Market Rally Continues: S&P 500's Six-Day Winning Streak And Positive Market Sentiment

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Rally Continues: S&P 500's Six-Day Winning Streak and Positive Market Sentiment

The S&P 500 has notched an impressive six-day winning streak, fueled by a surge in positive market sentiment and promising economic data. This rally marks a significant shift from recent market volatility and underscores growing investor confidence. But is this sustained climb sustainable, or is it a temporary reprieve before another downturn? Let's delve into the factors driving this impressive run and explore the potential implications for investors.

Six Days of Gains: A Detailed Look at the S&P 500's Performance

The S&P 500's upward trajectory is undeniable. This six-day winning streak represents a considerable increase in value, significantly outperforming analysts' initial predictions for the week. This sustained positive momentum signals a potential turning point in the market, prompting many to reassess their investment strategies. The daily gains, though varying, have consistently added to the overall positive trend, leaving investors cautiously optimistic.

Key Factors Driving the Market Rally:

Several factors are contributing to this positive market sentiment:

-

Stronger-than-Expected Economic Data: Recent economic reports have painted a more positive picture than initially anticipated, boosting investor confidence. Data points like [insert specific example of positive economic data, e.g., better-than-expected employment figures or consumer spending reports] have helped alleviate concerns about a potential recession. You can find more detailed economic reports on the [link to a reputable financial news source, e.g., Federal Reserve website].

-

Easing Inflation Concerns: While inflation remains a concern, recent data suggests a potential cooling trend. This easing of inflationary pressures has led to speculation that the Federal Reserve might moderate its aggressive interest rate hikes, a move that would positively impact the stock market. For more information on inflation trends, check out the [link to a reputable source for inflation data, e.g., Bureau of Labor Statistics].

-

Corporate Earnings Reports: Positive corporate earnings reports from key sectors have also contributed to the rally. Companies exceeding expectations have boosted investor confidence in their long-term growth prospects. Analyzing individual company earnings can provide valuable insight into the overall market health.

Positive Market Sentiment: More Than Just Numbers

Beyond the hard data, a palpable shift in market sentiment is evident. Investor confidence, which had been shaken by recent economic uncertainty, appears to be rebounding. This renewed optimism is crucial, as it can create a self-fulfilling prophecy, driving further investment and pushing the market higher. However, it's crucial to remember that sentiment can be fickle and can change rapidly.

Is This Rally Sustainable? A Look Ahead:

While the current market rally is encouraging, it's crucial to approach it with caution. Several factors could still impact the market's trajectory, including:

- Geopolitical Instability: Ongoing geopolitical tensions could easily disrupt the market's positive momentum.

- Further Interest Rate Hikes: The Federal Reserve's future actions regarding interest rates remain a key uncertainty.

- Unexpected Economic Shocks: Unforeseen economic events could trigger another market downturn.

Investing in Times of Uncertainty:

Investors should approach this rally with a balanced perspective. While the positive trend is encouraging, diversification and a long-term investment strategy remain crucial. Seeking advice from a qualified financial advisor can help you navigate the complexities of the market and make informed investment decisions. [Consider adding a subtle call to action here, e.g., "Learn more about diversifying your portfolio by visiting [link to a relevant resource]."]

Conclusion:

The S&P 500's six-day winning streak reflects a significant shift in market sentiment. While the factors driving this rally are promising, investors should remain vigilant and aware of the potential risks. A balanced approach, informed decision-making, and a long-term perspective are vital for navigating the ever-evolving landscape of the stock market. Stay tuned for further updates as the market continues to unfold.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Rally Continues: S&P 500's Six-Day Winning Streak And Positive Market Sentiment. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

