Moody's Downgrade Ignored: S&P 500, Dow, And Nasdaq Post Strong Gains

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Moody's Downgrade Ignored: S&P 500, Dow, and Nasdaq Post Strong Gains

Wall Street shrugs off Moody's downgrade, enjoying a robust rally. The major US stock market indices defied expectations on Tuesday, posting impressive gains despite Moody's Investors Service downgrading 10 small and midsize banking companies and issuing a negative outlook for the broader banking sector. This unexpected surge highlights the resilience of the market and the potential disconnect between credit rating agency assessments and investor sentiment.

A Day of Defiance: Market Performance in Detail

The S&P 500 closed up 1.1%, the Dow Jones Industrial Average climbed 1.2%, and the Nasdaq Composite surged 1.6%. This robust performance directly contradicts the negative sentiment that typically follows a credit rating downgrade. Many analysts attribute this surprising market reaction to several factors:

Reasons Behind the Market's Resilience:

- Strong Corporate Earnings: The recent reporting season has seen surprisingly strong earnings from several major corporations, bolstering investor confidence in the overall economic outlook despite inflationary pressures and rising interest rates. This positive news overshadows the concerns raised by Moody's.

- Resilient Consumer Spending: Despite persistent inflation, consumer spending remains relatively robust, indicating a degree of economic resilience that many analysts had not predicted. This sustained consumer demand continues to support corporate profitability.

- Market Anticipation: Some argue that the market had already priced in much of the negative news regarding the banking sector, making Moody's downgrade less impactful than initially anticipated. This preemptive pricing suggests a degree of market sophistication in navigating economic uncertainty.

- Federal Reserve Policy Expectations: While interest rate hikes remain a concern, some analysts believe the market is anticipating a potential pause or even a pivot in Federal Reserve policy in the near future, leading to increased investor optimism.

Moody's Downgrade: A Closer Look

Moody's downgrade cited concerns about the creditworthiness of several smaller banks, particularly their vulnerability to rising interest rates and potential economic slowdowns. While the agency emphasized that the overall US banking system remains strong, the downgrade served as a stark reminder of the ongoing challenges facing the financial sector. [Link to Moody's report - insert relevant link here]

What's Next for the Market?

While Tuesday's gains were impressive, it's crucial to avoid reading too much into a single day's performance. The market's reaction to Moody's downgrade highlights the complexity of market dynamics and the numerous factors that influence investor behavior. Ongoing geopolitical uncertainties, inflation, and interest rate policies will continue to play significant roles in shaping future market trends.

Conclusion:

The market's strong performance following Moody's downgrade suggests a level of resilience and perhaps an underestimation of the market's ability to absorb negative news. While the long-term outlook remains uncertain, Tuesday's gains provide a glimmer of optimism for investors. However, caution remains warranted, and continued monitoring of economic indicators and Federal Reserve policy is essential. Stay informed and consult with a financial advisor for personalized investment guidance.

Keywords: Moody's, Downgrade, S&P 500, Dow Jones, Nasdaq, Stock Market, Banking Sector, Economic Outlook, Investor Sentiment, Federal Reserve, Interest Rates, Inflation, Market Rally, Credit Rating, Wall Street

Related Articles: (Internal links to relevant articles on your website would go here)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Moody's Downgrade Ignored: S&P 500, Dow, And Nasdaq Post Strong Gains. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Hall Explains Decisive Try In Recent Match

May 20, 2025

Hall Explains Decisive Try In Recent Match

May 20, 2025 -

Horrific Train Accident Family Of Four Hit Two Adults Killed

May 20, 2025

Horrific Train Accident Family Of Four Hit Two Adults Killed

May 20, 2025 -

What Is Femicide Examining The Problem And Potential Solutions

May 20, 2025

What Is Femicide Examining The Problem And Potential Solutions

May 20, 2025 -

From Zero To Billions A Self Made Billionaires Approach To Idea Generation

May 20, 2025

From Zero To Billions A Self Made Billionaires Approach To Idea Generation

May 20, 2025 -

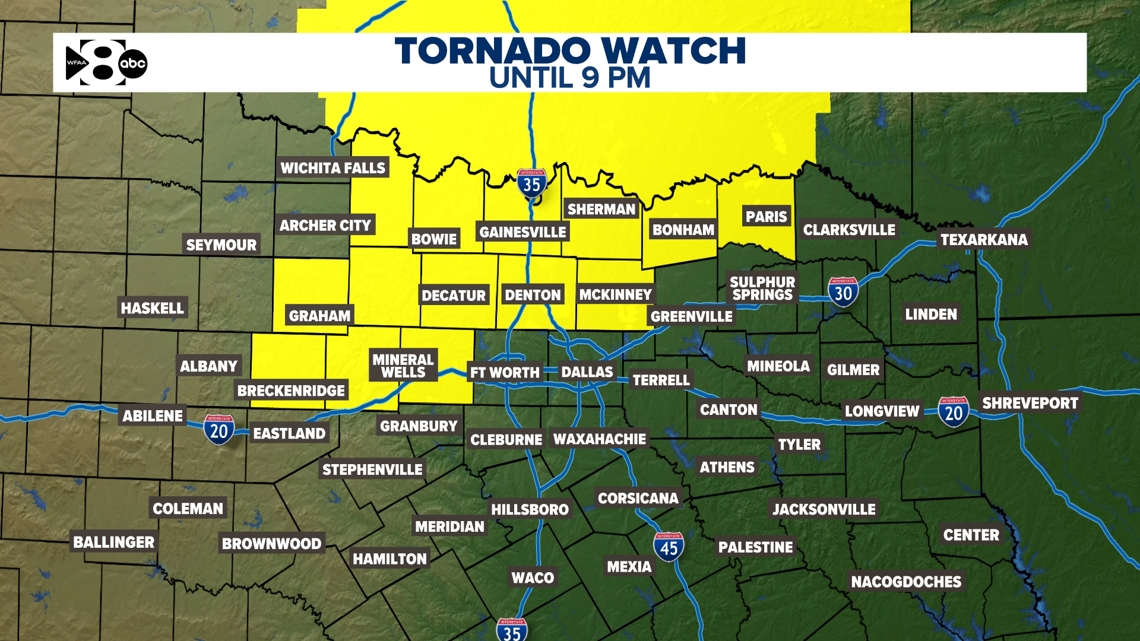

Dfw Weather Forecast Cold Front Arrival And Temperature Drop

May 20, 2025

Dfw Weather Forecast Cold Front Arrival And Temperature Drop

May 20, 2025

Latest Posts

-

Weight Comments And Brutal Training How A Coach Destroyed An Olympic Swimmers Well Being

May 20, 2025

Weight Comments And Brutal Training How A Coach Destroyed An Olympic Swimmers Well Being

May 20, 2025 -

Jon Jones Retirement Rumors Intensify After Cryptic I M Done Post

May 20, 2025

Jon Jones Retirement Rumors Intensify After Cryptic I M Done Post

May 20, 2025 -

Us Treasury Yield Decline Follows Feds 2025 Rate Cut Indication

May 20, 2025

Us Treasury Yield Decline Follows Feds 2025 Rate Cut Indication

May 20, 2025 -

Enhanced Consumer Safeguards The Impact Of New Buy Now Pay Later Regulations

May 20, 2025

Enhanced Consumer Safeguards The Impact Of New Buy Now Pay Later Regulations

May 20, 2025 -

Trump Intervenes Immediate Russia Ukraine Truce Talks Planned

May 20, 2025

Trump Intervenes Immediate Russia Ukraine Truce Talks Planned

May 20, 2025