Financial Avengers Inc. Portfolio Analysis: Bank Of America's Role

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Financial Avengers Inc. Portfolio Analysis: Bank of America's Strategic Role

Financial Avengers Inc. (FAI), a renowned investment firm known for its aggressive yet calculated strategies, recently unveiled a portfolio analysis highlighting the significant role of Bank of America (BAC) in their overall investment strategy. This move comes amidst growing market volatility and speculation about FAI's future investment directions. The analysis sheds light not only on FAI's holdings but also offers insights into the current financial landscape and potential future trends.

This detailed look at FAI's portfolio reveals a significant weighting towards financial institutions, with Bank of America emerging as a cornerstone holding. The firm's strategic decision to maintain a substantial position in BAC warrants a closer examination.

Why Bank of America? A Deep Dive into FAI's Rationale

FAI's justification for its significant investment in Bank of America rests on several key pillars:

-

Strong Fundamentals: Bank of America boasts robust financial fundamentals, including a healthy capital ratio, consistent profitability, and a diversified revenue stream. These factors provide a buffer against economic downturns and contribute to long-term stability. This aligns with FAI's established preference for blue-chip companies with proven track records.

-

Growth Potential: Despite recent market challenges, Bank of America continues to demonstrate significant growth potential. Their expansion into digital banking, coupled with a strong focus on customer acquisition and retention, positions them favorably for future growth. FAI's investment likely anticipates this continued expansion.

-

Dividend Yield: Bank of America's consistent dividend payouts are an attractive feature for income-oriented investors. This passive income stream adds another layer of value to FAI's investment, aligning with their strategy of maximizing returns.

-

Market Position: As one of the largest banks in the United States, Bank of America occupies a dominant position within the financial sector. This market dominance translates to significant influence and resilience, making it a less volatile investment compared to smaller players.

The Broader Context: FAI's Portfolio Strategy and Market Outlook

FAI’s heavy investment in Bank of America is not an isolated decision. It reflects their overall conservative, yet growth-oriented portfolio strategy. The firm consistently prioritizes long-term value creation over short-term gains. This long-term perspective is crucial in navigating the current uncertain economic climate.

The analysis also suggests that FAI views the financial sector as a promising area for future growth, despite recent interest rate hikes and economic uncertainty. This belief underscores a long-term optimistic outlook on the U.S. economy and the continued need for robust financial services.

Implications and Future Outlook

FAI’s continued commitment to Bank of America sends a strong signal to the market. It suggests confidence in BAC's long-term prospects and potentially influences other investors to re-evaluate their positions. However, it's important to remember that this is just one piece of a larger investment puzzle.

This analysis serves as a valuable case study for investors seeking to understand how seasoned firms approach portfolio management in challenging market conditions. The careful consideration of fundamentals, growth potential, and risk mitigation provides a blueprint for building a robust investment portfolio.

Disclaimer: This article provides general information and should not be considered financial advice. Investing involves risk, and the value of investments can fluctuate. Consult with a qualified financial advisor before making any investment decisions.

Keywords: Financial Avengers Inc., FAI, Bank of America, BAC, Portfolio Analysis, Investment Strategy, Stock Market, Financial News, Investment Portfolio, Dividend Yield, Stock Market Analysis, Economic Outlook, Financial Sector, Market Volatility.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Financial Avengers Inc. Portfolio Analysis: Bank Of America's Role. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Partners Early Death From Heart Attack Understanding The Risks

