Enhanced Consumer Safeguards: The Impact Of New Buy Now, Pay Later Regulations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Enhanced Consumer Safeguards: The Impact of New Buy Now, Pay Later Regulations

Buy Now, Pay Later (BNPL) services have exploded in popularity, offering consumers a seemingly effortless way to purchase goods and services. However, this rapid growth has also raised concerns about consumer debt and financial vulnerability. Responding to these anxieties, regulators worldwide are implementing stricter rules, significantly impacting how BNPL operates and, crucially, protecting consumers. This article delves into the key changes and their implications.

The Rise of BNPL and the Subsequent Need for Regulation

The convenience of BNPL – splitting purchases into interest-free installments – has attracted millions. From online shopping giants to smaller retailers, BNPL integration has become ubiquitous. But this ease of access has led to a surge in debt for some consumers, particularly those already struggling financially. Overspending and a lack of transparency surrounding fees and repayment schedules have contributed to this problem. This prompted regulatory bodies to intervene, aiming to create a safer and more transparent BNPL landscape.

Key Changes Introduced by New Regulations

Recent regulatory changes vary across jurisdictions, but several common themes emerge:

-

Credit Checks: Many regulations now mandate credit checks for BNPL transactions exceeding a certain threshold. This helps prevent over-indebted individuals from accumulating further debt. This move is a significant shift from the earlier, largely unregulated, landscape.

-

Affordability Assessments: Lenders are increasingly required to conduct thorough affordability assessments before approving BNPL applications. This involves evaluating a consumer's income, existing debt, and spending habits to ensure they can comfortably manage repayments.

-

Improved Transparency: Regulations are pushing for greater transparency in BNPL agreements. Consumers are now better informed about fees, interest rates (if applicable), and repayment terms, minimizing the risk of unexpected charges.

-

Debt Collection Practices: New rules are also focusing on responsible debt collection practices. Harsh collection methods are being curtailed, protecting consumers from harassment and financial distress.

-

Data Protection: Stricter data protection regulations are being implemented to safeguard consumer information collected by BNPL providers.

The Impact on Consumers and Businesses

These regulatory changes are having a significant impact:

-

Increased Consumer Protection: Consumers are now better protected from predatory lending practices and irresponsible borrowing. The increased transparency and affordability assessments offer vital safeguards.

-

Shift in BNPL Business Models: BNPL providers are adapting their business models to comply with the new regulations. This may involve investing in more robust credit scoring systems and improving their customer support processes.

-

Potential for Reduced BNPL Usage: Some predict that stricter regulations might lead to a slight decrease in BNPL usage, particularly amongst those who previously relied on it without fully understanding the financial implications. However, responsible lending practices could ultimately lead to a healthier financial ecosystem.

Looking Ahead: A More Sustainable Future for BNPL?

The implementation of these enhanced consumer safeguards marks a crucial turning point for the BNPL industry. While the increased regulatory scrutiny might initially present challenges for some providers, it ultimately contributes to a more sustainable and responsible lending environment. The focus is shifting towards protecting consumers while allowing this convenient payment method to continue to thrive, albeit with greater transparency and accountability.

Further Reading: For more in-depth information on specific regulations in your region, consult your country's financial regulator website. [Link to relevant government website - replace with actual link].

Call to Action: Understanding your financial obligations is crucial. Before using any BNPL service, carefully review the terms and conditions and ensure you can comfortably manage the repayments.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Enhanced Consumer Safeguards: The Impact Of New Buy Now, Pay Later Regulations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Snls 50th Season Ends On A High Note Record Breaking Episode Details

May 20, 2025

Snls 50th Season Ends On A High Note Record Breaking Episode Details

May 20, 2025 -

Beyond The Screen Jamie Lee Curtis Shares Her Heartfelt Feelings For Lindsay Lohan

May 20, 2025

Beyond The Screen Jamie Lee Curtis Shares Her Heartfelt Feelings For Lindsay Lohan

