Market Update: S&P 500, Dow, And Nasdaq Climb Despite Moody's Negative Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Update: S&P 500, Dow, and Nasdaq Climb Despite Moody's Negative Outlook

Wall Street defies Moody's downgrade warning, posting solid gains across major indices.

The major US stock market indices defied a negative outlook from Moody's Investors Service, closing higher on [Date of article]. The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all saw significant gains, demonstrating resilience in the face of economic uncertainty. This unexpected surge has left analysts scrambling to understand the underlying factors driving the market's performance.

Moody's recently downgraded the credit ratings of several small and mid-sized US banks, citing concerns about the banking sector's vulnerability to further economic stress. This action cast a shadow over the market, fueling concerns about potential contagion and further economic slowdown. However, the market's response suggests investor confidence remains, at least for now.

S&P 500: A Strong Performance Against the Odds

The S&P 500, a broad measure of the US stock market, closed up [Percentage]% at [Closing Value], marking its [Description of performance, e.g., best day in a week/month]. This positive performance indicates a degree of optimism amongst investors, possibly reflecting expectations of a "soft landing" for the US economy, despite inflationary pressures. Key sectors driving the gains included [List key performing sectors, e.g., technology, energy].

Dow Jones Industrial Average: A Steady Climb

The Dow Jones Industrial Average also experienced a robust increase, closing up [Percentage]% at [Closing Value]. This reflects a positive sentiment towards established, large-cap companies, suggesting continued investor confidence in these blue-chip stocks. The Dow's performance mirrors the overall positive trend observed across the broader market, reinforcing the strength of the upward movement.

Nasdaq Composite: Tech Stocks Lead the Charge

The tech-heavy Nasdaq Composite saw particularly strong gains, closing up [Percentage]% at [Closing Value]. This suggests investor enthusiasm remains high for the technology sector, despite ongoing concerns about interest rate hikes and their potential impact on growth stocks. [Mention specific high-performing tech stocks, if applicable, with links to relevant articles or financial data].

Factors Contributing to the Market's Resilience

Several factors may have contributed to the market's unexpected resilience despite Moody's negative outlook:

- Stronger-than-expected economic data: Recent economic indicators, such as [mention specific data, e.g., employment figures, consumer spending], may have fueled optimism about the economy's ability to withstand further challenges.

- Resilience of the banking sector: While Moody's downgrade raised concerns, the overall banking sector has shown signs of stability, mitigating fears of a widespread crisis.

- Investor anticipation of future rate cuts: Some analysts believe the Federal Reserve may soon pause or even reverse its interest rate hikes, potentially boosting market sentiment.

- Bargain hunting: The recent market downturn may have created opportunities for bargain hunting, leading to increased buying activity.

What This Means for Investors

The market's reaction to Moody's downgrade highlights the complexity and often unpredictable nature of the stock market. While the gains are encouraging, investors should remain cautious and diversify their portfolios. It's crucial to consult with a financial advisor before making any significant investment decisions. The current market environment necessitates a carefully considered approach, balancing risk and potential reward.

Further Reading:

- [Link to article on Moody's downgrade]

- [Link to article on recent economic data]

- [Link to article on Federal Reserve policy]

Disclaimer: This article provides general information and should not be considered financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Update: S&P 500, Dow, And Nasdaq Climb Despite Moody's Negative Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Critically Acclaimed Wwi Drama Starring Daniel Craig Now Available To Stream

