Market Update: Six-Day Win Streak For S&P 500 As Investors Ignore Moody's

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Update: S&P 500's Six-Day Win Streak Defies Moody's Downgrade

The S&P 500 has achieved a remarkable six-day winning streak, defying concerns sparked by Moody's recent downgrade of several US banking institutions. This unexpected surge has left market analysts scrambling to understand the driving forces behind this bullish trend, particularly in light of the negative credit rating news.

Moody's Downgrade and Market Resilience:

Moody's decision to downgrade the credit ratings of 10 small and mid-sized US banks sent ripples through the financial world. The agency cited concerns about the rising interest rate environment and potential pressures on banks' profitability and capital adequacy. Many predicted a negative market reaction, but the S&P 500's performance tells a different story. This resilience highlights the complexity of the current market landscape and suggests investors are focusing on other factors.

Factors Fueling the S&P 500's Rally:

Several key factors may be contributing to the S&P 500's impressive run:

- Strong Corporate Earnings: Despite economic headwinds, many companies have reported better-than-expected earnings, bolstering investor confidence. Positive earnings reports often outweigh concerns about broader economic uncertainty.

- Resilient Consumer Spending: Consumer spending remains relatively robust, indicating a level of economic strength that is supporting corporate performance. This continued spending suggests that the economy might be more resilient than some forecasts predicted.

- Easing Inflation Concerns: While inflation remains a concern, recent data suggests a potential easing of inflationary pressures. This could lead to less aggressive interest rate hikes by the Federal Reserve, a positive signal for the stock market.

- Investor Sentiment: Despite the Moody's downgrade, overall investor sentiment seems to be leaning towards optimism. This could be attributed to a combination of factors, including the aforementioned strong earnings and potential for a less hawkish Fed.

Analyzing the Disconnect:

The apparent disconnect between Moody's downgrade and the S&P 500's performance raises important questions. Are investors underestimating the potential risks associated with the banking sector downgrade? Or are they simply prioritizing the positive aspects of the current economic data? Some analysts suggest that the impact of the downgrade might be limited to smaller banks, leaving the broader market relatively unaffected. Others point to the possibility of a market "overreaction" to the positive earnings news, overshadowing the negative rating implications.

Looking Ahead: Uncertainty Remains:

While the current market trend is positive, uncertainty remains. The ongoing impact of rising interest rates, potential future economic slowdowns, and geopolitical risks all contribute to a volatile market environment. Investors should proceed with caution and maintain a diversified portfolio. Closely monitoring economic indicators and corporate earnings will be crucial in navigating this complex market landscape.

Keywords: S&P 500, Moody's, stock market, market update, six-day winning streak, US banks, credit rating downgrade, interest rates, inflation, investor sentiment, economic outlook, market analysis, stock market trends.

Call to Action: Stay informed about market developments by subscribing to our newsletter for daily market updates and insightful analysis. (Link to Newsletter Signup)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Update: Six-Day Win Streak For S&P 500 As Investors Ignore Moody's. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Client Data Breach Legal Aid Confirms Theft Of Sensitive Information Including Criminal Records

May 21, 2025

Client Data Breach Legal Aid Confirms Theft Of Sensitive Information Including Criminal Records

May 21, 2025 -

Former Olympic Champion Speaks Out The Emotional Toll Of A Demanding Coach

May 21, 2025

Former Olympic Champion Speaks Out The Emotional Toll Of A Demanding Coach

May 21, 2025 -

Data Breach At Legal Aid Agency Thousands Of Criminal Records And Personal Data Exposed

May 21, 2025

Data Breach At Legal Aid Agency Thousands Of Criminal Records And Personal Data Exposed

