Holding My Amazon Stock After A 560% Return

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Holding My Amazon Stock After a 560% Return: A Smart Move or Time to Cash Out?

The thrill of a 560% return on your investment is exhilarating. But when that investment is in a behemoth like Amazon, the question becomes less about the past gains and more about the future strategy. Holding onto Amazon stock after such a significant increase is a decision fraught with both potential for continued growth and the risk of substantial losses. This article explores the considerations involved in making this crucial investment choice.

The Amazon Juggernaut: A Look at the Past Decade

Amazon's trajectory over the past decade has been nothing short of phenomenal. From online retail dominance to cloud computing leadership (AWS), and now venturing into grocery, healthcare, and even space exploration, Amazon has consistently defied expectations. This growth fueled the impressive 560% return many investors experienced. But past performance, as they say, is not indicative of future results.

Reasons to Hold:

- Continued Growth Potential: Amazon’s diversification across multiple sectors ensures a resilient business model. Their expansion into new markets and ongoing technological innovation presents significant opportunities for further growth.

- Dominant Market Share: Amazon's position as a market leader in e-commerce and cloud computing provides a strong competitive advantage, making it less vulnerable to market fluctuations than smaller companies.

- Long-Term Investment Strategy: For investors with a long-term horizon, the potential for continued growth outweighs the short-term risks associated with market volatility. Holding onto Amazon shares aligns with a buy-and-hold strategy that often proves successful in the long run.

- Dividend Reinvestment: While Amazon doesn't currently offer a dividend, future dividend payouts could significantly enhance returns. This is a factor to consider for long-term holders.

Reasons to Consider Selling (at least partially):

- Market Volatility: The stock market is inherently volatile. While Amazon is relatively robust, no company is immune to market downturns. Partial selling allows you to secure some profits and reduce your risk exposure.

- Diversification: Holding a significant portion of your portfolio in a single stock, even a blue-chip like Amazon, is risky. Diversifying your investments across different asset classes can help mitigate potential losses.

- Tax Implications: Selling your Amazon stock will trigger capital gains taxes. Understanding the tax implications is crucial before making any decisions. Consider consulting a financial advisor to strategize tax-efficient selling.

- Alternative Investment Opportunities: The significant gains from Amazon could be reinvested into other promising ventures with high growth potential. This requires thorough research and a well-defined investment strategy.

Making the Right Decision: Seeking Expert Advice

The decision of whether to hold or sell your Amazon stock after a 560% return is highly personal and depends on your individual financial situation, risk tolerance, and investment goals. Before making any rash decisions, consider consulting a qualified financial advisor. They can help you analyze your portfolio, assess your risk tolerance, and develop a personalized investment strategy that aligns with your long-term financial goals. Remember, this article is for informational purposes only and not financial advice.

Keywords: Amazon stock, Amazon investment, 560% return, stock market, investment strategy, financial advisor, diversification, capital gains, long-term investment, holding stocks, selling stocks, AWS, e-commerce, market volatility, risk tolerance, buy-and-hold.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Holding My Amazon Stock After A 560% Return. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ukraine Unanswered Questions Linger After Andriy Portnovs Death

May 27, 2025

Ukraine Unanswered Questions Linger After Andriy Portnovs Death

May 27, 2025 -

Wwii Plane Crash Victims Four Airmen Identified Bringing Closure After Decades

May 27, 2025

Wwii Plane Crash Victims Four Airmen Identified Bringing Closure After Decades

May 27, 2025 -

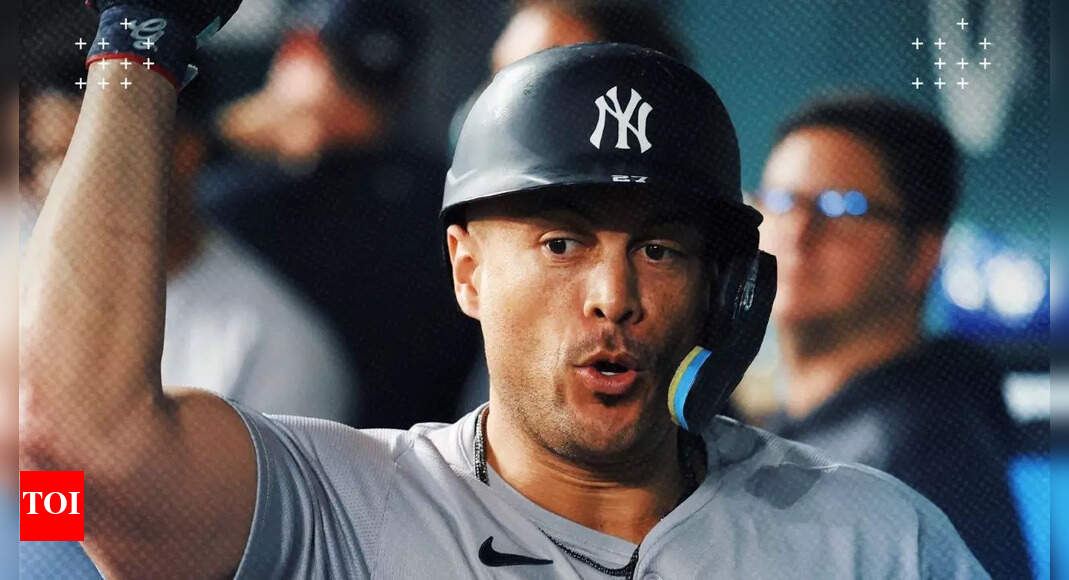

Giancarlo Stanton To Seattle Report Links Slugger To Mariners

May 27, 2025

Giancarlo Stanton To Seattle Report Links Slugger To Mariners

May 27, 2025 -

T J Maxx Memorial Day Sale Store Hours And Shopping Tips

May 27, 2025

T J Maxx Memorial Day Sale Store Hours And Shopping Tips

May 27, 2025 -

United States Social Security Payments Full June 2025 Schedule

May 27, 2025

United States Social Security Payments Full June 2025 Schedule

May 27, 2025

Latest Posts

-

Trumps 50 Steel Tariff Impact On Us And Global Markets

Jun 01, 2025

Trumps 50 Steel Tariff Impact On Us And Global Markets

Jun 01, 2025 -

Ina Gartens Guide Essential Party Etiquette Tips

Jun 01, 2025

Ina Gartens Guide Essential Party Etiquette Tips

Jun 01, 2025 -

The Ultimate Dinner Party Gift Guide Inspired By Ina Garten

Jun 01, 2025

The Ultimate Dinner Party Gift Guide Inspired By Ina Garten

Jun 01, 2025 -

Philadelphias Pride Celebrations Begin With Historic Flag Raising

Jun 01, 2025

Philadelphias Pride Celebrations Begin With Historic Flag Raising

Jun 01, 2025 -

Exclusive Ina Gartens Unexpected Dinner Party Tip From Willie Geist

Jun 01, 2025

Exclusive Ina Gartens Unexpected Dinner Party Tip From Willie Geist

Jun 01, 2025