Institutional Investor Activity: Two Sigma Takes Large Position In Bank Of America (BAC)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Institutional Investor Activity: Two Sigma Invests Heavily in Bank of America (BAC)

A significant shift in the financial landscape: Two Sigma Investments, a prominent quantitative investment firm, has recently made a substantial investment in Bank of America (BAC), sparking considerable interest and speculation within the investment community. This move signals a potential vote of confidence in Bank of America's future performance and raises questions about the firm's overall strategy. This article delves into the details of this substantial investment and analyzes its implications for both Bank of America and the broader market.

Two Sigma's Strategic Investment in BAC:

Two Sigma, known for its data-driven approach and sophisticated algorithms, doesn't typically disclose its holdings publicly. However, recent regulatory filings revealed a significantly increased stake in Bank of America, making it one of the firm's largest holdings. While the exact size of the position remains undisclosed beyond the regulatory minimum, the sheer scale of the investment represents a substantial commitment. This strategic move suggests Two Sigma's quantitative models are projecting positive growth and profitability for Bank of America in the coming periods.

What Drives This Investment?

Several factors could be contributing to Two Sigma's bullish stance on Bank of America:

- Strong Earnings Reports: Bank of America has consistently delivered strong earnings reports in recent quarters, showcasing resilience in a challenging economic climate. This robust performance likely influenced Two Sigma's decision.

- Interest Rate Hikes: The Federal Reserve's interest rate hikes have significantly benefited banks, boosting net interest income. Bank of America, with its substantial loan portfolio, is well-positioned to capitalize on this trend.

- Economic Outlook: While economic uncertainty persists, many analysts believe the US economy will avoid a significant recession. This relatively positive outlook likely plays a role in Two Sigma's confidence in Bank of America's prospects.

- Technological Investments: Bank of America's significant investments in technology and digital banking initiatives could also be attractive to a data-driven firm like Two Sigma. These advancements suggest potential for increased efficiency and market share.

Implications for Bank of America (BAC) and Investors:

Two Sigma's substantial investment in Bank of America acts as a powerful endorsement, potentially boosting investor confidence and driving up the stock price. This move could attract further investment from other institutional investors, reinforcing the positive momentum. For individual investors, this development warrants closer examination of Bank of America's fundamentals and future growth prospects. Conducting thorough due diligence before making any investment decisions is crucial.

Understanding Two Sigma's Investment Style:

Two Sigma's investment strategy is complex and multifaceted, relying heavily on advanced quantitative analysis. Their approach often involves identifying undervalued assets and leveraging sophisticated algorithms to predict market trends. This data-driven approach suggests a high degree of confidence in Bank of America's long-term potential.

Looking Ahead:

The impact of Two Sigma's investment in Bank of America will unfold over time. However, it's a significant event that highlights the potential for growth and profitability within the financial sector. It will be important to monitor Bank of America's performance and the broader market conditions to understand the full implications of this strategic investment. This situation underscores the dynamic nature of the financial markets and the importance of staying informed about key developments. Further analysis and monitoring are recommended for anyone considering investments in the financial sector.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing involves risk, including the potential loss of principal. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Institutional Investor Activity: Two Sigma Takes Large Position In Bank Of America (BAC). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Moment De Detente Ou Altercation L Elysee Decrypte La Video Impliquant Brigitte Et Emmanuel Macron

May 27, 2025

Moment De Detente Ou Altercation L Elysee Decrypte La Video Impliquant Brigitte Et Emmanuel Macron

