Major 401(k) Changes On The Horizon: Are You Prepared?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Major 401(k) Changes on the Horizon: Are You Prepared?

Retirement planning is a marathon, not a sprint, and the rules of the race are constantly evolving. For millions of Americans relying on their 401(k) plans for retirement security, significant changes are brewing. Are you ready for what’s coming? This article explores the key potential shifts in 401(k) regulations and offers guidance on how to adapt your retirement strategy.

Potential 401(k) Changes and Their Impact

The landscape of retirement savings is facing several potential transformations, impacting both employers and employees. While specific legislative details are still emerging, here are some key areas to watch:

1. Increased Required Minimum Distributions (RMDs): Current RMD ages may be adjusted, potentially forcing retirees to withdraw funds earlier than anticipated. This could impact your overall retirement income strategy, especially if you're relying on your 401(k) as a primary source of funds. Understanding these changes is crucial to avoid unexpected tax liabilities and depletion of your savings.

2. Higher Contribution Limits: While potentially positive, increased contribution limits might also present challenges. Keeping track of these changes and maximizing contributions requires vigilance. Failing to adjust your contributions could mean leaving substantial tax-advantaged savings on the table.

3. Enhanced Transparency and Fee Disclosure: Regulations aimed at increasing transparency regarding fees associated with 401(k) plans are likely. This is a positive development for consumers, offering greater clarity on the costs impacting their retirement savings. Being informed allows you to make more strategic decisions about your plan's management.

4. Auto-Enrollment and Escalation Modifications: Changes might affect auto-enrollment features, which automatically enroll employees in their company’s 401(k) plan. Modifications to automatic contribution escalation could also impact your savings trajectory. Stay informed about these alterations to ensure your contributions align with your retirement goals.

5. Changes to Roth 401(k) Contributions: Rules governing Roth 401(k) contributions might be refined, potentially impacting the tax benefits associated with this type of plan. Understanding these changes is crucial for making informed decisions about your tax-advantaged retirement savings strategy.

How to Prepare for Upcoming 401(k) Changes

Navigating these potential changes requires proactive planning. Here’s how to prepare:

- Stay Informed: Regularly check your plan documents and keep an eye on news from the Department of Labor and other relevant regulatory bodies. Websites like the IRS website () offer valuable resources.

- Diversify Your Investments: Don’t put all your eggs in one basket. Diversification across different asset classes can help mitigate risks associated with market fluctuations.

- Consult a Financial Advisor: A qualified financial advisor can help you navigate the complexities of retirement planning and adjust your strategy in response to regulatory changes.

- Review Your Retirement Projections: Regularly review your projected retirement income to ensure it aligns with your goals, considering potential changes to 401(k) rules.

- Maximize Contributions Within Limits: Stay abreast of contribution limits and maximize your contributions whenever possible to take full advantage of tax benefits.

Conclusion:

The future of 401(k) plans is evolving. By staying informed, proactively adjusting your strategy, and seeking professional advice when needed, you can better prepare for these changes and secure your retirement future. Don’t wait until it’s too late; take control of your retirement savings today. Are you ready to take the next step in securing your financial future? Consider consulting a financial advisor to discuss your specific situation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Major 401(k) Changes On The Horizon: Are You Prepared?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Salaires Des Joueuses De Tennis A Cincinnati Analyse Du Prize Money

