Industry Group Rejects Proposed Car Finance Redress Scheme

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Industry Group Rejects Proposed Car Finance Redress Scheme: Consumers Left in Limbo?

The proposed car finance redress scheme, designed to address widespread consumer complaints regarding unfair practices, has been met with fierce opposition from the influential Automotive Finance Association (AFA). This rejection throws the future of the scheme into serious doubt, leaving thousands of consumers potentially facing continued struggles to resolve their complaints. The AFA's concerns, while raising important questions, are overshadowed by the urgent need for effective redress for those harmed by predatory lending practices within the car finance industry.

AFA's Key Objections and the Counterarguments

The AFA's statement cites several key reasons for its rejection, primarily focusing on the scheme's perceived cost and potential impact on its member companies. They argue the proposed financial burden is disproportionate and unfairly targets responsible lenders. However, consumer advocates counter that the cost is a necessary investment in restoring consumer trust, particularly given the scale of reported mis-selling and unfair contract terms.

- Cost Concerns: The AFA highlights the significant financial implications for its members, suggesting many smaller firms could be forced out of business. Consumer groups argue that the cost should be viewed as an investment in restoring public confidence and preventing future misconduct. The long-term benefits of a fair and transparent market outweigh the short-term financial burden.

- Scheme Design: The AFA expresses concerns over the scheme's design, suggesting it lacks clarity and is overly complex, potentially leading to inconsistent application. This is countered by the claim that the scheme underwent extensive consultation and incorporates robust safeguards to ensure fairness and transparency.

- Impact on Responsible Lenders: The AFA argues that the scheme unfairly penalizes responsible lenders, who should not be held accountable for the actions of rogue operators. However, critics point out that the scheme aims to address systemic issues, not just isolate individual bad actors. A strong redress scheme benefits the entire industry by fostering a culture of responsible lending.

The Current State of Car Finance Consumer Complaints

Recent years have seen a surge in complaints against car finance companies, alleging practices such as:

- Mis-selling of products: Consumers being sold unsuitable or unaffordable finance packages.

- Unfair contract terms: Hidden fees, excessive interest rates, and unclear terms and conditions.

- Aggressive debt collection practices: Harassing phone calls and threats from debt collectors.

These issues have led to significant financial hardship for many consumers, highlighting the crucial need for an effective redress mechanism. The Financial Conduct Authority (FCA) has already expressed its concern regarding these practices and has been actively investigating numerous complaints. [Link to FCA website regarding car finance complaints]

What Happens Next? The Fight for Consumer Rights Continues

The rejection by the AFA creates a significant hurdle in the path of establishing a much-needed redress scheme. Consumer advocacy groups are now calling for increased government intervention to ensure that a fair and effective system is put in place. The battle for consumer rights in the car finance sector is far from over, and the coming months will be crucial in determining whether a viable solution can be found to address the ongoing concerns of affected consumers.

Call to Action: If you have experienced unfair treatment from a car finance company, document your experience and consider contacting a consumer advocacy group for advice and support. [Link to relevant consumer advocacy group]. Stay informed about developments in this story by following us on [Social Media Links].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Industry Group Rejects Proposed Car Finance Redress Scheme. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Trump Presidency And The White House Examining Significant Institutional Changes

Aug 05, 2025

The Trump Presidency And The White House Examining Significant Institutional Changes

Aug 05, 2025 -

Naming Corbyns New Party A Difficult Task Ahead

Aug 05, 2025

Naming Corbyns New Party A Difficult Task Ahead

Aug 05, 2025 -

Tyler Loop Solidifies Kicker Position In Training Camp

Aug 05, 2025

Tyler Loop Solidifies Kicker Position In Training Camp

Aug 05, 2025 -

Amber Weather Warning Storm Floris To Batter Uk On Monday

Aug 05, 2025

Amber Weather Warning Storm Floris To Batter Uk On Monday

Aug 05, 2025 -

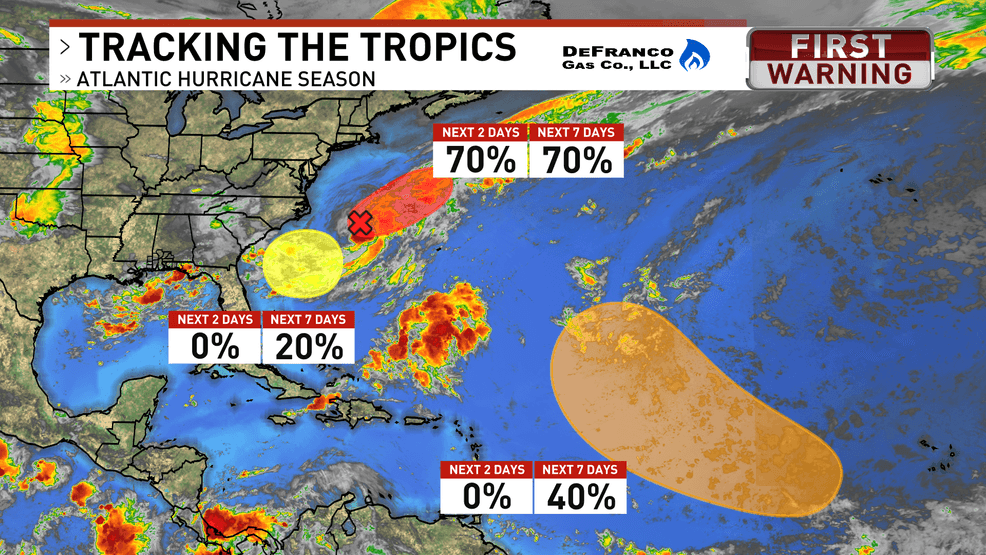

Quiet Start Then Action Understanding The 2025 Tropical Storm Season

Aug 05, 2025

Quiet Start Then Action Understanding The 2025 Tropical Storm Season

Aug 05, 2025

Latest Posts

-

Hundreds Of Former Israeli Officials Urge Trumps Intervention In Gaza Conflict

Aug 05, 2025

Hundreds Of Former Israeli Officials Urge Trumps Intervention In Gaza Conflict

Aug 05, 2025 -

Industry Group Rejects Proposed Car Finance Redress Scheme

Aug 05, 2025

Industry Group Rejects Proposed Car Finance Redress Scheme

Aug 05, 2025 -

New Car Finance Redress Proposal Faces Industry Backlash

Aug 05, 2025

New Car Finance Redress Proposal Faces Industry Backlash

Aug 05, 2025 -

Mace Challenges Status Quo South Carolina Governors Race Gets Competitive

Aug 05, 2025

Mace Challenges Status Quo South Carolina Governors Race Gets Competitive

Aug 05, 2025 -

Afghanistans Expanding Religious Schools Girls Education In Crisis

Aug 05, 2025

Afghanistans Expanding Religious Schools Girls Education In Crisis

Aug 05, 2025