Higher Mortgage Payments: The Reality For Millions Of Homeowners

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Higher Mortgage Payments: The Reality for Millions of Homeowners

The era of ultra-low interest rates is officially over, leaving millions of homeowners facing a stark reality: significantly higher mortgage payments. This isn't just a minor inconvenience; for many, it represents a substantial increase in monthly expenses, potentially impacting their financial stability and overall wellbeing. This article explores the factors driving this surge, the challenges faced by affected homeowners, and what steps they can take to navigate this difficult period.

The Perfect Storm: Rising Interest Rates and Inflation

The primary culprit behind soaring mortgage payments is the aggressive increase in interest rates implemented by central banks worldwide to combat inflation. After years of historically low rates, mortgage rates have climbed dramatically, impacting both new homebuyers and those refinancing existing mortgages. This increase, coupled with persistent inflation driving up the cost of everyday goods and services, creates a perfect storm for household budgets.

Many homeowners locked into fixed-rate mortgages are feeling the pinch indirectly. While their payments remain stable, the money they have left over after paying for essentials is significantly reduced, decreasing their disposable income. For those with adjustable-rate mortgages (ARMs), the impact is even more immediate and potentially devastating, as their monthly payments fluctuate with market interest rates.

The Impact on Homeowners: More Than Just a Number

The increased financial burden isn't just about numbers on a spreadsheet. For many homeowners, higher mortgage payments mean:

- Reduced Spending Power: Less disposable income means cutting back on essential expenses, delaying major purchases, or forgoing leisure activities.

- Increased Financial Stress: The constant worry about affording monthly payments contributes to heightened stress and anxiety. [Link to a relevant article on financial stress and mental health].

- Difficulty Saving: Saving for retirement, emergencies, or future investments becomes significantly more challenging, potentially jeopardizing long-term financial security.

- Potential for Delinquency: In severe cases, higher mortgage payments can lead to missed payments and ultimately, foreclosure. This is a particularly worrying prospect for those already struggling financially.

Navigating the Challenges: Strategies for Homeowners

While the situation is undeniably challenging, homeowners aren't powerless. Several strategies can help mitigate the impact of higher mortgage payments:

- Budgeting and Expense Reduction: Carefully reviewing spending habits and identifying areas for cost reduction is crucial. Creating a detailed budget can help visualize where money is going and identify areas for savings.

- Seeking Financial Counseling: A financial advisor can provide personalized guidance and strategies for managing debt and improving financial stability. [Link to a reputable financial counseling organization].

- Exploring Refinancing Options (if applicable): If interest rates decrease or financial circumstances improve, refinancing the mortgage at a lower rate could reduce monthly payments. However, it's crucial to carefully evaluate all fees and terms before proceeding.

- Communication with Lenders: Open communication with mortgage lenders is key. Early contact to discuss potential challenges can help explore options like forbearance or loan modification programs.

Looking Ahead: A Difficult but Navigable Path

The increase in mortgage payments represents a significant challenge for many homeowners. However, by understanding the contributing factors, implementing effective strategies, and seeking support when needed, it is possible to navigate this difficult period and maintain financial stability. Remember, proactive planning and responsible financial management are crucial during times of economic uncertainty. This period requires careful consideration and action, but with the right approach, homeowners can work through these challenges. [Link to a government resource on mortgage assistance programs].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Higher Mortgage Payments: The Reality For Millions Of Homeowners. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

New Car Loan Interest Deduction Who Qualifies

Jul 11, 2025

New Car Loan Interest Deduction Who Qualifies

Jul 11, 2025 -

Trump Administration Claims Broad Jewish Support For Nominee Fact Check Reveals Disconnects

Jul 11, 2025

Trump Administration Claims Broad Jewish Support For Nominee Fact Check Reveals Disconnects

Jul 11, 2025 -

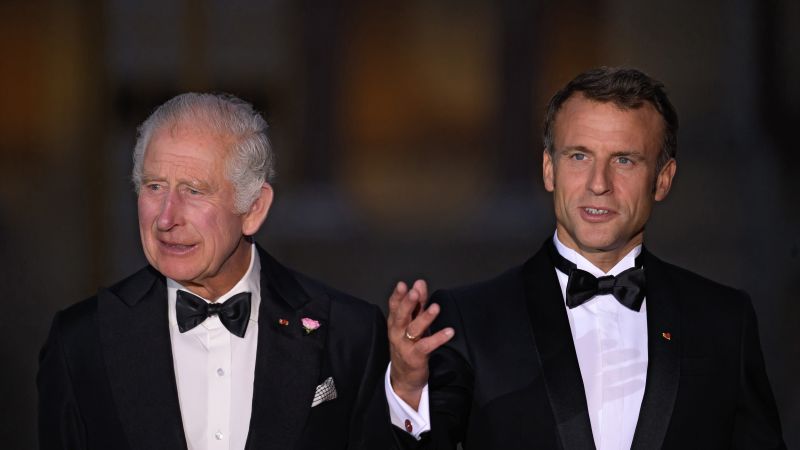

King Charless State Visit Strengthening Uk France Relations Post Brexit

Jul 11, 2025

King Charless State Visit Strengthening Uk France Relations Post Brexit

Jul 11, 2025 -

Tour De France Why Van Der Poel Tied With Pogacar Wears The Yellow Jersey

Jul 11, 2025

Tour De France Why Van Der Poel Tied With Pogacar Wears The Yellow Jersey

Jul 11, 2025 -

Khtahay Mhajrty Dwlt Syzdhm W Pyamdhay Amnyty An

Jul 11, 2025

Khtahay Mhajrty Dwlt Syzdhm W Pyamdhay Amnyty An

Jul 11, 2025

Latest Posts

-

Life After Love Island Usa Amaya And Bryans Relationship Update

Jul 17, 2025

Life After Love Island Usa Amaya And Bryans Relationship Update

Jul 17, 2025 -

September 2025 Ynw Melly Faces Retrial In Double Homicide Case

Jul 17, 2025

September 2025 Ynw Melly Faces Retrial In Double Homicide Case

Jul 17, 2025 -

Love Island Usas Amaya And Bryan Building A Future Beyond The Villa

Jul 17, 2025

Love Island Usas Amaya And Bryan Building A Future Beyond The Villa

Jul 17, 2025 -

September Retrial For Ynw Melly On Murder Charges After Jury Fails To Reach Verdict

Jul 17, 2025

September Retrial For Ynw Melly On Murder Charges After Jury Fails To Reach Verdict

Jul 17, 2025 -

Amaya Espinal Speaks Out Addressing Cierra Ortegas Racism Scandal On Love Island

Jul 17, 2025

Amaya Espinal Speaks Out Addressing Cierra Ortegas Racism Scandal On Love Island

Jul 17, 2025