Market Analysis: IBM Stock's Recent Underperformance And Potential Recovery

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Analysis: IBM Stock's Recent Underperformance and Potential Recovery

IBM, a tech giant with a storied history, has recently seen its stock price underperform compared to the broader market. This has left many investors questioning the future of this established player in the tech landscape. While challenges remain, a closer look reveals potential catalysts for a recovery, making it crucial for investors to understand the current situation and potential future trajectory of IBM stock.

IBM's Recent Struggles: A Deeper Dive

Several factors have contributed to IBM's recent underperformance. The company's transition away from its legacy hardware business towards hybrid cloud and AI solutions, while strategically sound in the long term, has resulted in short-term headwinds. Competition in the rapidly evolving cloud market from giants like AWS, Microsoft Azure, and Google Cloud is fierce, putting pressure on IBM's market share and revenue growth.

Furthermore, macroeconomic factors like inflation and rising interest rates have impacted investor sentiment across the tech sector, with IBM not being immune to these broader market forces. Concerns around slowing global economic growth have also contributed to a more cautious approach by investors towards traditionally stable, large-cap stocks like IBM.

H2: Identifying the Potential for Recovery

Despite these challenges, several key factors suggest a potential for IBM stock to recover and regain investor confidence:

-

Strategic Shift to High-Growth Areas: IBM's strategic pivot towards hybrid cloud, AI, and data analytics is positioning the company for growth in lucrative sectors. Their investments in these areas are starting to bear fruit, albeit gradually. The long-term potential in these markets is significant, promising substantial returns for patient investors.

-

Strong Free Cash Flow: IBM continues to generate robust free cash flow, which allows them to invest in research and development, pursue acquisitions, and return value to shareholders through dividends and share buybacks. This financial strength provides a solid foundation for future growth and stability.

-

Focus on Hybrid Cloud: IBM's hybrid cloud solutions are gaining traction, offering businesses a path to migrate their data and applications to the cloud while maintaining control and security. This approach appeals to many organizations hesitant to fully embrace public cloud solutions, giving IBM a competitive edge.

-

AI and Data Analytics Leadership: IBM's Watson AI platform and its expertise in data analytics provide a significant advantage in the burgeoning AI market. As AI adoption accelerates across industries, IBM's capabilities are poised to play a crucial role, driving future growth.

H3: What Investors Should Consider

Before investing in IBM, it's crucial to consider both the risks and opportunities. While the long-term outlook might be positive, the transition period could still involve volatility. Investors should carefully assess their risk tolerance and investment horizon before making any decisions. Conduct thorough due diligence and consider consulting with a financial advisor to determine if IBM aligns with your individual investment strategy.

H3: Conclusion: A Long-Term Perspective

IBM's recent underperformance shouldn't be interpreted as a definitive sign of failure. The company's strategic transformation, strong financial position, and focus on high-growth areas present opportunities for long-term growth. While short-term market fluctuations are expected, investors with a long-term perspective might find IBM stock an attractive investment opportunity. The path to recovery may be gradual, but the potential rewards are substantial for those willing to weather the short-term challenges. Remember to always conduct your own research and consult with a financial advisor before making any investment decisions.

(Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Analysis: IBM Stock's Recent Underperformance And Potential Recovery. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

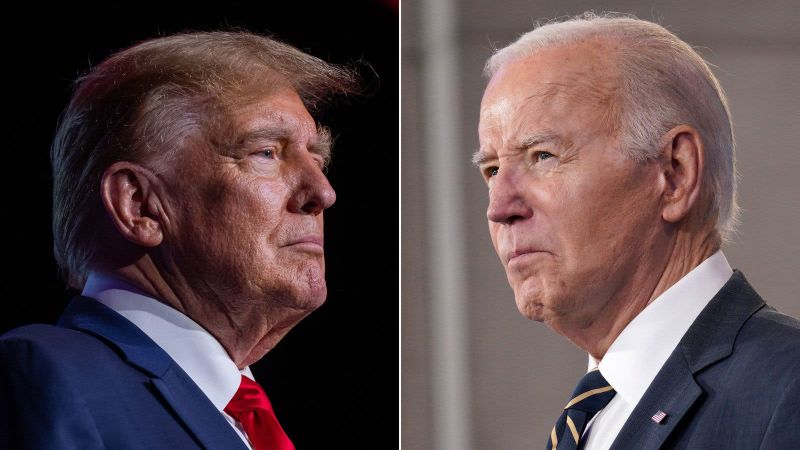

Trumps Investigation Into Biden Autopen Use And Questionable Decisions Under Scrutiny

Jun 07, 2025

Trumps Investigation Into Biden Autopen Use And Questionable Decisions Under Scrutiny

Jun 07, 2025 -

Lifetimes New Movie Features Steve Guttenberg As A Shocking Serial Killer

Jun 07, 2025

Lifetimes New Movie Features Steve Guttenberg As A Shocking Serial Killer

Jun 07, 2025 -

Steve Guttenberg Takes On A Dark Role In New Lifetime Film

Jun 07, 2025

Steve Guttenberg Takes On A Dark Role In New Lifetime Film

Jun 07, 2025 -

Trumps Travel Ban A Deep Dive Into The 12 Banned Countries

Jun 07, 2025

Trumps Travel Ban A Deep Dive Into The 12 Banned Countries

Jun 07, 2025 -

Longtime Friend Of Cassie Ventura To Provide Further Testimony In Combs Case

Jun 07, 2025

Longtime Friend Of Cassie Ventura To Provide Further Testimony In Combs Case

Jun 07, 2025

Latest Posts

-

Matthew Hussey Expecting First Child With Wife A Happy Announcement

Jun 07, 2025

Matthew Hussey Expecting First Child With Wife A Happy Announcement

Jun 07, 2025 -

Wisconsin Court Delivers Guilty Verdict In Gruesome First Date Murder Case

Jun 07, 2025

Wisconsin Court Delivers Guilty Verdict In Gruesome First Date Murder Case

Jun 07, 2025 -

Uk Government Bans Rob Cross Former World Darts Champion From Company Directorships Following Tax Investigation

Jun 07, 2025

Uk Government Bans Rob Cross Former World Darts Champion From Company Directorships Following Tax Investigation

Jun 07, 2025 -

Ukraines Daring Airfield Raids A Strategic Turning Point Or Tactical Success

Jun 07, 2025

Ukraines Daring Airfield Raids A Strategic Turning Point Or Tactical Success

Jun 07, 2025 -

Guilty Verdict Wisconsin Man Found Responsible For First Date Killing And Dismemberment

Jun 07, 2025

Guilty Verdict Wisconsin Man Found Responsible For First Date Killing And Dismemberment

Jun 07, 2025