Government Borrowing Exceeds Forecasts For April

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Government Borrowing Exceeds Forecasts for April: A Sign of Economic Strain?

Government borrowing surged to unexpected heights in April, exceeding forecasts and raising concerns about the nation's fiscal health. The figures, released [Source Name - e.g., by the Office for National Statistics] on [Date], reveal a borrowing total of [Insert Specific Amount] – significantly higher than the anticipated [Insert Forecasted Amount] and sparking debate among economists and policymakers. This unexpected increase has ignited discussions regarding the underlying causes and potential implications for the UK economy.

This substantial overshoot represents a [Percentage]% increase compared to April of the previous year and marks the [Superlative - e.g., highest] monthly borrowing figure since [Date/Event]. The deviation from predictions underscores the challenges facing the government in managing public finances amidst a complex economic climate.

Factors Contributing to the Increased Borrowing

Several key factors are believed to be contributing to this significant jump in government borrowing:

-

Inflationary Pressures: Persistent high inflation continues to impact government spending. Increased costs for public services, including healthcare and social welfare programs, are placing significant strain on the public purse. The impact of inflation on the cost of living is discussed further in [Link to relevant article on inflation].

-

Cost of Living Crisis: The ongoing cost of living crisis is placing immense pressure on household budgets, leading to increased demand for government support and social safety nets. This increased demand translates directly into higher government expenditure.

-

Energy Crisis: The lingering effects of the global energy crisis continue to exert pressure on public finances, with significant government interventions required to mitigate the impact on both households and businesses. This has contributed substantially to increased borrowing.

-

Tax Revenue Shortfalls: While tax revenues are generally expected to rise with inflation, several factors may have contributed to underperformance, including potential decreases in consumer spending and business investment. Understanding tax revenue trends is crucial for a balanced perspective on the current economic situation.

Implications for the UK Economy

The exceeding of borrowing forecasts raises several important questions regarding the UK's economic outlook. The increased borrowing could lead to:

-

Higher Interest Rates: The Bank of England may respond to increased government borrowing by raising interest rates to control inflation, potentially impacting mortgage holders and businesses. Learn more about the effects of interest rate changes in [Link to relevant article on interest rates].

-

Increased National Debt: The higher-than-expected borrowing will inevitably contribute to a rise in the national debt, potentially impacting the government's long-term fiscal sustainability. A deeper dive into the UK's national debt can be found in [Link to relevant article on national debt].

-

Fiscal Policy Adjustments: The government may need to consider implementing further austerity measures or explore alternative revenue-generating strategies to address the widening fiscal gap.

What's Next?

The government's response to this unexpected surge in borrowing will be closely watched. Analysts anticipate that upcoming fiscal policy announcements will provide further clarity on the government's plan to address the widening budget deficit. Further analysis is needed to fully assess the long-term implications of this development for the UK economy. Keep an eye on [Source Name] for further updates and analysis.

Keywords: Government borrowing, April borrowing figures, UK economy, national debt, inflation, cost of living crisis, fiscal policy, interest rates, economic forecast, budget deficit, government spending, tax revenue.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Government Borrowing Exceeds Forecasts For April. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Uk And Us Politics Starmers Reversal And Trumps Strategic Surprise

May 24, 2025

Uk And Us Politics Starmers Reversal And Trumps Strategic Surprise

May 24, 2025 -

Government Borrowing Exceeds Expectations Aprils Financial Report

May 24, 2025

Government Borrowing Exceeds Expectations Aprils Financial Report

May 24, 2025 -

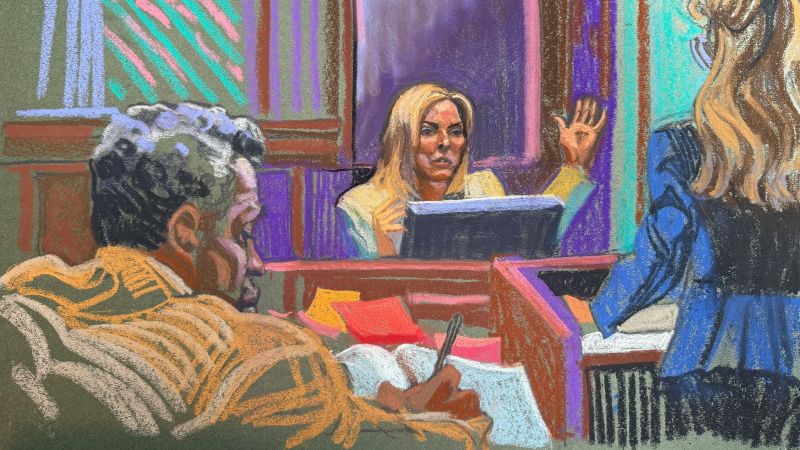

Sean Combs Trial Update Experts Testimony On Trauma And Cassie Ventura

May 24, 2025

Sean Combs Trial Update Experts Testimony On Trauma And Cassie Ventura

May 24, 2025 -

Olly Murs Abruptly Ends Glasgow Ovo Hydro Concert A Stage Walk Off Explained

May 24, 2025

Olly Murs Abruptly Ends Glasgow Ovo Hydro Concert A Stage Walk Off Explained

May 24, 2025 -

Pacquiao Out Of Retirement Las Vegas Showdown With Barrios

May 24, 2025

Pacquiao Out Of Retirement Las Vegas Showdown With Barrios

May 24, 2025