Is SiriusXM Holdings A Smart Investment? Analyzing Its Past Performance And Future Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is SiriusXM Holdings a Smart Investment? Analyzing its Past Performance and Future Outlook

SiriusXM Holdings (SIRI) has carved a niche for itself in the satellite radio market, offering a diverse range of programming to millions of subscribers. But is investing in SiriusXM a smart move? This in-depth analysis examines its past performance, current challenges, and future prospects to help you decide.

A Look Back: SiriusXM's Past Performance

SiriusXM's history is a rollercoaster. Born from the merger of Sirius and XM Satellite Radio in 2008, the company initially struggled to navigate the economic downturn and intense competition. However, it successfully consolidated the market, eliminating direct rivals and establishing a near-monopoly in satellite radio. This allowed for significant revenue growth and subscriber acquisition over the past decade.

Analyzing its past performance reveals a mixed bag. While subscriber growth has been generally positive, revenue growth has fluctuated, impacted by factors like churn rates and the increasing popularity of streaming services. Stock price performance has also been volatile, reflecting the complexities of the media and entertainment sector. Investors should review historical financial statements and analyst reports for a more granular understanding. [Link to reputable financial website with SiriusXM data]

Current Strengths and Weaknesses

Strengths:

- Dominant Market Position: SiriusXM holds a commanding position in satellite radio, enjoying high switching costs and a loyal subscriber base.

- Diverse Programming: The company offers a wide range of content, including music, sports, news, and talk radio, catering to a broad audience.

- Recurring Revenue Model: The subscription-based business model provides predictable revenue streams, offering a degree of stability compared to ad-driven models.

- Expansion into Connected Vehicles: SiriusXM is strategically expanding its reach through partnerships with automakers, integrating its services into new vehicles. This represents a significant growth opportunity.

Weaknesses:

- Competition from Streaming Services: The rise of streaming audio platforms like Spotify and Apple Music presents a significant challenge to SiriusXM's subscriber base.

- Dependence on the Automotive Industry: A downturn in the auto industry could directly impact SiriusXM's subscriber growth.

- Content Costs: Securing and maintaining high-quality programming represents a considerable expense, impacting profitability.

- Potential for Regulatory Changes: Changes in telecommunications regulations could affect the company's operations and profitability.

Future Outlook: Navigating the Changing Landscape

SiriusXM's future hinges on its ability to adapt to the evolving media landscape. The company's strategic focus on connected vehicles and its expansion into podcasting and other audio content are key to its long-term success. However, competition from streaming services and maintaining a high level of subscriber engagement remain crucial challenges.

Factors to Consider Before Investing:

- Market Saturation: The satellite radio market is essentially saturated. Future growth relies on expansion into new markets and technologies.

- Technological Advancements: The emergence of 5G and improved streaming technologies could potentially disrupt SiriusXM's dominance.

- Economic Conditions: The overall economic climate significantly impacts consumer spending, which can directly affect subscription rates.

Conclusion: Is it a Smart Investment?

Whether SiriusXM is a smart investment depends heavily on your individual risk tolerance and investment strategy. Its dominant market position and recurring revenue model offer a degree of stability, but the competitive pressures from streaming services and the cyclical nature of the automotive industry introduce significant risks. Thorough due diligence, including analyzing financial statements, understanding industry trends, and considering your personal investment goals, is crucial before making any investment decisions. Consult a financial advisor for personalized guidance.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is SiriusXM Holdings A Smart Investment? Analyzing Its Past Performance And Future Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Russian Orthodox Church Sees Increase In Young American Male Membership