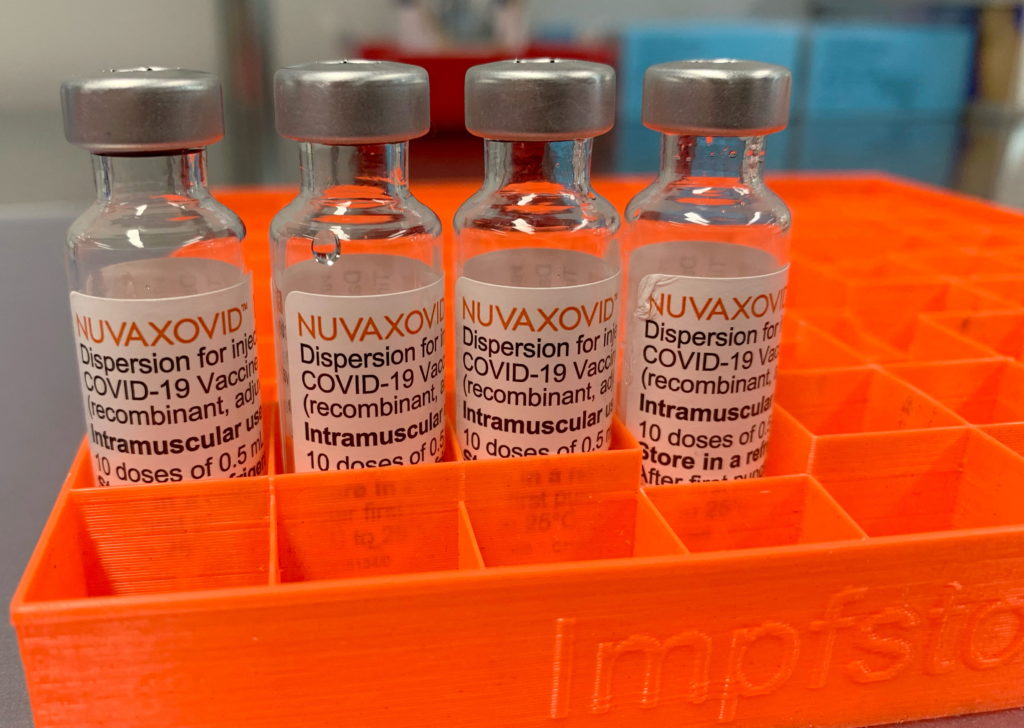

Fda Greenlights Novavax Covid 19 Vaccine With Conditional Authorization

May 21, 2025

Fda Greenlights Novavax Covid 19 Vaccine With Conditional Authorization

May 21, 2025 -

Congresswoman Indicted For Assault At Ice Facility Newark Mayor Case Dismissed

May 21, 2025

Congresswoman Indicted For Assault At Ice Facility Newark Mayor Case Dismissed

May 21, 2025 -

Devastating St Louis Tornado Residents Rebuild After Powerful Storm

May 21, 2025

Devastating St Louis Tornado Residents Rebuild After Powerful Storm

May 21, 2025 -

New York Attorney General Under Federal Investigation Fbi Confirmation

May 21, 2025

New York Attorney General Under Federal Investigation Fbi Confirmation

May 21, 2025 -

Big Changes Confirmed For New Peaky Blinders Series What We Know So Far

May 21, 2025

Big Changes Confirmed For New Peaky Blinders Series What We Know So Far

May 21, 2025

Latest Posts

-

Trumps Funding Cuts Lead Sesame Street To Seek New Platform Netflix

May 21, 2025

Trumps Funding Cuts Lead Sesame Street To Seek New Platform Netflix

May 21, 2025 -

Police Investigate Church Vandalism Teenagers Defecate And Urinate Inside

May 21, 2025

Police Investigate Church Vandalism Teenagers Defecate And Urinate Inside

May 21, 2025 -

Trump Putin Call Reveals Shifting Sands In Ukraine Conflict Resolution

May 21, 2025

Trump Putin Call Reveals Shifting Sands In Ukraine Conflict Resolution

May 21, 2025 -

Fourth Orleans Parish Inmate Apprehended Das Office Staff Seek Safety Amidst Intensified Manhunt

May 21, 2025

Fourth Orleans Parish Inmate Apprehended Das Office Staff Seek Safety Amidst Intensified Manhunt

May 21, 2025 -

Safe Sunscreen Choices For 2025 Protecting You And Your Family

May 21, 2025

Safe Sunscreen Choices For 2025 Protecting You And Your Family

May 21, 2025