Institutional Money Fuels Bitcoin ETF Boom: $5 Billion And Counting

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Institutional Money Fuels Bitcoin ETF Boom: $5 Billion and Counting

The long-awaited arrival of Bitcoin exchange-traded funds (ETFs) has ignited a firestorm of investment, with institutional money pouring in at an unprecedented rate. Since the approval of the first spot Bitcoin ETF by the SEC in October 2023, over $5 billion has flowed into these funds, signaling a significant shift in the perception and adoption of Bitcoin as a legitimate asset class. This surge represents a landmark moment for the cryptocurrency industry, potentially paving the way for wider mainstream acceptance.

This massive influx of capital isn't just about chasing returns; it's a testament to the growing institutional confidence in Bitcoin's long-term viability. For years, institutional investors were hesitant due to regulatory uncertainty and concerns about volatility. However, the SEC's approval of several Bitcoin ETFs has dramatically altered this landscape, providing a regulated and accessible entry point for large-scale investment.

<h3>The Drivers Behind the Bitcoin ETF Boom</h3>

Several factors contribute to this explosive growth:

- Regulatory Clarity: The SEC's approval, after years of deliberation, provided much-needed regulatory certainty. This reduced risk significantly, encouraging institutional investors to allocate capital. The clear regulatory framework makes Bitcoin ETFs more appealing than directly investing in Bitcoin, which can involve complexities like private key management and exchange security.

- Increased Accessibility: ETFs offer a familiar and convenient investment vehicle for institutional investors accustomed to traditional markets. The ease of trading and the regulated nature of ETFs lowers the barrier to entry for large-scale participation.

- Diversification Strategies: Many institutional investors view Bitcoin as a diversifying asset, uncorrelated with traditional markets. This is particularly attractive in times of economic uncertainty, where Bitcoin's decentralized nature provides a hedge against inflation and geopolitical risks.

- Growing Institutional Adoption: The initial wave of institutional investment is likely to trigger a snowball effect. As more established financial institutions enter the market, others will follow, driven by fear of missing out (FOMO) and the desire to maintain competitiveness.

<h3>What Does This Mean for the Future of Bitcoin?</h3>

The $5 billion figure represents a significant milestone, but it's likely just the beginning. The continued growth of Bitcoin ETFs could lead to:

- Increased Price Volatility (Short Term): Further significant inflows could lead to short-term price volatility as the market adjusts to this new level of investment. However, long-term price stability is anticipated as more institutional investors provide liquidity and stability to the market.

- Increased Market Maturity: The increased institutional participation fosters a more mature and stable Bitcoin market. This could attract even more investors, ultimately driving further price appreciation.

- Mainstream Adoption: The accessibility offered by ETFs will help normalize Bitcoin as an investment option for a broader range of investors, contributing to wider mainstream acceptance.

<h3>Investing in Bitcoin ETFs: Considerations and Cautions</h3>

While the current trend is positive, potential investors should remember that Bitcoin remains a volatile asset. It's crucial to conduct thorough research and understand the risks involved before investing. Consider diversifying your portfolio and consulting with a financial advisor before making any investment decisions. Learn more about from reputable sources.

In conclusion, the surge of institutional investment into Bitcoin ETFs signifies a crucial turning point for the cryptocurrency market. While volatility is inherent, the long-term outlook appears positive, suggesting that Bitcoin's journey towards mainstream adoption is accelerating. The next few years will be pivotal in determining the long-term impact of this monumental shift. Stay tuned for further updates on the evolving landscape of Bitcoin investment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Institutional Money Fuels Bitcoin ETF Boom: $5 Billion And Counting. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bali Urges Global Cooperation To Prioritize Tourist Safety And Conduct

May 21, 2025

Bali Urges Global Cooperation To Prioritize Tourist Safety And Conduct

May 21, 2025 -

Fan Frenzy Jon Jones I M Done Statement And The Impact On His Ufc Future With Aspinall

May 21, 2025

Fan Frenzy Jon Jones I M Done Statement And The Impact On His Ufc Future With Aspinall