May 28, 2025

Partners Early Death From Heart Attack Understanding The Risks

May 28, 2025 -

Michael Gaine Confirmation Of Remains Found In County Kerry

May 28, 2025

Michael Gaine Confirmation Of Remains Found In County Kerry

May 28, 2025 -

Facing A 15 Cut Understanding Social Security Changes In June 2025

May 28, 2025

Facing A 15 Cut Understanding Social Security Changes In June 2025

May 28, 2025 -

American Dream Or German Comfort A Former Californians Perspective

May 28, 2025

American Dream Or German Comfort A Former Californians Perspective

May 28, 2025 -

Heightened Tensions In Jerusalem Amidst Ultra Nationalist Israeli March

May 28, 2025

Heightened Tensions In Jerusalem Amidst Ultra Nationalist Israeli March

May 28, 2025

Latest Posts

-

Extended Wait For Newark Airport Air Traffic Control System Enhancements

May 30, 2025

Extended Wait For Newark Airport Air Traffic Control System Enhancements

May 30, 2025 -

Athletic Advantage In Transgender Women What The Research Shows

May 30, 2025

Athletic Advantage In Transgender Women What The Research Shows

May 30, 2025 -

Newark Airport Delays Secretary Duffys Air Traffic Control Overhaul Sparks Disruption

May 30, 2025

Newark Airport Delays Secretary Duffys Air Traffic Control Overhaul Sparks Disruption

May 30, 2025 -

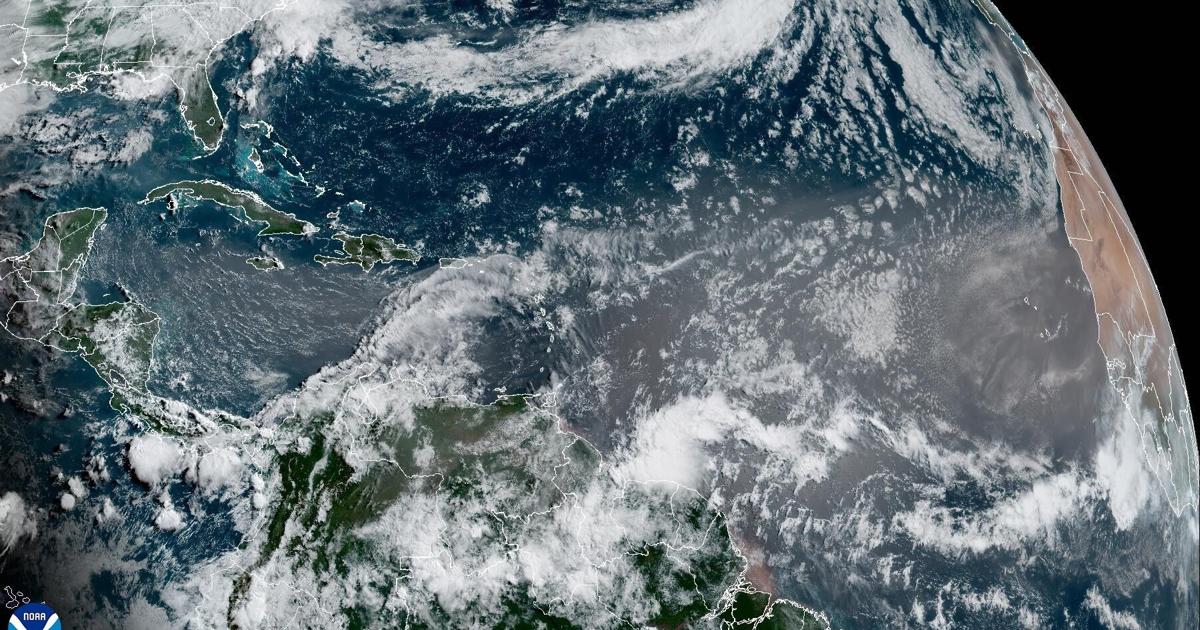

Saharan Dust Plume Headed For Louisiana Expect Dramatic Sunrises And Sunsets

May 30, 2025

Saharan Dust Plume Headed For Louisiana Expect Dramatic Sunrises And Sunsets

May 30, 2025 -

Sheinelle Jones And Family Grieve After The Passing Of Uche Ojeh

May 30, 2025

Sheinelle Jones And Family Grieve After The Passing Of Uche Ojeh

May 30, 2025