Ethereum Investment Surge: $200M Inflows After Shanghai Upgrade

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Ethereum Investment Surge: $200M Inflows After Shanghai Upgrade

The Ethereum network has witnessed a significant surge in investment following the highly anticipated Shanghai upgrade, with over $200 million in inflows reported in the days immediately after its launch. This influx of capital signifies a renewed confidence in the second-largest cryptocurrency and highlights the positive impact of the upgrade on investor sentiment. The upgrade, which unlocked staked ETH, was a pivotal moment for the network's future and its wider adoption.

Unlocking Staked ETH: A Catalyst for Growth?

The Shanghai upgrade's most significant feature was the ability for users to withdraw their staked Ether (ETH) for the first time since the Beacon Chain launch in December 2020. This had been a major point of discussion and concern for many investors, who were hesitant to lock up their ETH for an indefinite period. The successful implementation of this withdrawal mechanism has seemingly assuaged these fears, leading to the substantial investment surge.

Prior to the upgrade, the inability to unstake ETH presented a significant risk. Investors worried about being locked out of their assets, potentially impacting liquidity and overall market confidence. The successful unlocking process has, therefore, been interpreted as a major milestone, signaling the network's maturity and stability.

Market Reaction and Future Implications

The $200 million inflow is just the initial response. Analysts predict further positive impacts on the Ethereum ecosystem. This includes:

- Increased Liquidity: The ability to withdraw staked ETH significantly improves market liquidity, making it easier for investors to buy and sell.

- Enhanced Staking Participation: With the risk of lock-in reduced, more investors are likely to participate in ETH staking, further decentralizing the network.

- Boost to DeFi Applications: Increased liquidity and participation could lead to a surge in activity within the decentralized finance (DeFi) ecosystem built on Ethereum.

However, it's crucial to note that market volatility remains a factor. While the Shanghai upgrade is a significant positive, external economic conditions and overall cryptocurrency market trends will continue to influence ETH's price.

Beyond the Numbers: Long-Term Vision for Ethereum

The Shanghai upgrade represents more than just a technical improvement; it's a significant step towards Ethereum's long-term vision of becoming a robust and scalable platform for decentralized applications (dApps). The successful withdrawal mechanism demonstrates the network's resilience and its ability to adapt to evolving market demands. This instills confidence not just in ETH as an investment, but also in the broader Ethereum ecosystem as a platform for innovation and growth.

Looking Ahead: What to Expect

While the immediate impact is undeniably positive, the long-term consequences of the Shanghai upgrade will unfold over time. Continued monitoring of market trends, network activity, and the development of new dApps on the Ethereum platform will be crucial in assessing the full extent of its influence. The successful implementation, however, suggests a bright future for Ethereum, paving the way for further advancements and broader adoption. Keep an eye on developments in the Ethereum ecosystem for further updates and analysis. Consider diversifying your investment portfolio and conducting thorough research before making any investment decisions.

Keywords: Ethereum, Shanghai upgrade, ETH, staking, cryptocurrency, investment, DeFi, blockchain, decentralized finance, cryptocurrency market, blockchain technology, crypto investment, Shanghai hard fork.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Ethereum Investment Surge: $200M Inflows After Shanghai Upgrade. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jamie Lee Curtis And Lindsay Lohan A Candid Friendship Revealed

May 20, 2025

Jamie Lee Curtis And Lindsay Lohan A Candid Friendship Revealed

May 20, 2025 -

Is Your Child Ready To Give Up Their Pacifier Or Thumb A Parents Guide

May 20, 2025

Is Your Child Ready To Give Up Their Pacifier Or Thumb A Parents Guide

May 20, 2025 -

Water Vole Conservation In Wales The Surprising Potential Of Glitter

May 20, 2025

Water Vole Conservation In Wales The Surprising Potential Of Glitter

May 20, 2025 -

Prostate Cancer Diagnosis For President Joe Biden Impact On Presidency

May 20, 2025

Prostate Cancer Diagnosis For President Joe Biden Impact On Presidency

May 20, 2025 -

Ethereum Investment Surge 200 Million Inflows Post Pectra Upgrade

May 20, 2025

Ethereum Investment Surge 200 Million Inflows Post Pectra Upgrade

May 20, 2025

Latest Posts

-

Lufthansa Plane Flies Unaided For 10 Minutes Following Co Pilots Medical Emergency

