Institutional Investing: Financial Avengers' Stake In Bank Of America (BAC)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Institutional Investing: Financial Avengers' Stake in Bank of America (BAC)

Bank of America (BAC) continues to attract significant attention from institutional investors, with recent filings revealing substantial shifts in holdings. This article delves into the latest investment moves, analyzing the implications for BAC's future and the broader financial landscape.

The financial world is abuzz with activity, and a key player in this dynamic environment is Bank of America (BAC). Recent Securities and Exchange Commission (SEC) filings unveil a fascinating picture of institutional investor confidence – or lack thereof – in the nation's second-largest bank by assets. Understanding these shifts provides crucial insights into market sentiment and potential future performance of BAC stock.

The Avengers Assemble (and Sometimes Disperse): A Look at Institutional Holdings

Several prominent institutional investors have significantly altered their positions in Bank of America in recent quarters. While pinpointing exact motivations is difficult without direct statements from the firms themselves, analyzing the changes allows us to speculate on underlying market forces. For example, a large increase in holdings might suggest a belief in BAC's future growth potential, while a decrease could indicate a shift in investment strategy or concerns about potential risks.

-

Increased Stakes: Identify and discuss specific institutional investors who have increased their BAC holdings, citing specific figures from SEC filings where possible. Mention the size and percentage of the increase. Analyze potential reasons – positive outlook on the bank's performance, sector-wide optimism, or anticipation of future growth opportunities. Connect this to relevant news items, such as recent BAC earnings reports or strategic announcements.

-

Decreased Stakes: Similarly, highlight institutional investors who have reduced their holdings in BAC. Quantify these changes and explore the potential reasons behind the divestment. This could be attributed to concerns about the economic outlook, rising interest rates, increased competition within the banking sector, or a shift in investment portfolio diversification strategies.

-

New Entrants and Departures: Note any significant new institutional investors entering the BAC landscape or those exiting completely. Such changes can offer valuable clues about broader market perceptions of the bank's long-term prospects.

Analyzing the Implications: What Does it Mean for BAC?

The collective actions of these institutional investors provide a valuable barometer of market sentiment towards Bank of America. A strong inflow of capital suggests a positive outlook, potentially driving up the stock price. Conversely, a significant outflow could signal concerns, leading to downward pressure.

However, it's crucial to avoid drawing overly simplistic conclusions. Institutional investors' decisions are complex and influenced by a myriad of factors beyond just the performance of BAC itself. Macroeconomic conditions, regulatory changes, and competitive pressures all play a significant role.

Beyond the Numbers: Looking Ahead

While analyzing institutional investment activity provides valuable insights, it's vital to consider other factors impacting Bank of America's performance. These include:

- Economic Outlook: The overall health of the US economy and global financial markets significantly impacts BAC's performance.

- Interest Rate Hikes: Changes in interest rates directly influence BAC's profitability.

- Technological Advancements: The ongoing shift towards digital banking and fintech presents both opportunities and challenges for traditional banks like BAC.

- Regulatory Environment: Changes in financial regulations can significantly impact BAC's operations and profitability.

Investors should conduct their own thorough due diligence before making any investment decisions. This article offers analysis based on publicly available information and should not be considered financial advice.

Call to Action: Stay informed about the latest developments in the financial sector by subscribing to our newsletter (link to newsletter signup). Understanding institutional investor activity is crucial for making informed investment choices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Institutional Investing: Financial Avengers' Stake In Bank Of America (BAC). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Details Emerge The Liverpool Fc Parade Incident Explained

May 28, 2025

Details Emerge The Liverpool Fc Parade Incident Explained

May 28, 2025 -

Artificial Consciousness A Technological And Philosophical Crossroads

May 28, 2025

Artificial Consciousness A Technological And Philosophical Crossroads

May 28, 2025 -

Nba Trade Rumors Which Teams Could Surprise With A Giannis Antetokounmpo Bid

May 28, 2025

Nba Trade Rumors Which Teams Could Surprise With A Giannis Antetokounmpo Bid

May 28, 2025 -

Birmingham Capital Management Co Inc Al Decreases Bank Of America Position

May 28, 2025

Birmingham Capital Management Co Inc Al Decreases Bank Of America Position

May 28, 2025 -

Significant Amazon Gains The Case For Long Term Holding

May 28, 2025

Significant Amazon Gains The Case For Long Term Holding

May 28, 2025

Latest Posts

-

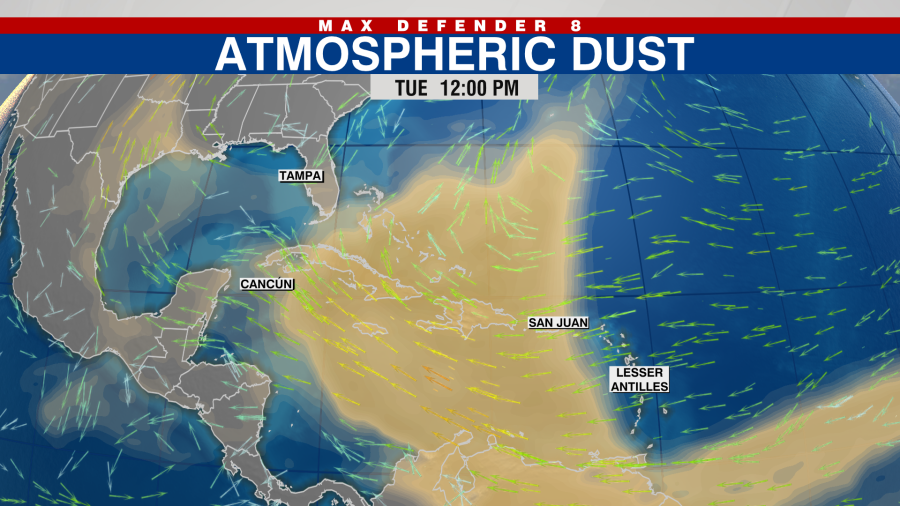

Saharan Dust Air Quality Alert Issued For Florida

May 31, 2025

Saharan Dust Air Quality Alert Issued For Florida

May 31, 2025 -

New York Knicks Ending The Drought A Realistic Championship Pursuit

May 31, 2025

New York Knicks Ending The Drought A Realistic Championship Pursuit

May 31, 2025 -

From Juniors To Stars Day 4s Standout Performances

May 31, 2025

From Juniors To Stars Day 4s Standout Performances

May 31, 2025 -

Sheinelle Jones Husband Uche Ojeh Passes Away At 45 After Brain Cancer Battle

May 31, 2025

Sheinelle Jones Husband Uche Ojeh Passes Away At 45 After Brain Cancer Battle

May 31, 2025 -

Factors Contributing To The Dramatic Rise Of Sbet Stock

May 31, 2025

Factors Contributing To The Dramatic Rise Of Sbet Stock

May 31, 2025