Lengthening Loan Terms: How 31-Year Mortgages Affect First-Time Homebuyers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lengthening Loan Terms: How 31-Year Mortgages Affect First-Time Homebuyers

The dream of homeownership is increasingly elusive for many, particularly first-time buyers. Rising interest rates and soaring property prices have made saving for a down payment a monumental task. Enter the 31-year mortgage – a longer-term loan designed to lower monthly payments and potentially broaden access to homeownership. But is this extended timeline a boon or a bane for aspiring homeowners? Let's delve into the implications.

Lower Monthly Payments: The Allure of the 31-Year Mortgage

One of the most significant advantages of a 31-year mortgage is the reduced monthly payment. By stretching the repayment period, the amount you pay each month decreases considerably. This can make a substantial difference for first-time homebuyers with limited disposable income. For example, a buyer might find they can afford a more expensive home with a 31-year mortgage compared to a traditional 15 or 30-year loan. This increased affordability can open doors to neighborhoods or property types previously out of reach.

The Hidden Costs of Extended Repayment: Interest and Total Cost

While lower monthly payments are attractive, it's crucial to understand the long-term financial implications. A 31-year mortgage significantly increases the total interest paid over the life of the loan. This means you'll end up paying considerably more than the original loan amount. This increased cost is a critical factor first-time homebuyers need to carefully consider. Financial calculators can help determine the total interest paid over different loan terms, allowing for a clear comparison.

Building Equity: A Slower Pace

With a 31-year mortgage, building equity in your home occurs at a slower pace. This is because a larger portion of your early payments goes towards interest, rather than principal. While you’ll own your home outright eventually, you won't accumulate as much equity in the same timeframe as with a shorter-term loan. This can have implications if you plan to refinance or sell your home within a shorter time frame.

Qualifying for a 31-Year Mortgage: Credit Score and Debt-to-Income Ratio

Securing a 31-year mortgage involves the same qualifying process as shorter-term loans. Lenders will assess your credit score, debt-to-income ratio, and overall financial stability. A strong credit history and a lower debt-to-income ratio significantly improve your chances of approval. Understanding your financial standing is crucial before applying for any mortgage. Consider consulting with a financial advisor to explore your options and ensure you're making informed decisions.

Is a 31-Year Mortgage Right for You?

Ultimately, the suitability of a 31-year mortgage depends on individual circumstances and financial goals. It can be a beneficial tool for first-time homebuyers struggling with affordability in today's market, provided they fully understand the implications of the extended repayment period.

Before committing to a 31-year mortgage, consider these key questions:

- Can you comfortably afford the monthly payments, even if interest rates rise?

- What are your long-term financial goals, and how does this mortgage align with them?

- Have you explored all other financing options, such as down payment assistance programs?

- Have you consulted with a financial advisor to assess your financial health and discuss your options?

By carefully weighing the pros and cons and seeking professional financial advice, first-time homebuyers can make informed decisions about their mortgage choices, maximizing their chances of achieving the dream of homeownership while minimizing long-term financial risk. Remember to shop around and compare rates from multiple lenders to secure the best possible terms.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lengthening Loan Terms: How 31-Year Mortgages Affect First-Time Homebuyers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

French Open Day 8 2025 Complete Match Results And Highlights

Jun 04, 2025

French Open Day 8 2025 Complete Match Results And Highlights

Jun 04, 2025 -

Ronny Mauricios Mlb Debut A New Era For The Mets

Jun 04, 2025

Ronny Mauricios Mlb Debut A New Era For The Mets

Jun 04, 2025 -

Swansea Court Rules Pontardawe Woman Must Repay Stolen Funds

Jun 04, 2025

Swansea Court Rules Pontardawe Woman Must Repay Stolen Funds

Jun 04, 2025 -

Billionaire Buffetts Strategic Shift From Banking To Booming Consumer Brand

Jun 04, 2025

Billionaire Buffetts Strategic Shift From Banking To Booming Consumer Brand

Jun 04, 2025 -

Private Equity Firm Accel Kkr Invests In Healthcare Technology Leader Care Line Live

Jun 04, 2025

Private Equity Firm Accel Kkr Invests In Healthcare Technology Leader Care Line Live

Jun 04, 2025

Latest Posts

-

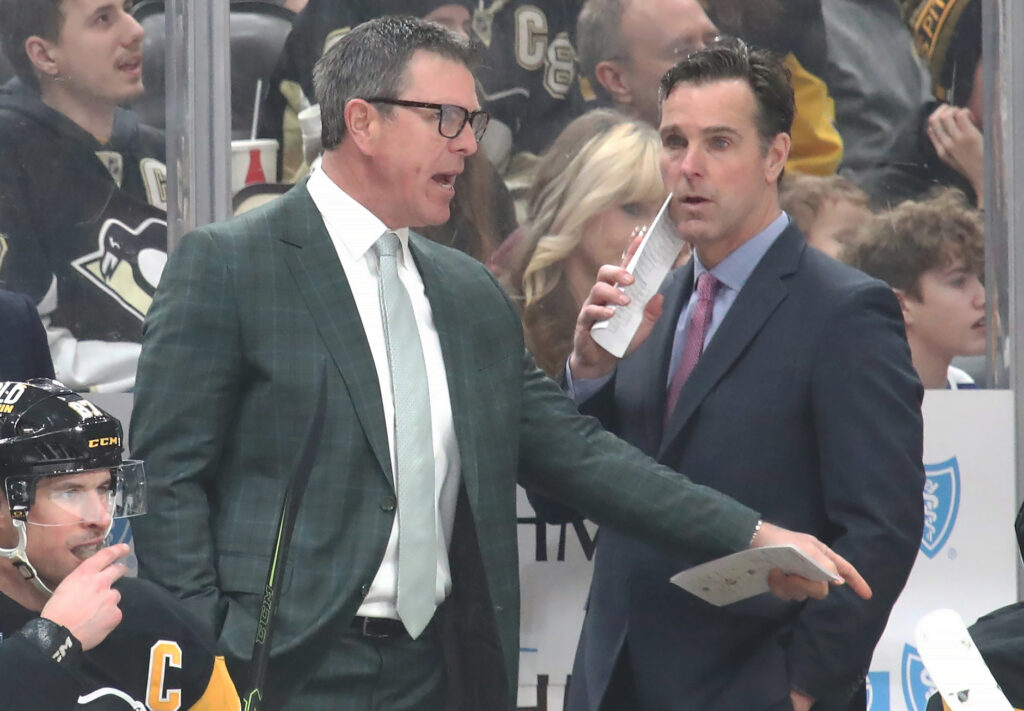

David Quinn And Joe Sacco Join Rangers Coaching Team

Jun 06, 2025

David Quinn And Joe Sacco Join Rangers Coaching Team

Jun 06, 2025 -

Harry Enten Deconstructs Mike Lindells Business And Political Career On Cnn

Jun 06, 2025

Harry Enten Deconstructs Mike Lindells Business And Political Career On Cnn

Jun 06, 2025 -

The Unique Demands Of Clay Why Roland Garros Is Different

Jun 06, 2025

The Unique Demands Of Clay Why Roland Garros Is Different

Jun 06, 2025 -

Is Coca Cola Ko Stock A Buy Analyzing The Investment Potential

Jun 06, 2025

Is Coca Cola Ko Stock A Buy Analyzing The Investment Potential

Jun 06, 2025 -

Madeleine Mc Cann Case Still Unsolved After 18 Years

Jun 06, 2025

Madeleine Mc Cann Case Still Unsolved After 18 Years

Jun 06, 2025