First-Time Homebuyers: Average Mortgage Length Now 31 Years

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

First-Time Homebuyers Face Longer Mortgage Terms: The 31-Year Reality

The dream of homeownership is alive and well, but for first-time buyers, that dream is increasingly stretching over a longer timeframe. A recent analysis reveals the average mortgage length for new homeowners is now a staggering 31 years, significantly impacting financial planning and long-term budgeting. This shift raises important questions about affordability, financial stability, and the evolving landscape of the housing market.

The 31-Year Mortgage: A New Normal?

The increase in average mortgage length isn't just a statistical anomaly; it reflects a complex interplay of factors impacting the housing market. Rising interest rates, persistently high home prices, and increased competition have combined to push the affordability threshold higher than ever before. For many first-time homebuyers, securing a manageable monthly payment often necessitates opting for longer loan terms, even if it means paying significantly more in interest over the life of the loan.

This trend presents both opportunities and challenges. While a longer repayment period reduces monthly payments, making homeownership more accessible in the short term, it also locks buyers into debt for a considerably longer period. This extended commitment can impact other financial goals, such as saving for retirement or investing in education.

Factors Contributing to Lengthier Mortgages:

Several key elements contribute to this lengthening trend:

- Increased Home Prices: Across many regions, home prices continue to outpace wage growth, forcing buyers to borrow more to secure a property.

- Rising Interest Rates: Higher interest rates directly impact monthly mortgage payments, pushing many buyers towards longer loan terms to keep payments affordable.

- Limited Inventory: A shortage of available homes fuels competition, driving up prices and making it more challenging for first-time buyers to find suitable properties within their budget.

- Student Loan Debt: The burden of student loan repayments often limits the amount first-time buyers can borrow for a mortgage, leading them to choose longer repayment periods.

Navigating the 31-Year Mortgage: Tips for First-Time Homebuyers:

Facing a 31-year mortgage commitment requires careful financial planning. Here are some key strategies for first-time homebuyers:

- Prioritize Saving: Building a substantial down payment can significantly reduce the loan amount needed and, consequently, the overall interest paid. Explore resources like [link to a reputable savings guide or financial planning website].

- Shop Around for Mortgage Rates: Comparing offers from multiple lenders is crucial to securing the best possible interest rate and loan terms.

- Consider Different Mortgage Types: Explore options like fixed-rate and adjustable-rate mortgages to find the best fit for your financial situation and risk tolerance.

- Budget Wisely: Create a detailed budget that accounts for all expenses, including mortgage payments, property taxes, insurance, and maintenance.

- Seek Professional Advice: Consult with a financial advisor or mortgage broker to navigate the complexities of the home-buying process and develop a personalized financial plan.

The Future of Homeownership:

The shift towards longer mortgage terms highlights the need for sustainable solutions to address housing affordability. Policymakers, lenders, and the industry as a whole must address the root causes of this trend to ensure that homeownership remains attainable for future generations. Further research into the long-term financial implications of extended mortgage lengths is also crucial. This evolving landscape necessitates a proactive approach to financial planning and a deeper understanding of the implications of long-term debt for first-time homebuyers.

Call to Action: Are you a first-time homebuyer navigating this changing market? Share your experiences and challenges in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on First-Time Homebuyers: Average Mortgage Length Now 31 Years. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