May 27, 2025 -

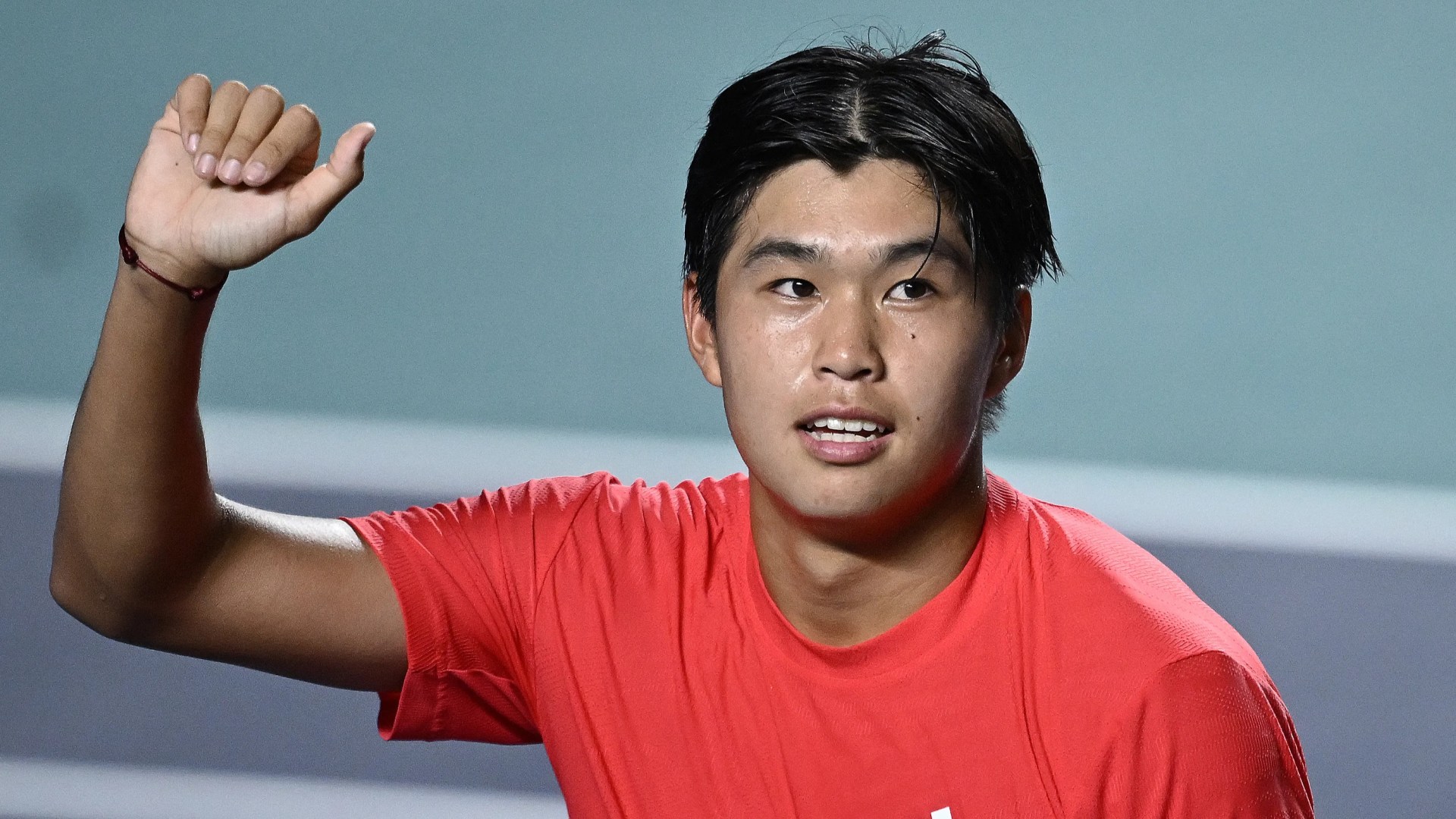

The Unlikely Journey A Us Tennis Prodigys Rise From A Job Inspired Name To Facing World No 3

May 27, 2025

The Unlikely Journey A Us Tennis Prodigys Rise From A Job Inspired Name To Facing World No 3

May 27, 2025 -

Michelle Mones Journey From Rags To Riches And Back Again

May 27, 2025

Michelle Mones Journey From Rags To Riches And Back Again

May 27, 2025 -

Match Of The Day Says Goodbye To Gary Lineker After 26 Years

May 27, 2025

Match Of The Day Says Goodbye To Gary Lineker After 26 Years

May 27, 2025 -

Failed Warship Launch In North Korea Results In Senior Officials Arrest

May 27, 2025

Failed Warship Launch In North Korea Results In Senior Officials Arrest

May 27, 2025

Latest Posts

-

Today Show Co Host Mourns Husband Uche Ojehs Death At 45 From Cancer

May 31, 2025

Today Show Co Host Mourns Husband Uche Ojehs Death At 45 From Cancer

May 31, 2025 -

Understanding The Dramatic 1000 Increase In Sbet Share Price

May 31, 2025

Understanding The Dramatic 1000 Increase In Sbet Share Price

May 31, 2025 -

Can A Drone Wall Stop Russia Ukraines Summer Offensive Defense Strategy

May 31, 2025

Can A Drone Wall Stop Russia Ukraines Summer Offensive Defense Strategy

May 31, 2025 -

Kelly Smith Jailed Mother Sentenced For Kidnapping And Sale Of Daughter Joshlin In South Africa

May 31, 2025

Kelly Smith Jailed Mother Sentenced For Kidnapping And Sale Of Daughter Joshlin In South Africa

May 31, 2025 -

Aep Rate Hike Explained The Historical Context You Need To Know

May 31, 2025

Aep Rate Hike Explained The Historical Context You Need To Know

May 31, 2025