May 20, 2025

Critically Acclaimed Wwi Drama Starring Daniel Craig Now Available To Stream

May 20, 2025 -

Moodys Downgrade Ignored S And P 500 Dow And Nasdaq Post Strong Gains

May 20, 2025

Moodys Downgrade Ignored S And P 500 Dow And Nasdaq Post Strong Gains

May 20, 2025 -

St Louis Tornado Aftermath Residents Share Stories Of Resilience And Loss

May 20, 2025

St Louis Tornado Aftermath Residents Share Stories Of Resilience And Loss

May 20, 2025 -

Daniel Craig Cillian Murphy And Tom Hardy Star In New Wwi Film Streaming Now

May 20, 2025

Daniel Craig Cillian Murphy And Tom Hardy Star In New Wwi Film Streaming Now

May 20, 2025 -

Australian Body Horror Film And Eurovision Upset A Week In Review

May 20, 2025

Australian Body Horror Film And Eurovision Upset A Week In Review

May 20, 2025

Latest Posts

-

Autonomous Vehicles Ubers 2023 Vision Conflicts With Uks 2027 Target

May 20, 2025

Autonomous Vehicles Ubers 2023 Vision Conflicts With Uks 2027 Target

May 20, 2025 -

Tom Aspinall Negotiations Stall Jon Jones Hints At Ufc Retirement

May 20, 2025

Tom Aspinall Negotiations Stall Jon Jones Hints At Ufc Retirement

May 20, 2025 -

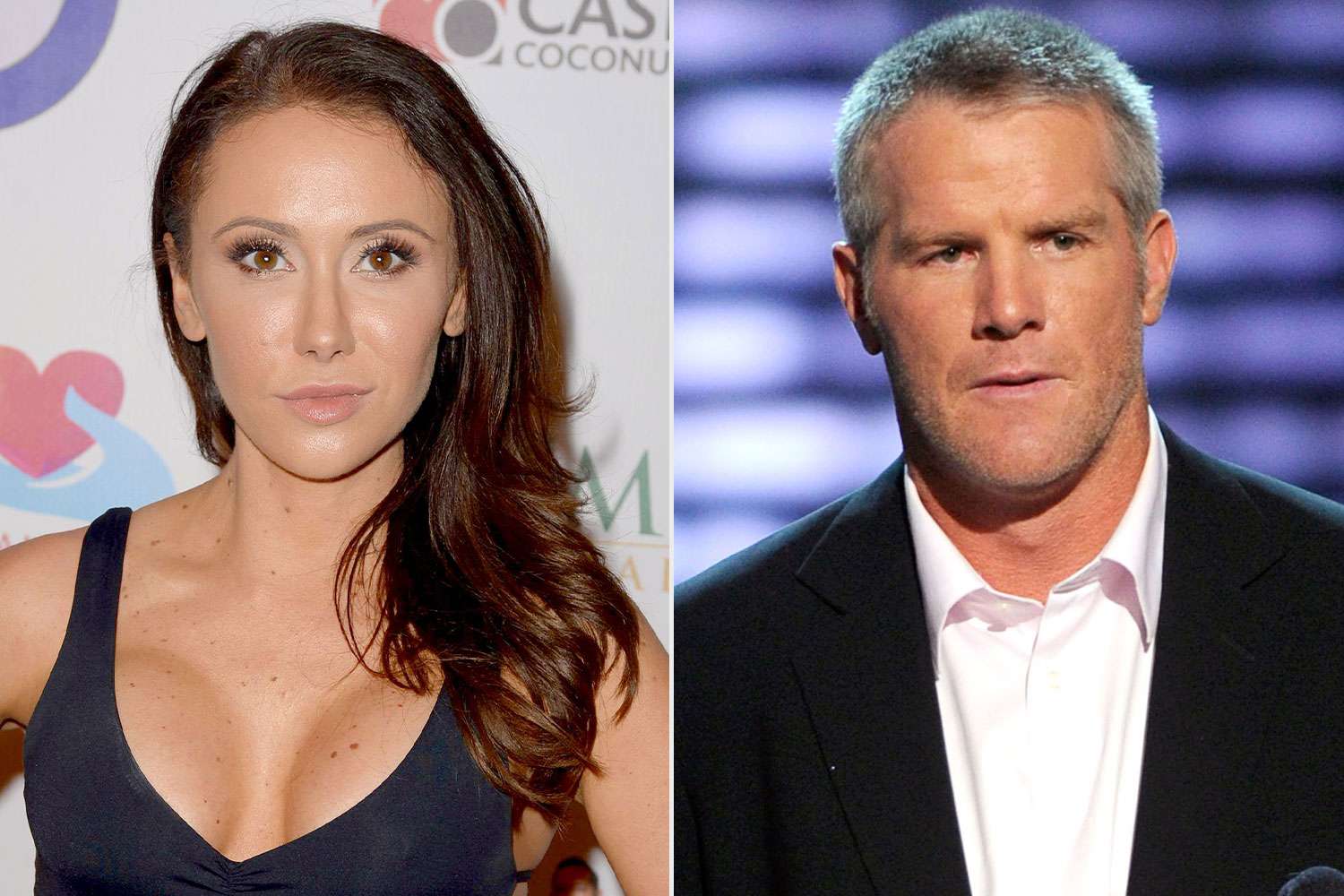

Brett Favre Sexting Scandal Jenn Sterger Recounts Her Experience And Its Aftermath

May 20, 2025

Brett Favre Sexting Scandal Jenn Sterger Recounts Her Experience And Its Aftermath

May 20, 2025 -

New Wwi Movie Featuring Daniel Craig Cillian Murphy And Tom Hardy Streaming Now

May 20, 2025

New Wwi Movie Featuring Daniel Craig Cillian Murphy And Tom Hardy Streaming Now

May 20, 2025 -

Peaky Blinders Creator Announces New Series Detailing Key Departure

May 20, 2025

Peaky Blinders Creator Announces New Series Detailing Key Departure

May 20, 2025