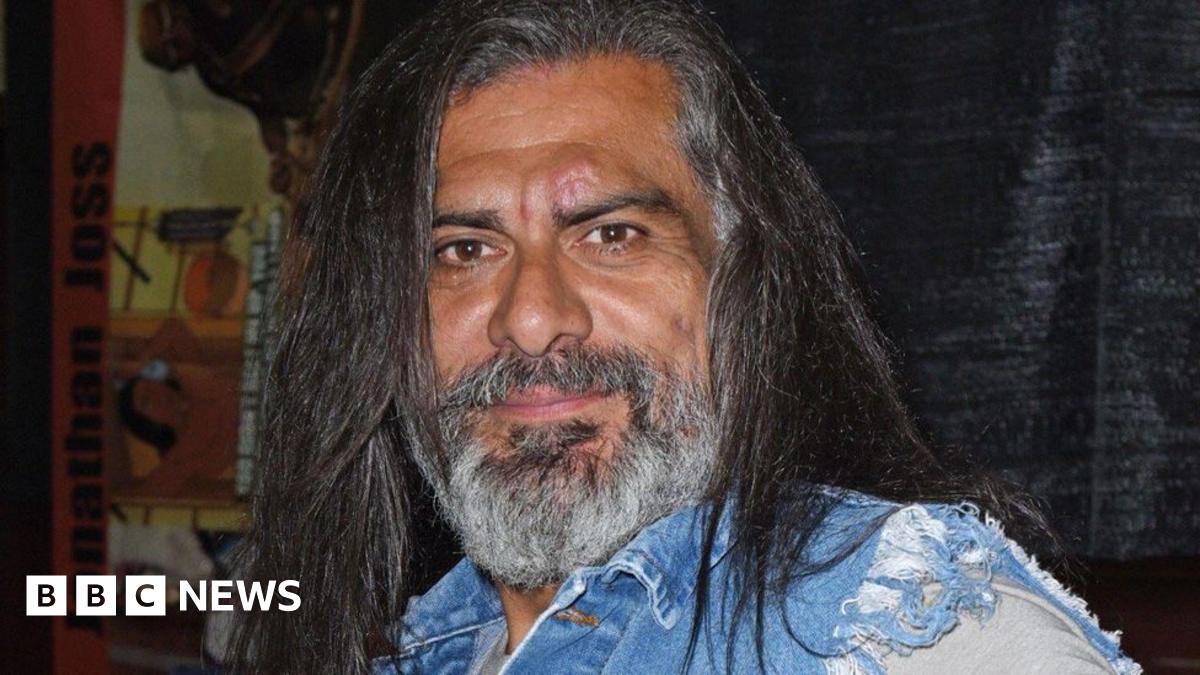

Jonathan Joss King Of The Hills John Redcorn Fatally Shot

Jun 04, 2025

Jonathan Joss King Of The Hills John Redcorn Fatally Shot

Jun 04, 2025 -

Billionaire Buffetts Portfolio Overhaul Exiting Bank Of America Embracing A Consumer Giant

Jun 04, 2025

Billionaire Buffetts Portfolio Overhaul Exiting Bank Of America Embracing A Consumer Giant

Jun 04, 2025 -

Setback For Thames Water As Preferred Bidder Pulls Out Of Deal

Jun 04, 2025

Setback For Thames Water As Preferred Bidder Pulls Out Of Deal

Jun 04, 2025 -

Is This The Next Big Netflix Hit Fans Cant Stop Watching This New Comedy

Jun 04, 2025

Is This The Next Big Netflix Hit Fans Cant Stop Watching This New Comedy

Jun 04, 2025 -

Political Polarization The Great American Emigration

Jun 04, 2025

Political Polarization The Great American Emigration

Jun 04, 2025

Latest Posts

-

Goodbye Summer House Paige De Sorbos Departure Confirmed

Jun 05, 2025

Goodbye Summer House Paige De Sorbos Departure Confirmed

Jun 05, 2025 -

Landmark Supreme Court Ruling Ohio Woman Prevails In Discrimination Lawsuit

Jun 05, 2025

Landmark Supreme Court Ruling Ohio Woman Prevails In Discrimination Lawsuit

Jun 05, 2025 -

22 Crew Members Rescued After Massive North Pacific Car Carrier Fire

Jun 05, 2025

22 Crew Members Rescued After Massive North Pacific Car Carrier Fire

Jun 05, 2025 -

Evaluating Robinhood Stock Risks And Rewards For Investors

Jun 05, 2025

Evaluating Robinhood Stock Risks And Rewards For Investors

Jun 05, 2025 -

Madeleine Mc Cann Case Is The 18 Year Search Futile

Jun 05, 2025

Madeleine Mc Cann Case Is The 18 Year Search Futile

Jun 05, 2025