Fed Under Fire: Prominent CEO Issues Stark Warning On Economic Future

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Fed Under Fire: Prominent CEO Issues Stark Warning on Economic Future

The Federal Reserve's monetary policy is facing intense scrutiny after a prominent CEO delivered a stark warning about the potential for a deeper economic downturn. The comments, made by [CEO's Name and Company], have sent shockwaves through financial markets and ignited a renewed debate about the effectiveness of the central bank's actions.

The CEO's warning, delivered during a [mention event/interview – e.g., high-profile interview on CNBC], painted a grim picture of the current economic landscape. [He/She] argued that the Fed's aggressive interest rate hikes, intended to combat inflation, are inadvertently pushing the economy towards a more severe recession than initially anticipated. This isn't just idle speculation; [CEO's Name] cited [specific economic indicators, e.g., weakening consumer spending, declining business investment] as key reasons for their concern.

<h3>The Core of the Criticism: Is the Fed Overreacting?</h3>

The central argument hinges on the potential for overcorrection. While inflation remains a significant concern, critics like [CEO's Name] argue that the Fed's rapid tightening of monetary policy risks stifling economic growth to a far greater extent than necessary. This could lead to:

- Higher unemployment: As businesses struggle with reduced demand and increased borrowing costs, job losses could surge.

- Increased bankruptcies: Companies burdened by debt may find it increasingly difficult to meet their financial obligations.

- A deeper, more prolonged recession: The aggressive approach could prolong the economic downturn, impacting consumers and businesses for years to come.

[Optional: Add a short paragraph summarizing previous criticism of the Fed's actions, referencing relevant news articles or reports with links. E.g., "This isn't the first time the Fed's approach has been questioned. A recent report by [Source] highlighted concerns about..." with a link to the report.]

<h3>Market Reactions and Expert Opinions</h3>

The CEO's stark warning immediately impacted market sentiment. [Describe market reactions – e.g., Stock prices fell sharply following the announcement, the yield on the 10-year Treasury note decreased]. Economists are now divided on the potential implications. Some agree with the CEO's assessment, pointing to the lagged effects of monetary policy. Others maintain that the Fed's actions are necessary to bring inflation under control, even if it means accepting some short-term economic pain.

[Optional: Include quotes from other economists or financial analysts, attributing their opinions properly and providing links to their sources where possible.]

<h3>What Happens Next? The Uncertain Future</h3>

The coming months will be crucial in determining the accuracy of the CEO's prediction. The Federal Reserve is expected to [mention the Fed's next meeting and potential actions]. Close monitoring of key economic indicators, such as [mention key indicators, e.g., GDP growth, inflation rates, unemployment figures], will be essential.

The situation underscores the delicate balancing act faced by central bankers. Successfully navigating the path to price stability without triggering a severe recession requires precise judgment and a willingness to adapt to changing economic circumstances. The CEO's warning serves as a potent reminder of the significant stakes involved.

Call to action (subtle): Stay informed about the evolving economic situation by following reputable financial news sources and keeping an eye on key economic indicators. Understanding these trends can help individuals and businesses make informed decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Fed Under Fire: Prominent CEO Issues Stark Warning On Economic Future. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