May 20, 2025 -

Lufthansa Co Pilot Fainting Flight Continues Pilotless For 10 Minutes

May 20, 2025

Lufthansa Co Pilot Fainting Flight Continues Pilotless For 10 Minutes

May 20, 2025 -

Eurovision 2024 Go Jos Shock Exit Amidst Australian Film Copyright Drama

May 20, 2025

Eurovision 2024 Go Jos Shock Exit Amidst Australian Film Copyright Drama

May 20, 2025 -

5 B Invested In Bitcoin Etfs Understanding The Recent Market Momentum

May 20, 2025

5 B Invested In Bitcoin Etfs Understanding The Recent Market Momentum

May 20, 2025

Latest Posts

-

Market Rally Continues Six Day Win Streak For S And P 500 Amidst Moodys Rating Action

May 21, 2025

Market Rally Continues Six Day Win Streak For S And P 500 Amidst Moodys Rating Action

May 21, 2025 -

Big Changes Ahead Creator Greenlights New Peaky Blinders Series

May 21, 2025

Big Changes Ahead Creator Greenlights New Peaky Blinders Series

May 21, 2025 -

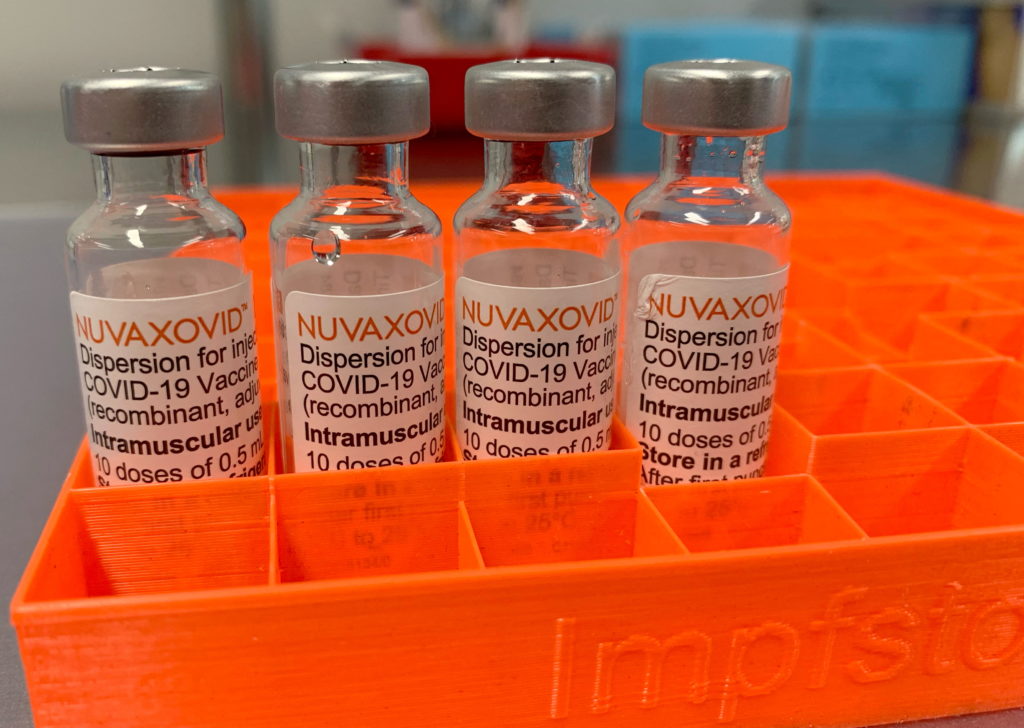

Novavax Covid 19 Vaccine Fda Approval Comes With Strict Conditions

May 21, 2025

Novavax Covid 19 Vaccine Fda Approval Comes With Strict Conditions

May 21, 2025 -

Assessing Justices Alito And Roberts Influence After Two Decades

May 21, 2025

Assessing Justices Alito And Roberts Influence After Two Decades

May 21, 2025 -

Massive Bitcoin Etf Investment 5 B Influx And Its Market Implications

May 21, 2025

Massive Bitcoin Etf Investment 5 B Influx And Its Market Implications

May 21, 2025