Investing In Robinhood: Analyzing The Stock's Recent Growth

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing in Robinhood: Analyzing the Stock's Recent Growth and Future Potential

Robinhood, the commission-free trading app that disrupted the brokerage industry, has experienced a rollercoaster ride since its highly anticipated IPO in July 2021. While the initial public offering didn't meet expectations, the stock's performance has shown intriguing signs of recovery and growth in recent months, leading many investors to question: is now the time to invest in Robinhood?

This article delves into a comprehensive analysis of Robinhood's recent growth, examining the factors contributing to its fluctuating stock price and exploring its future potential. We'll consider both the bullish and bearish arguments to help you make an informed investment decision.

Robinhood's Recent Performance: A Rollercoaster Ride

Robinhood's stock price (HOOD) initially plummeted after its IPO, largely due to concerns about slowing user growth and increasing competition in the fintech sector. The company faced regulatory scrutiny and struggled to adapt its business model to a changing market landscape. However, recent financial reports have revealed signs of improvement, particularly in areas such as:

- Increased Revenue: Robinhood has demonstrated consistent revenue growth, driven by increased trading activity and the expansion of its product offerings.

- Improved User Engagement: While user acquisition might have slowed, the company has seen improved engagement metrics, indicating a more loyal and active user base.

- Expansion into New Markets: Robinhood's strategic moves to expand into new financial products and services, such as crypto trading and options trading, have broadened its revenue streams and attracted a wider user base.

These positive developments have contributed to a gradual rise in the stock price, sparking renewed interest from investors.

Factors Influencing Robinhood's Stock Price

Several factors are crucial in understanding Robinhood's stock price fluctuations:

- Market Sentiment: The overall performance of the stock market significantly impacts Robinhood's valuation, as it does with many growth stocks.

- Regulatory Changes: The regulatory environment continues to play a vital role. Changes in regulations concerning commission-free trading and cryptocurrency trading can significantly affect Robinhood's operations and profitability.

- Competition: Intense competition from established players and emerging fintech companies is a major challenge. Robinhood needs to innovate and differentiate itself to maintain its market share.

- Technological Advancements: The fintech sector is constantly evolving. Robinhood's ability to adapt to new technologies and user preferences will be critical for its long-term success.

Is Robinhood a Good Investment? A Balanced Perspective

While Robinhood's recent growth is encouraging, it's crucial to approach any investment decision with caution. The company still faces significant challenges and uncertainties. Before investing, consider:

- High Risk, High Reward: Robinhood is considered a high-growth, high-risk stock. Investors should be prepared for potential volatility and potential losses.

- Long-Term Perspective: Investing in Robinhood requires a long-term perspective. Short-term fluctuations should not dictate investment decisions.

- Diversification: As with any investment, diversification is key. Don't put all your eggs in one basket.

Conclusion: Due Diligence is Key

Investing in Robinhood presents both opportunities and risks. While recent growth is positive, thorough research and careful consideration of the factors discussed above are crucial before making any investment decisions. It's recommended to consult with a financial advisor before investing in any stock, especially one as volatile as Robinhood. Stay informed about market trends and regulatory updates to make well-informed choices. Remember, past performance is not indicative of future results.

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In Robinhood: Analyzing The Stock's Recent Growth. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Analyzing Nvidias Core Weave Profitability Projections And Market Impact