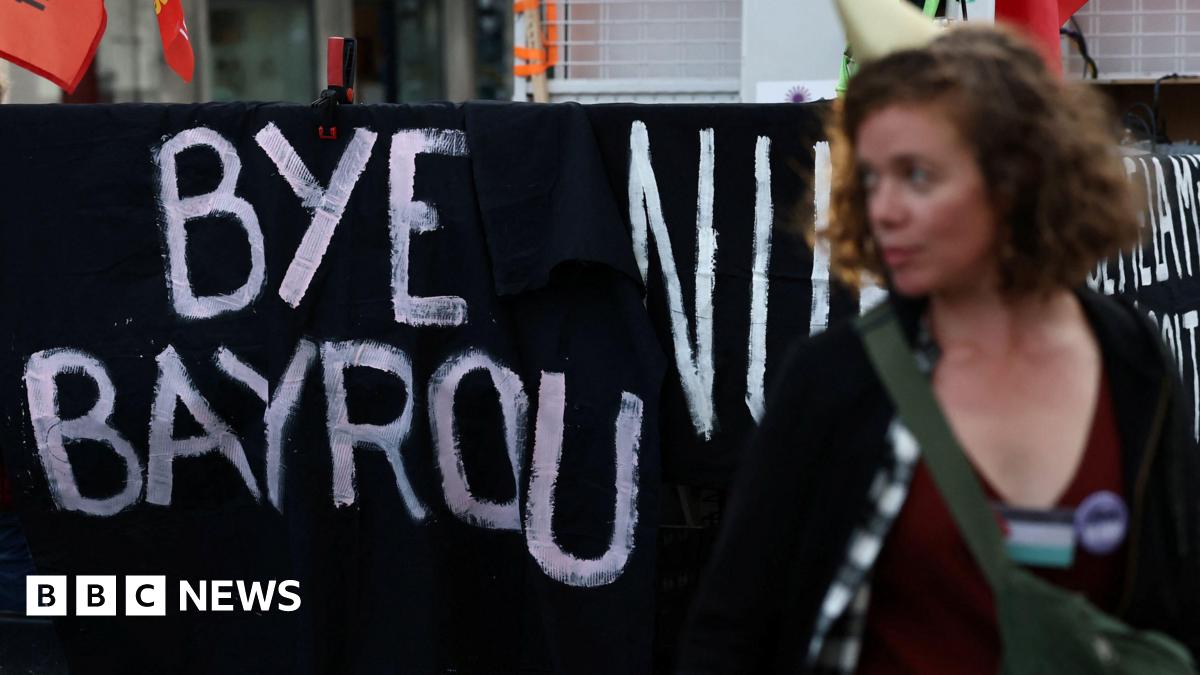

France Faces Fresh Political Uncertainty After Prime Ministers Removal

Sep 10, 2025

France Faces Fresh Political Uncertainty After Prime Ministers Removal

Sep 10, 2025 -

Prince Harry Lays Wreath At Queen Elizabeth Iis Remembrance Service

Sep 10, 2025

Prince Harry Lays Wreath At Queen Elizabeth Iis Remembrance Service

Sep 10, 2025 -

Usmnt Vs Japan Friendly Kickoff Time Tv Channel And Streaming Info

Sep 10, 2025

Usmnt Vs Japan Friendly Kickoff Time Tv Channel And Streaming Info

Sep 10, 2025 -

Epstein Estate Releases First Documents To House Committee

Sep 10, 2025

Epstein Estate Releases First Documents To House Committee

Sep 10, 2025 -

Four Year 100 M Deal Josh Giddeys Contract Extension Officially Announced

Sep 10, 2025

Four Year 100 M Deal Josh Giddeys Contract Extension Officially Announced

Sep 10, 2025

Latest Posts

-

Will Trump Send National Guard To Chicago Latest News And Analysis

Sep 10, 2025

Will Trump Send National Guard To Chicago Latest News And Analysis

Sep 10, 2025 -

Thunder Secure Giddeys Future Impact On Okcs Roster And Playoff Hopes

Sep 10, 2025

Thunder Secure Giddeys Future Impact On Okcs Roster And Playoff Hopes

Sep 10, 2025 -

French Parliament Votes Out Prime Minister Triggering Political Uncertainty

Sep 10, 2025

French Parliament Votes Out Prime Minister Triggering Political Uncertainty

Sep 10, 2025 -

Fed Under Fire Prominent Ceo Issues Stark Warning On Economic Future

Sep 10, 2025

Fed Under Fire Prominent Ceo Issues Stark Warning On Economic Future

Sep 10, 2025 -

Billionaire Ceo Feds Monetary Policy Is A Dangerous Attack

Sep 10, 2025

Billionaire Ceo Feds Monetary Policy Is A Dangerous Attack

Sep 10, 2025