Aug 09, 2025

Salaires Des Joueuses De Tennis A Cincinnati Analyse Du Prize Money

Aug 09, 2025 -

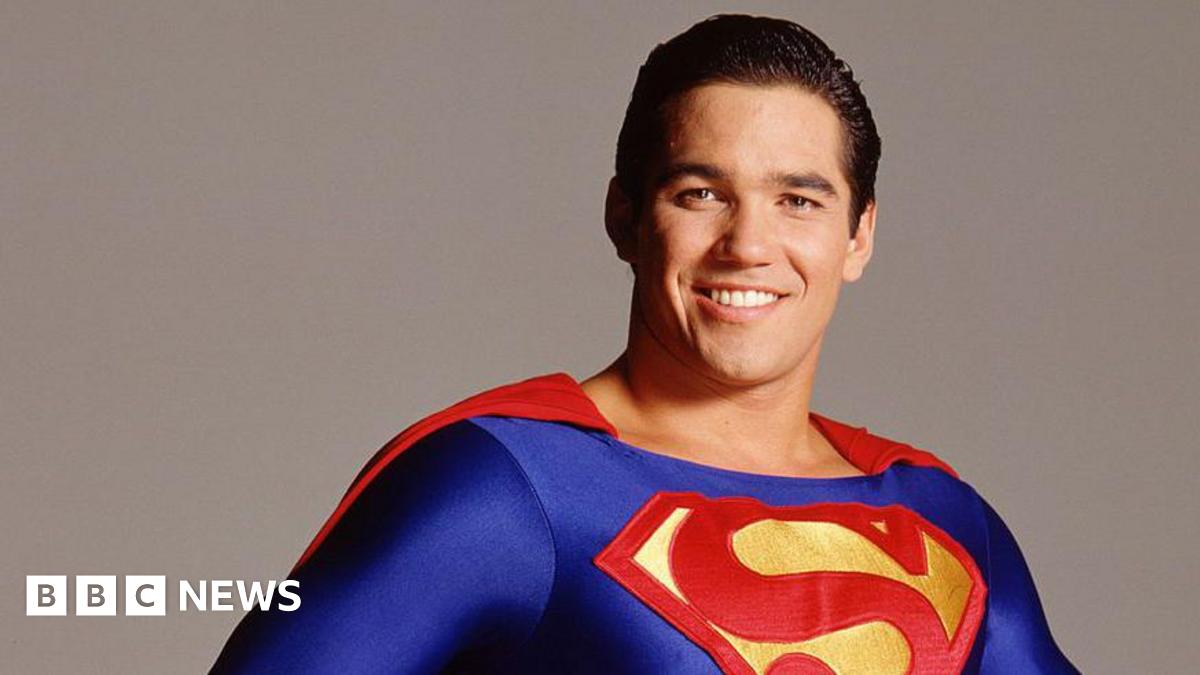

Dean Cains Unexpected Career Change Joining Ice

Aug 09, 2025

Dean Cains Unexpected Career Change Joining Ice

Aug 09, 2025 -

Cincinnati 2025 Following Kartal Garcias Progress

Aug 09, 2025

Cincinnati 2025 Following Kartal Garcias Progress

Aug 09, 2025 -

Debanking In Focus Trumps Planned Executive Order And Its Potential Impact

Aug 09, 2025

Debanking In Focus Trumps Planned Executive Order And Its Potential Impact

Aug 09, 2025 -

Wta Cincinnati Open 2025 Expert Prediction And Odds Analysis For Collins Vs Townsend

Aug 09, 2025

Wta Cincinnati Open 2025 Expert Prediction And Odds Analysis For Collins Vs Townsend

