Is Amazon (AMZN) A Strong Momentum Stock For 2024? Analysis And Outlook.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Amazon (AMZN) a Strong Momentum Stock for 2024? Analysis and Outlook

Amazon (AMZN) has been a tech titan for decades, but 2023 presented a mixed bag. While the company navigated economic headwinds, questions remain about its future growth trajectory. Is Amazon poised for a strong momentum run in 2024, or are investors facing headwinds? Let's delve into a comprehensive analysis and outlook.

Amazon's 2023 Performance: A Mixed Bag

Amazon's 2023 performance was marked by both successes and challenges. While AWS (Amazon Web Services), its cloud computing division, continued to be a significant revenue driver and profit center, [link to AWS earnings report], the e-commerce segment faced pressure from inflation and shifting consumer spending habits. The company also grappled with ongoing cost-cutting measures and workforce adjustments. However, strategic investments in areas like artificial intelligence (AI) and advertising suggest a long-term vision focused on future growth.

Key Factors Influencing Amazon's 2024 Momentum:

Several key factors will determine Amazon's momentum in 2024:

- Economic Conditions: The overall macroeconomic environment will play a crucial role. A robust economy could boost consumer spending, benefiting Amazon's e-commerce business. Conversely, a recessionary environment could further dampen sales.

- AWS Growth: The continued growth of AWS is paramount. Its dominance in cloud computing is undeniable, but competition from Microsoft Azure and Google Cloud Platform is intensifying. Maintaining a competitive edge and securing new clients will be vital.

- Advertising Revenue: Amazon's advertising business is a rapidly growing segment. Its strategic placement within its vast e-commerce ecosystem provides a significant advantage, and continued growth in this area could significantly impact overall profitability.

- AI Investments: Amazon's investments in AI, including generative AI models, are expected to yield significant returns in the long term. Successful integration of AI across its various businesses could drive efficiency gains and new revenue streams.

- Supply Chain Optimization: Efficient supply chain management remains crucial. Addressing potential bottlenecks and maintaining cost-effectiveness will be key to navigating any future economic uncertainty.

Potential Catalysts for Growth:

Several potential catalysts could propel Amazon's stock price in 2024:

- Stronger-than-expected holiday season sales: Exceeding analyst expectations during the crucial holiday shopping season could significantly boost investor confidence.

- Increased AWS market share: Gaining market share in the competitive cloud computing space would signal continued dominance and future growth.

- Successful AI product launches: The successful launch and adoption of new AI-powered products and services could unlock significant new revenue streams.

- Cost-cutting initiatives bearing fruit: Successfully implementing cost-cutting measures without compromising growth could significantly improve profitability.

Risks and Challenges:

Despite the potential for growth, several risks and challenges remain:

- Increased competition: Intense competition in e-commerce and cloud computing could pressure margins and hinder growth.

- Regulatory scrutiny: Amazon faces ongoing regulatory scrutiny, which could lead to increased costs and potential fines.

- Geopolitical uncertainty: Global geopolitical instability could negatively impact supply chains and consumer spending.

Conclusion: A Cautious Optimism for Amazon in 2024

While Amazon faces challenges, its diversification across various high-growth sectors, particularly AWS and advertising, provides a buffer against potential economic downturns. The company's strategic investments in AI also position it for future growth. However, investors should remain cautious, closely monitoring macroeconomic conditions and the company's ability to navigate increasing competition. While a strong momentum run in 2024 is possible, it's not guaranteed. A thorough due diligence and understanding of the risks involved is crucial before investing in AMZN stock. Stay informed and make informed investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Amazon (AMZN) A Strong Momentum Stock For 2024? Analysis And Outlook.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Amazon Stock Amzn Strong Momentum Signals Continued Success

May 28, 2025

Amazon Stock Amzn Strong Momentum Signals Continued Success

May 28, 2025 -

Analysis Of Pdd Holdings Q1 2025 Financial Performance Revenue Profitability And Growth

May 28, 2025

Analysis Of Pdd Holdings Q1 2025 Financial Performance Revenue Profitability And Growth

