IBM Stock Performance: Why It's Falling Behind The Market

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

IBM Stock Performance: Why It's Falling Behind the Market

IBM, a tech giant synonymous with innovation for decades, is currently facing a period of relative underperformance. While the broader market enjoys growth, IBM's stock price has lagged, leaving investors wondering about the future. This article delves into the reasons behind IBM's underperformance, exploring key factors impacting its stock price and offering insights into potential future trajectories.

The Current State of IBM Stock:

IBM's stock (IBM) has, in recent years, shown less robust growth compared to its tech counterparts. While some sectors experience explosive growth, IBM's performance has been more measured, raising concerns among investors. This slower growth is reflected in its stock price, which has underperformed major market indices like the S&P 500. Understanding the reasons behind this requires examining the company's strategic shifts and market dynamics.

Key Factors Contributing to IBM's Underperformance:

Several factors contribute to IBM's lagging performance. These include:

-

Transition to Hybrid Cloud: IBM's strategic shift towards hybrid cloud computing, while a crucial long-term investment, has resulted in short-term challenges. The transition requires significant investment and restructuring, impacting profitability in the immediate term. This transition, while promising long-term growth, has been a drag on the short-term stock price.

-

Increased Competition: The technology sector is fiercely competitive. IBM faces stiff competition from cloud giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP). These competitors possess significant market share and resources, making it challenging for IBM to gain traction in the rapidly evolving cloud market.

-

Legacy Business Challenges: IBM's legacy businesses, while still contributing revenue, are facing declining demand in a rapidly shifting technological landscape. The company's efforts to shed these legacy businesses and focus on higher-growth areas contribute to the volatility experienced in the stock price.

-

Economic Headwinds: The current macroeconomic environment, characterized by inflation and interest rate hikes, has dampened investor sentiment across many sectors, including technology. This broader economic uncertainty further impacts IBM's stock performance.

Looking Ahead: Potential for Future Growth?

Despite the challenges, IBM isn't without its strengths. Its robust hybrid cloud platform, Red Hat acquisition, and focus on AI and quantum computing offer promising avenues for future growth. The company's strategic investments in these areas could yield significant returns in the long term. However, the timeline for realizing these gains remains uncertain.

What Investors Should Consider:

Investors considering IBM should adopt a long-term perspective. While the current stock performance might be disappointing, the company's strategic investments in emerging technologies could lead to significant growth in the future. However, careful analysis of the company’s financial reports and strategic direction is crucial before investing. This includes examining their quarterly earnings reports and understanding their competitive landscape.

Conclusion:

IBM's recent underperformance reflects a complex interplay of factors including its strategic transition to the hybrid cloud, intense competition, and macroeconomic headwinds. While challenges remain, IBM's strategic investments in emerging technologies offer potential for future growth. Investors need to carefully weigh these factors before making investment decisions and understand that long-term growth may not always translate into immediate stock price appreciation. Further research into IBM's financial statements and industry analysis are recommended before making any investment decisions. Remember to consult with a financial advisor before making any significant investment choices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on IBM Stock Performance: Why It's Falling Behind The Market. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

May Jobs Report Shows Significant Slowdown Private Sector Hiring Plummets

Jun 06, 2025

May Jobs Report Shows Significant Slowdown Private Sector Hiring Plummets

Jun 06, 2025 -

Meghan Markles Pregnancy Dance Video Revealed

Jun 06, 2025

Meghan Markles Pregnancy Dance Video Revealed

Jun 06, 2025 -

Landmark Ruling Supreme Court Shifts Landscape Of Reverse Discrimination Claims

Jun 06, 2025

Landmark Ruling Supreme Court Shifts Landscape Of Reverse Discrimination Claims

Jun 06, 2025 -

Could Ryan Gosling Become The Mcus White Black Panther Ketemas Role Explored

Jun 06, 2025

Could Ryan Gosling Become The Mcus White Black Panther Ketemas Role Explored

Jun 06, 2025 -

Ibm Stock Market Underperformance Causes And Potential Recovery

Jun 06, 2025

Ibm Stock Market Underperformance Causes And Potential Recovery

Jun 06, 2025

Latest Posts

-

June 6th 2024 Maxwell Anderson Faces Trial For Sade Robinsons Death

Jun 07, 2025

June 6th 2024 Maxwell Anderson Faces Trial For Sade Robinsons Death

Jun 07, 2025 -

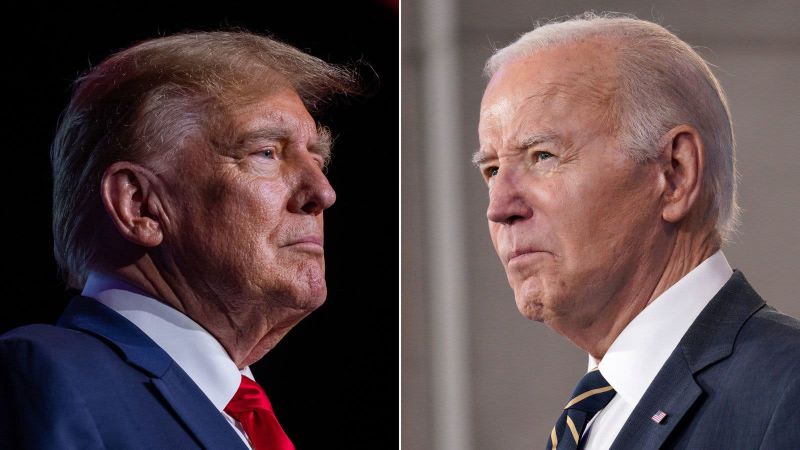

Cognitive Decline Allegations Fuel Trumps Investigation Into Biden

Jun 07, 2025

Cognitive Decline Allegations Fuel Trumps Investigation Into Biden

Jun 07, 2025 -

Maxwell Anderson Trial Begins Remembering Sade Robinson

Jun 07, 2025

Maxwell Anderson Trial Begins Remembering Sade Robinson

Jun 07, 2025 -

Preventing Hospitalization The Role Of The Infant Microbiome

Jun 07, 2025

Preventing Hospitalization The Role Of The Infant Microbiome

Jun 07, 2025 -

Longtime Friend Of Cassie Ventura To Testify Day Two In Combs Case

Jun 07, 2025

Longtime Friend Of Cassie Ventura To Testify Day Two In Combs Case

Jun 07, 2025