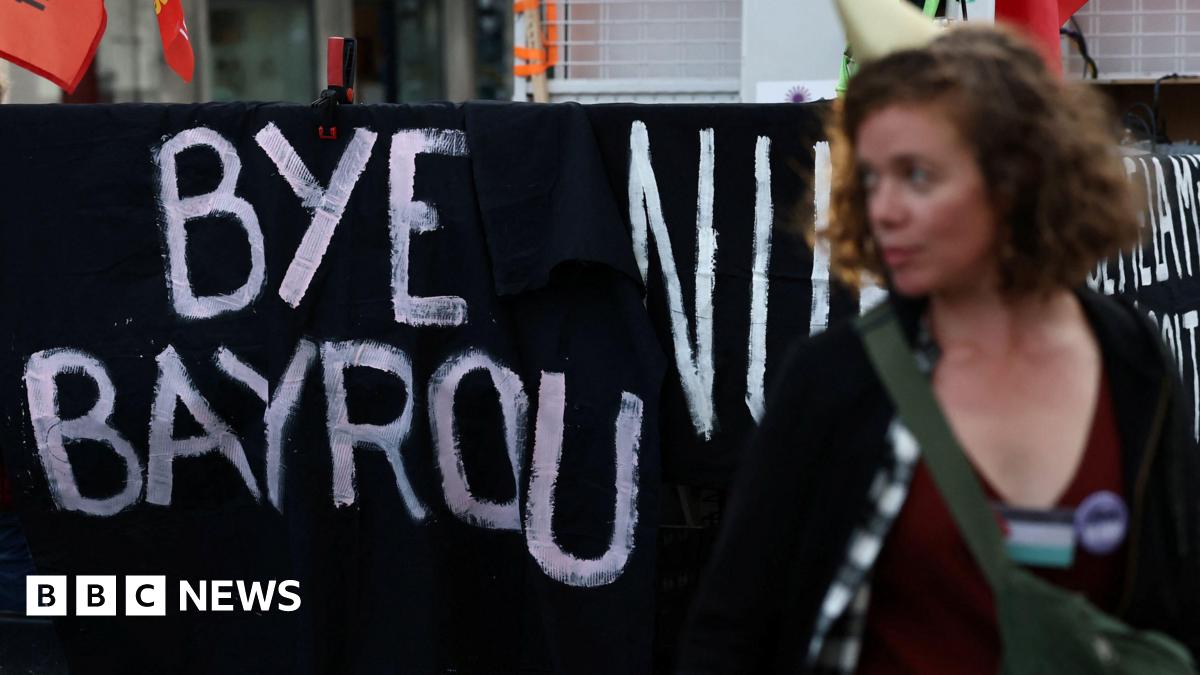

French Parliament Votes Out Prime Minister Triggering Political Uncertainty

Sep 10, 2025

French Parliament Votes Out Prime Minister Triggering Political Uncertainty

Sep 10, 2025 -

Fed Under Fire Prominent Ceo Issues Stark Warning On Economic Future

Sep 10, 2025

Fed Under Fire Prominent Ceo Issues Stark Warning On Economic Future

Sep 10, 2025 -

Billionaire Ceo Feds Monetary Policy Is A Dangerous Attack

Sep 10, 2025

Billionaire Ceo Feds Monetary Policy Is A Dangerous Attack

Sep 10, 2025