Government Borrowing Figures Exceed Expectations In April

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Government Borrowing Figures Exceed Expectations in April: A Deeper Dive into the National Debt

The UK government's borrowing figures for April have significantly surpassed economists' forecasts, sparking renewed debate about the nation's fiscal health and the trajectory of the national debt. The Office for National Statistics (ONS) revealed a borrowing figure of £20.6 billion, considerably higher than the anticipated £14 billion and significantly exceeding the £1.9 billion borrowed during the same period last year. This unexpected surge raises concerns about the government's ability to meet its fiscal targets and control public spending.

What Contributed to the Unexpectedly High Borrowing Figures?

Several factors contributed to this substantial increase in government borrowing. Firstly, higher-than-expected inflation continues to impact public finances. The cost of government services, including public sector pensions and welfare payments, is rising faster than anticipated, putting pressure on the budget.

Secondly, tax revenues have fallen short of projections. While the government has implemented various tax measures, the impact has been less pronounced than initially hoped. This shortfall in revenue, combined with increased expenditure, has widened the government's fiscal deficit.

Finally, the ongoing energy crisis and the continuing need for economic support packages are playing a substantial role. While these interventions are crucial for mitigating the cost of living crisis, they also represent a significant financial burden on the government's coffers.

Implications for the UK Economy:

This substantial increase in government borrowing has significant implications for the UK economy. The higher-than-expected figures could:

- Increase national debt: The continued high borrowing will undoubtedly add to the already substantial national debt, potentially impacting the UK's credit rating and borrowing costs in the future.

- Lead to higher interest rates: To manage the increased borrowing, the Bank of England might be forced to consider further interest rate increases, impacting mortgage holders and businesses.

- Constrain government spending: The government might be forced to re-evaluate its spending plans, potentially delaying or cancelling planned investments in public services.

Government Response and Future Outlook:

The government has yet to release a formal statement addressing the April borrowing figures directly. However, Treasury officials have previously emphasized their commitment to fiscal responsibility and reducing the national debt over the medium term. The upcoming budget will likely offer further insights into the government's plans for managing public finances and tackling the challenges posed by the current economic climate. Experts will be closely analyzing the government's strategy to assess its effectiveness in controlling borrowing and navigating the economic uncertainties ahead.

Analyzing the Data: It's crucial to analyze the full ONS report for a complete picture. Understanding the detailed breakdown of expenditure and revenue will provide a more nuanced understanding of the underlying factors contributing to these figures. [Link to ONS Report - Insert Link Here]

Conclusion:

The April borrowing figures serve as a stark reminder of the challenges facing the UK economy. While the government's commitment to fiscal responsibility is essential, the unexpected surge in borrowing raises serious questions about the sustainability of current fiscal policies and the potential impact on the nation's long-term economic prospects. Further monitoring and analysis are crucial to understand the full implications and inform future economic strategies. The coming months will be critical in assessing the government's response and the effectiveness of its measures in managing the national debt.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Government Borrowing Figures Exceed Expectations In April. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Experts React Evaluating Trumps Golden Dome Missile Defense Proposal

May 23, 2025

Experts React Evaluating Trumps Golden Dome Missile Defense Proposal

May 23, 2025 -

Ms Rachel And A 3 Year Old Gaza Double Amputee A Heartwarming Musical Collaboration

May 23, 2025

Ms Rachel And A 3 Year Old Gaza Double Amputee A Heartwarming Musical Collaboration

May 23, 2025 -

La Inesperada Reaccion De Angela Marmol Al Conocer A Tom Cruise

May 23, 2025

La Inesperada Reaccion De Angela Marmol Al Conocer A Tom Cruise

May 23, 2025 -

Government Borrowing Figures For April Exceed Expectations

May 23, 2025

Government Borrowing Figures For April Exceed Expectations

May 23, 2025 -

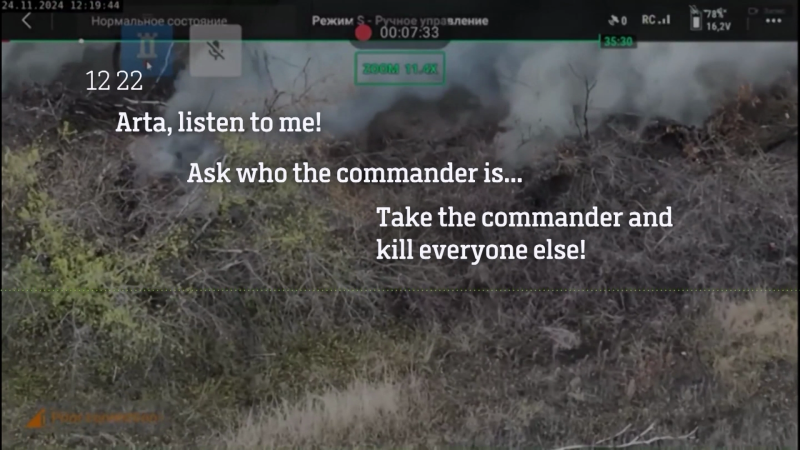

Gruesome Command Analysis Of Intercepted Russian Military Communication

May 23, 2025

Gruesome Command Analysis Of Intercepted Russian Military Communication

May 23, 2025

Latest Posts

-

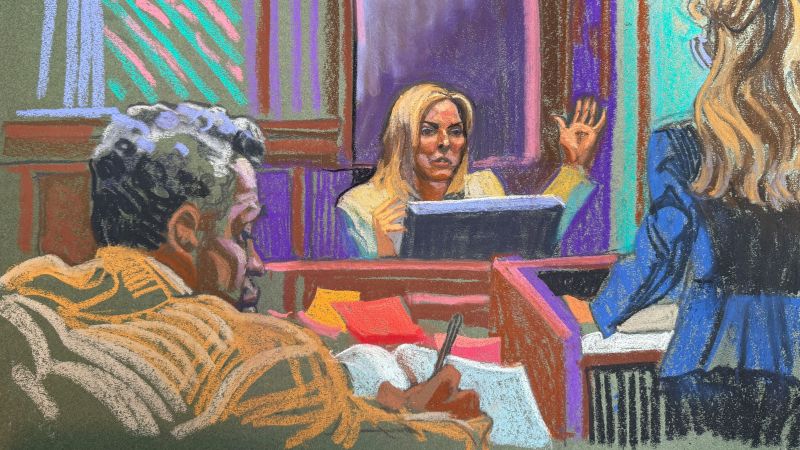

Expert Witness Testimony In Diddy Abuse Case A Detailed Recap

May 23, 2025

Expert Witness Testimony In Diddy Abuse Case A Detailed Recap

May 23, 2025 -

Is Paramount Censoring South Park Box Set Sales Surge Suggests Yes

May 23, 2025

Is Paramount Censoring South Park Box Set Sales Surge Suggests Yes

May 23, 2025 -

Sean Combs Trial Update Prosecutors Use Expert To Back Venturas Account

May 23, 2025

Sean Combs Trial Update Prosecutors Use Expert To Back Venturas Account

May 23, 2025 -

Legal Action Delays Controversial Chagos Islands Deal

May 23, 2025

Legal Action Delays Controversial Chagos Islands Deal

May 23, 2025 -

Pedro Pascals Pride And Prejudice Reference To Chris Evans The Internets New Favorite Thing

May 23, 2025

Pedro Pascals Pride And Prejudice Reference To Chris Evans The Internets New Favorite Thing

May 23, 2025