May 21, 2025 -

Espns Untold And Brett Favre A J Perez Reveals Threats From Favres Camp

May 21, 2025

Espns Untold And Brett Favre A J Perez Reveals Threats From Favres Camp

May 21, 2025 -

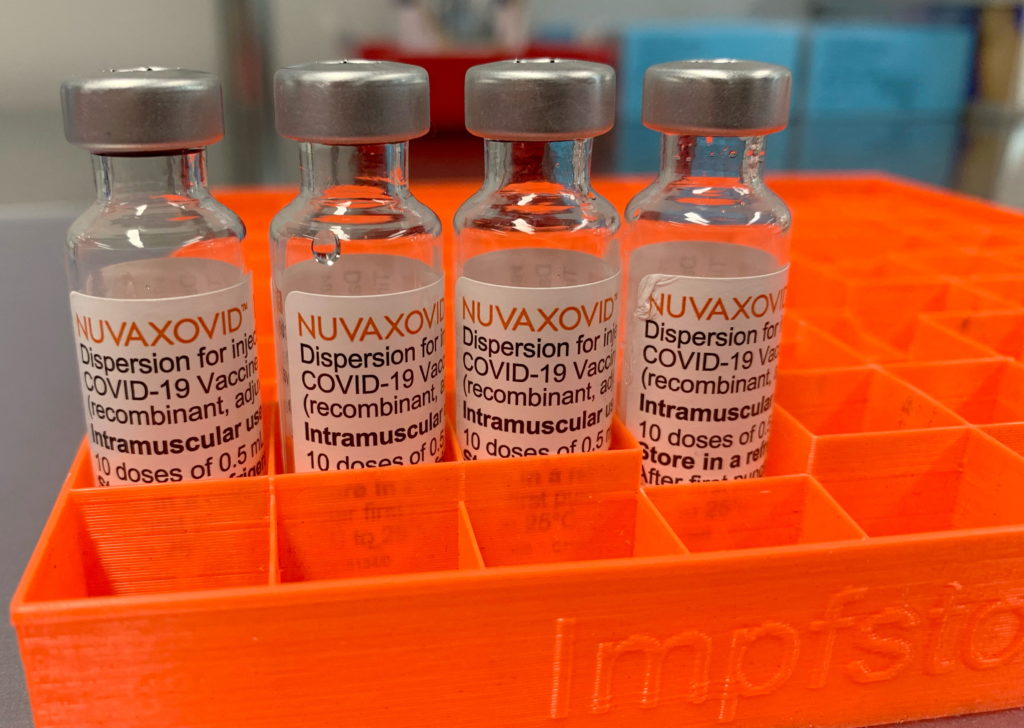

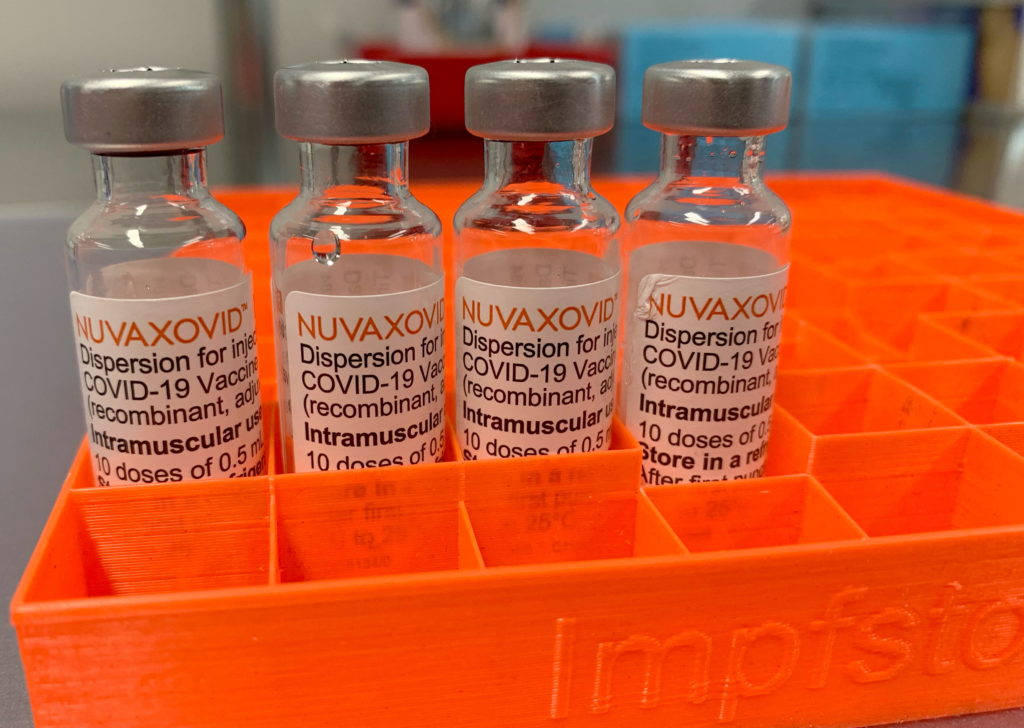

Novavax Covid 19 Vaccine Gets Fda Nod But With Significant Usage Restrictions

May 21, 2025

Novavax Covid 19 Vaccine Gets Fda Nod But With Significant Usage Restrictions

May 21, 2025

Latest Posts

-

Brexit Betrayal Claims Rock Eu Negotiations A Critical Juncture

May 21, 2025

Brexit Betrayal Claims Rock Eu Negotiations A Critical Juncture

May 21, 2025 -

Femicide Defining The Crime And Understanding The Trends

May 21, 2025

Femicide Defining The Crime And Understanding The Trends

May 21, 2025 -

Solving The Puzzle The Mass Extinction Of Pachyrhinosaurus In Canada

May 21, 2025

Solving The Puzzle The Mass Extinction Of Pachyrhinosaurus In Canada

May 21, 2025 -

Fda Approval For Novavax Covid 19 Vaccine Comes With Unusual Restrictions

May 21, 2025

Fda Approval For Novavax Covid 19 Vaccine Comes With Unusual Restrictions

May 21, 2025 -

Should Your Child Still Be Using A Pacifier Age And Weaning Tips

May 21, 2025

Should Your Child Still Be Using A Pacifier Age And Weaning Tips

May 21, 2025