May 28, 2025 -

Examining The Career Of Michelle Mone Triumphs And Controversies

May 28, 2025

Examining The Career Of Michelle Mone Triumphs And Controversies

May 28, 2025 -

Canadian Boycott Of Us Goods Impact On American Travelers

May 28, 2025

Canadian Boycott Of Us Goods Impact On American Travelers

May 28, 2025 -

Sirius Xm Stock A Deep Dive Into Its Success And Future Potential For Investors

May 28, 2025

Sirius Xm Stock A Deep Dive Into Its Success And Future Potential For Investors

May 28, 2025

Latest Posts

-

Kidnapped And Sold Joshlin Smiths Mother Receives Jail Sentence In South Africa

May 31, 2025

Kidnapped And Sold Joshlin Smiths Mother Receives Jail Sentence In South Africa

May 31, 2025 -

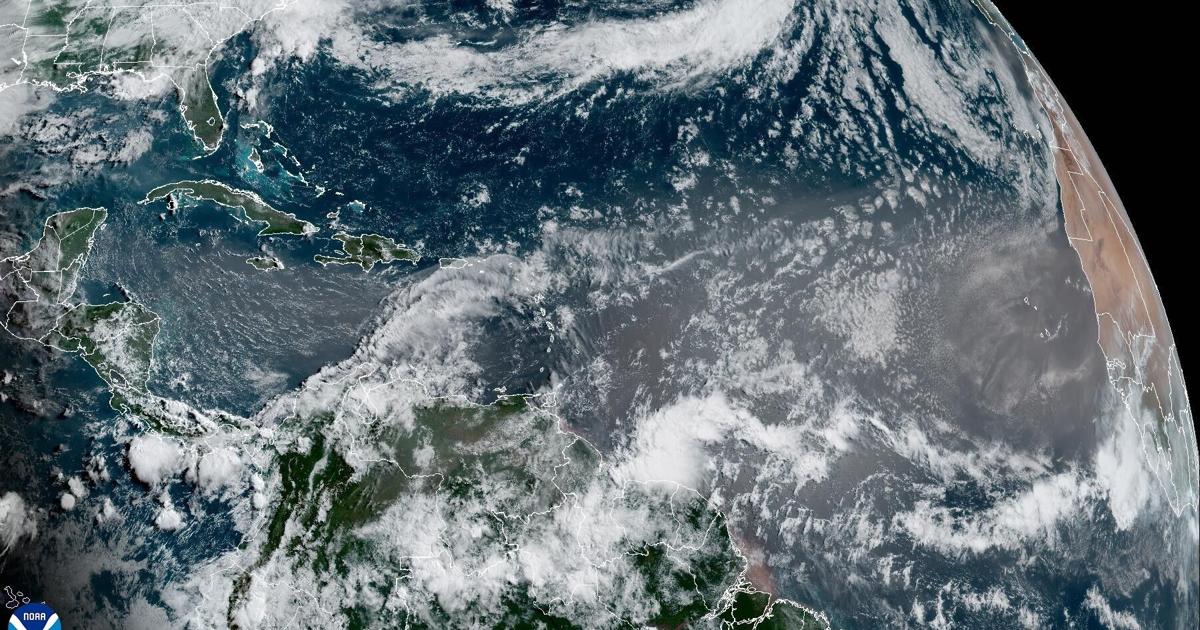

Dramatic Louisiana Sunsets Predicted Saharan Dust Plume On The Way

May 31, 2025

Dramatic Louisiana Sunsets Predicted Saharan Dust Plume On The Way

May 31, 2025 -

Air Traffic Control Crisis At Newark Airport A Proposed Solution

May 31, 2025

Air Traffic Control Crisis At Newark Airport A Proposed Solution

May 31, 2025 -

Holger Runes Third Round Berth At French Open A Dominant Display

May 31, 2025

Holger Runes Third Round Berth At French Open A Dominant Display

May 31, 2025 -

Joshlin Smith Kidnapping Mother Kelly Jailed In South Africa

May 31, 2025

Joshlin Smith Kidnapping Mother Kelly Jailed In South Africa

May 31, 2025