Jun 06, 2025

Analyzing Nvidias Core Weave Profitability Projections And Market Impact

Jun 06, 2025 -

Broadcom Avgo Earnings Analyst Predictions And Stock Price Outlook

Jun 06, 2025

Broadcom Avgo Earnings Analyst Predictions And Stock Price Outlook

Jun 06, 2025 -

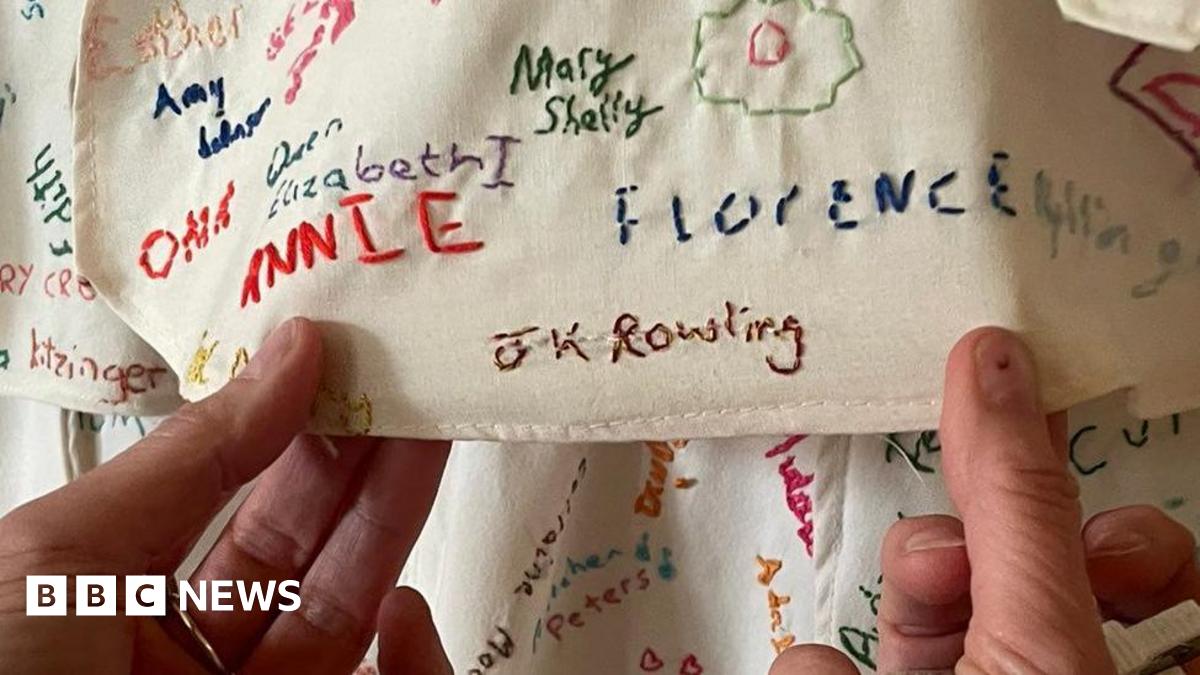

Derbyshire National Trust Site Covers Up Vandalized J K Rowling Artwork

Jun 06, 2025

Derbyshire National Trust Site Covers Up Vandalized J K Rowling Artwork

Jun 06, 2025 -

David Quinn Back In Pittsburgh New Coaching Position With The Penguins

Jun 06, 2025

David Quinn Back In Pittsburgh New Coaching Position With The Penguins

Jun 06, 2025 -

Dallas Stars Playoff Exit Leads To De Boers Dismissal

Jun 06, 2025

Dallas Stars Playoff Exit Leads To De Boers Dismissal

Jun 06, 2025

Latest Posts

-

Playoff Disappointment Costs Peter De Boer His Job With Dallas Stars

Jun 07, 2025

Playoff Disappointment Costs Peter De Boer His Job With Dallas Stars

Jun 07, 2025 -

Matthew Hussey And Wife Expecting First Child Ex Partner Camila Cabellos Reaction

Jun 07, 2025

Matthew Hussey And Wife Expecting First Child Ex Partner Camila Cabellos Reaction

Jun 07, 2025 -

Trump Vs Musk Uncovering The Advisor Behind The Fallout

Jun 07, 2025

Trump Vs Musk Uncovering The Advisor Behind The Fallout

Jun 07, 2025 -

Dumb Idea Reform Party Chair Slams Mps Burka Ban Call

Jun 07, 2025

Dumb Idea Reform Party Chair Slams Mps Burka Ban Call

Jun 07, 2025 -

First Date Turns Deadly Wisconsin Man Convicted Of Murder And Dismemberment

Jun 07, 2025

First Date Turns Deadly Wisconsin Man Convicted Of Murder And Dismemberment

Jun 07, 2025