May 27, 2025

Russian Orthodox Church Sees Increase In Young American Male Membership

May 27, 2025 -

Holding Onto Amazon Stock After A Massive 560 Return

May 27, 2025

Holding Onto Amazon Stock After A Massive 560 Return

May 27, 2025 -

Big Red Vs Terps A Preview Of Mondays Ncaa Championship Game

May 27, 2025

Big Red Vs Terps A Preview Of Mondays Ncaa Championship Game

May 27, 2025 -

Hs 2 Probes Staffing Firms For West Midlands Section

May 27, 2025

Hs 2 Probes Staffing Firms For West Midlands Section

May 27, 2025 -

Uk Rail Nationalisation Begins South Western Railways Return To Public Hands

May 27, 2025

Uk Rail Nationalisation Begins South Western Railways Return To Public Hands

May 27, 2025

Latest Posts

-

French Media Censorship Macrons Marital Ad Disappears

May 30, 2025

French Media Censorship Macrons Marital Ad Disappears

May 30, 2025 -

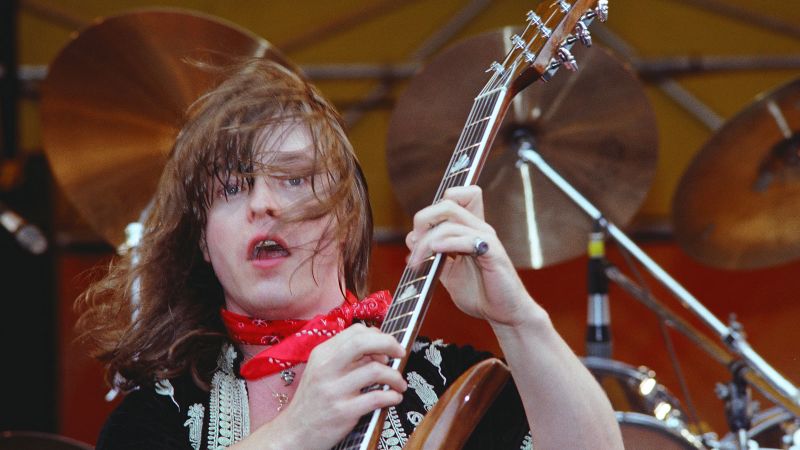

Musician Rick Derringer Dead At 77 His Collaborations And Impact

May 30, 2025

Musician Rick Derringer Dead At 77 His Collaborations And Impact

May 30, 2025 -

High Profile Jailbreaks Fuel Renewed Debate On Us Prison Security

May 30, 2025

High Profile Jailbreaks Fuel Renewed Debate On Us Prison Security

May 30, 2025 -

Tesco Shoppers Mock Self Checkout Surveillance

May 30, 2025

Tesco Shoppers Mock Self Checkout Surveillance

May 30, 2025 -

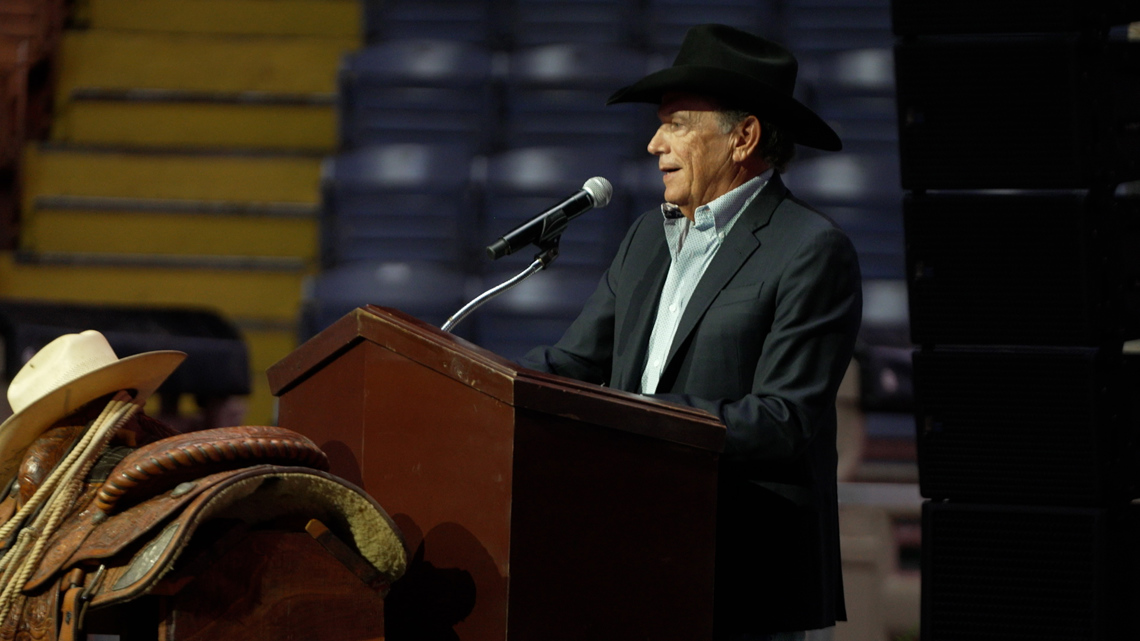

In Memoriam George Strait Remembers His Hero Victim Of North Texas House Fire

May 30, 2025

In Memoriam George Strait Remembers His Hero Victim Of North Texas House Fire

May 30, 2025