May 21, 2025 -

Report Reveals Lufthansa Flight Flew Pilotless For 10 Minutes

May 21, 2025

Report Reveals Lufthansa Flight Flew Pilotless For 10 Minutes

May 21, 2025 -

Market Rally Continues S And P 500s Six Day Winning Streak And Positive Market Sentiment

May 21, 2025

Market Rally Continues S And P 500s Six Day Winning Streak And Positive Market Sentiment

May 21, 2025 -

Uk Self Driving Cars 2027 Target Date Ubers Early Readiness Claim

May 21, 2025

Uk Self Driving Cars 2027 Target Date Ubers Early Readiness Claim

May 21, 2025

Latest Posts

-

Emotional Return Ellen De Generes Addresses Fans After Personal Loss

May 21, 2025

Emotional Return Ellen De Generes Addresses Fans After Personal Loss

May 21, 2025 -

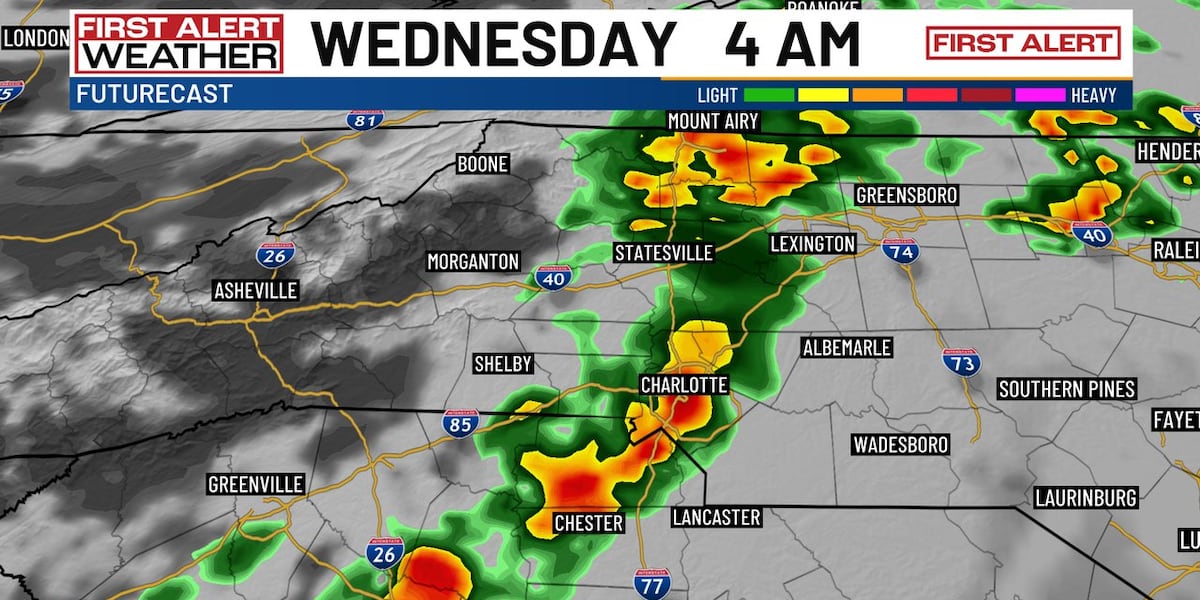

Incoming Cooldown Charlotte Residents Brace For Overnight Storms And Cooler Temperatures

May 21, 2025

Incoming Cooldown Charlotte Residents Brace For Overnight Storms And Cooler Temperatures

May 21, 2025 -

Top Rated Sunscreens For 2025 Safeguarding Your Familys Skin

May 21, 2025

Top Rated Sunscreens For 2025 Safeguarding Your Familys Skin

May 21, 2025 -

Career Opportunity Ubisoft Milan Expanding Rayman Franchise

May 21, 2025

Career Opportunity Ubisoft Milan Expanding Rayman Franchise

May 21, 2025 -

Data Breach Settlement Hundreds Of Post Office Customers To Be Compensated

May 21, 2025

Data Breach Settlement Hundreds Of Post Office Customers To Be Compensated

May 21, 2025