May 20, 2025

Lufthansa Plane Flies Unaided For 10 Minutes Following Co Pilots Medical Emergency

May 20, 2025 -

Slight Decrease In U S Treasury Yields Following Feds Rate Cut Outlook

May 20, 2025

Slight Decrease In U S Treasury Yields Following Feds Rate Cut Outlook

May 20, 2025 -

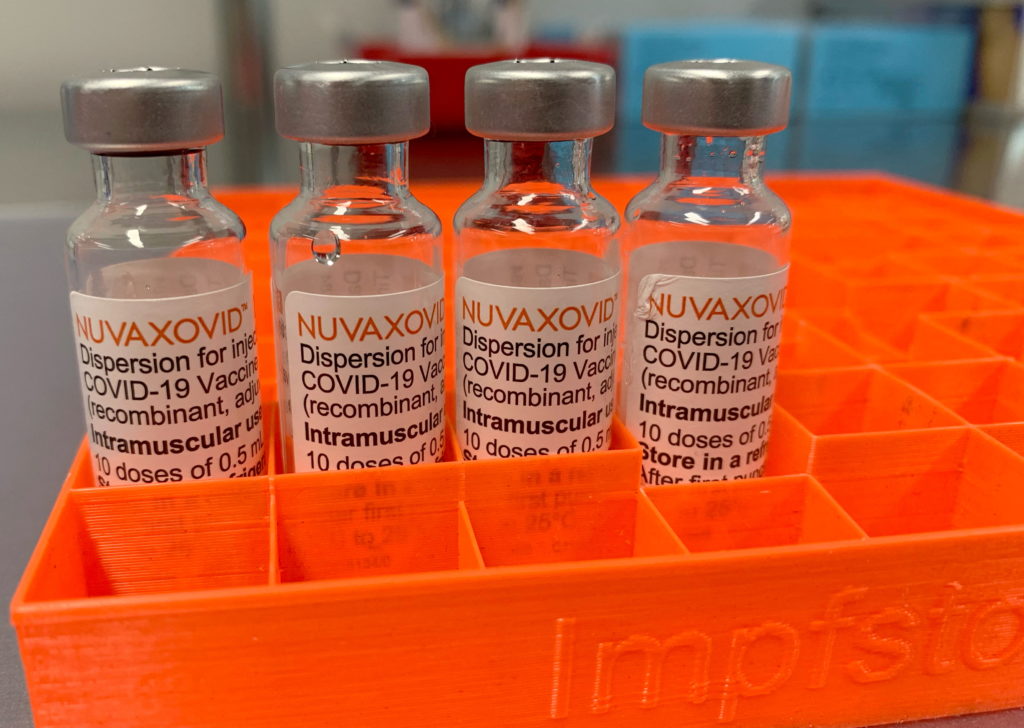

Novavax Covid 19 Vaccine Gets Fda Nod But With Significant Usage Constraints

May 20, 2025

Novavax Covid 19 Vaccine Gets Fda Nod But With Significant Usage Constraints

May 20, 2025 -

Death Toll Rises As Israeli Strikes Wipe Out Last Hospital In North Gaza

May 20, 2025

Death Toll Rises As Israeli Strikes Wipe Out Last Hospital In North Gaza

May 20, 2025 -

The Right Time To Wean Your Child Off Pacifiers And Thumb Sucking

May 20, 2025

The Right Time To Wean Your Child Off Pacifiers And Thumb Sucking

May 20, 2025