Aug 09, 2025

Latest Posts

-

Jaxson Darts Preseason Debut Best Plays And Highlights From Week 1

Aug 10, 2025

Jaxson Darts Preseason Debut Best Plays And Highlights From Week 1

Aug 10, 2025 -

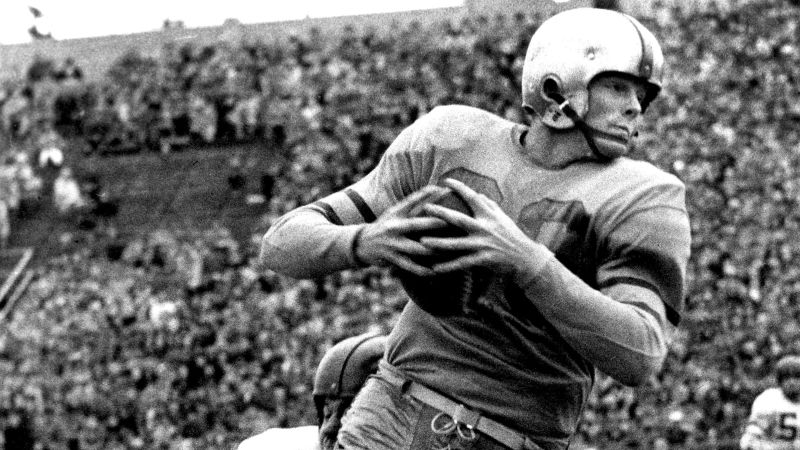

Hall Of Fame Candidate Billy Howton Packers Star And Nflpa Founder Dead At 95

Aug 10, 2025

Hall Of Fame Candidate Billy Howton Packers Star And Nflpa Founder Dead At 95

Aug 10, 2025 -

Apollo 13s Jim Lovell A Life In Space And A Nations Tribute

Aug 10, 2025

Apollo 13s Jim Lovell A Life In Space And A Nations Tribute

Aug 10, 2025 -

Nicola Sturgeons Memoir Arrest Detailed As Worst Day Of My Life

Aug 10, 2025

Nicola Sturgeons Memoir Arrest Detailed As Worst Day Of My Life

Aug 10, 2025 -

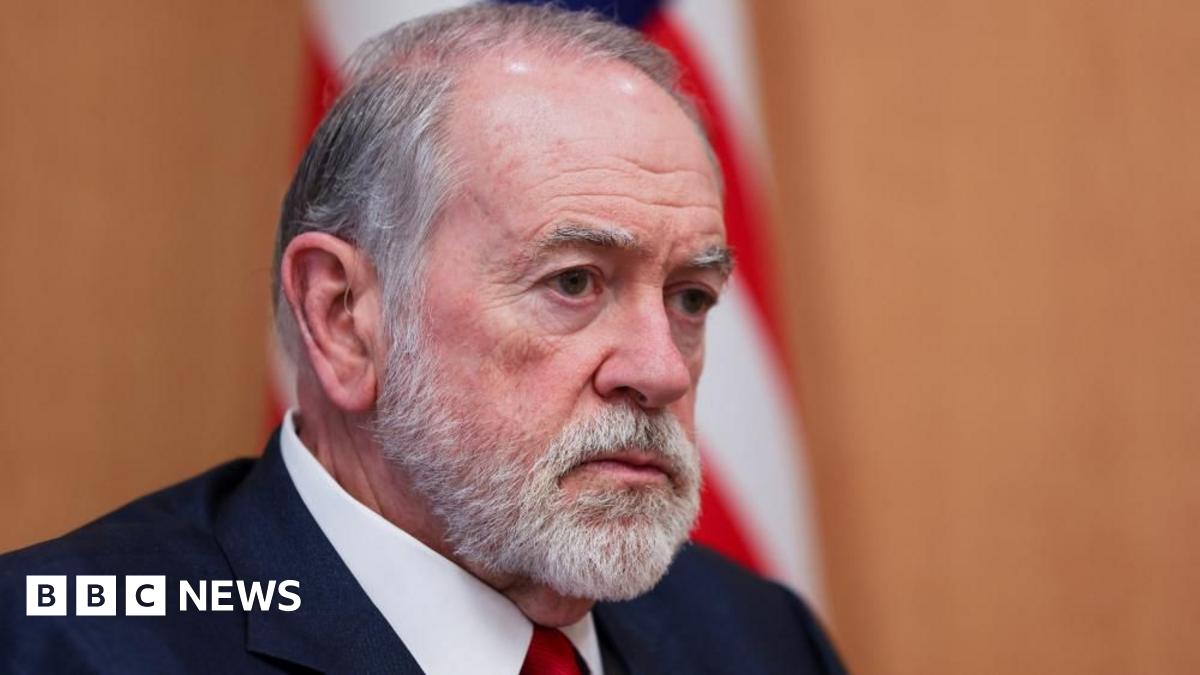

Mike Huckabee Weighs In Starmers Leadership And Wwii Hypothetical

Aug 10, 2025

Mike Huckabee Weighs In Starmers Leadership And Wwii Hypothetical

Aug 10, 2025