Maximize Your Child's Future: The Power Of 529 Plans

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Maximize Your Child's Future: The Power of 529 Plans

Saving for your child's future education can feel daunting, but understanding the benefits of a 529 plan can significantly ease the burden and unlock opportunities. This powerful savings vehicle offers tax advantages that can make a substantial difference in funding your child's college education, or even vocational training. Let's explore why 529 plans are a crucial tool for securing your child's financial future.

What is a 529 Plan?

A 529 plan is a tax-advantaged savings plan designed specifically to help families save for qualified education expenses. These expenses include tuition, fees, room and board, and even certain books and supplies at eligible colleges, universities, and vocational schools. There are two main types:

- State-sponsored plans: Offered by individual states, these plans often come with in-state tax benefits. However, you can invest in any state's 529 plan regardless of your residency.

- Private plans: Managed by financial institutions, these plans may offer a wider range of investment options.

The Key Benefits of 529 Plans:

The primary advantage of a 529 plan lies in its tax benefits. Earnings grow tax-deferred, meaning you don't pay taxes on investment gains until you withdraw the money for qualified education expenses. Furthermore, withdrawals used for these expenses are generally tax-free at the federal level. This significant tax advantage can substantially boost your savings over time.

- Tax-Deferred Growth: Your investment grows without incurring annual tax liabilities.

- Tax-Free Withdrawals: Funds used for qualified education expenses are typically tax-free.

- Flexibility: You can change your investment options within the plan to adjust to your child's age and educational goals.

- Gifting Potential: You can make significant contributions upfront using gift tax rules, leveraging larger contributions within a short timeframe. Consult a financial advisor to explore these strategies.

- Potential State Tax Deductions: Many states offer state income tax deductions or credits for contributions made to their 529 plans. Check your state's specific rules for details.

Choosing the Right 529 Plan:

Selecting the right 529 plan requires careful consideration of your financial goals and risk tolerance. Factors to consider include:

- Investment Options: Different plans offer varying investment choices, ranging from conservative to aggressive options. Your choice should align with your time horizon and risk appetite.

- Fees: Compare the expense ratios and management fees associated with different plans to find the most cost-effective option.

- State Tax Benefits: Evaluate any potential state tax benefits associated with your state's 529 plan.

Beyond College: Unexpected Uses of 529 Plans

While primarily associated with college, 529 plans offer some flexibility. Under certain circumstances, you can withdraw funds for K-12 tuition expenses (with potential limitations and tax implications), though this is often subject to specific state regulations. Always consult a financial advisor before making any withdrawals.

Getting Started:

Opening a 529 plan is often a straightforward process. Many state websites provide detailed information and online application portals. However, seeking advice from a qualified financial advisor is crucial to ensure the plan aligns with your specific financial situation and long-term goals. Don't delay – starting early allows your savings to grow significantly over time.

Conclusion:

A 529 plan is an invaluable tool for securing your child's educational future. The tax advantages and flexibility make it a powerful investment vehicle. By understanding its benefits and carefully choosing a plan, you can significantly increase your chances of achieving your child's educational aspirations. Take the first step today and secure your child's tomorrow. Learn more about 529 plans by visiting the [link to a reputable financial website providing 529 plan information].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Maximize Your Child's Future: The Power Of 529 Plans. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

How The Republican Retirement Plan Impacts Americans In Their 30s

Jun 04, 2025

How The Republican Retirement Plan Impacts Americans In Their 30s

Jun 04, 2025 -

Roland Garros 2024 Sinner Addresses His Struggles Against Alcaraz

Jun 04, 2025

Roland Garros 2024 Sinner Addresses His Struggles Against Alcaraz

Jun 04, 2025 -

Singer Grace Potter Discusses Her Overlooked New Album

Jun 04, 2025

Singer Grace Potter Discusses Her Overlooked New Album

Jun 04, 2025 -

Texas Infants Life Changing Treatment Fish Skin Used To Heal Extensive Wound

Jun 04, 2025

Texas Infants Life Changing Treatment Fish Skin Used To Heal Extensive Wound

Jun 04, 2025 -

Copyright Clash She The People Creator Takes On Tyler Perry In Netflix Series Lawsuit

Jun 04, 2025

Copyright Clash She The People Creator Takes On Tyler Perry In Netflix Series Lawsuit

Jun 04, 2025

Latest Posts

-

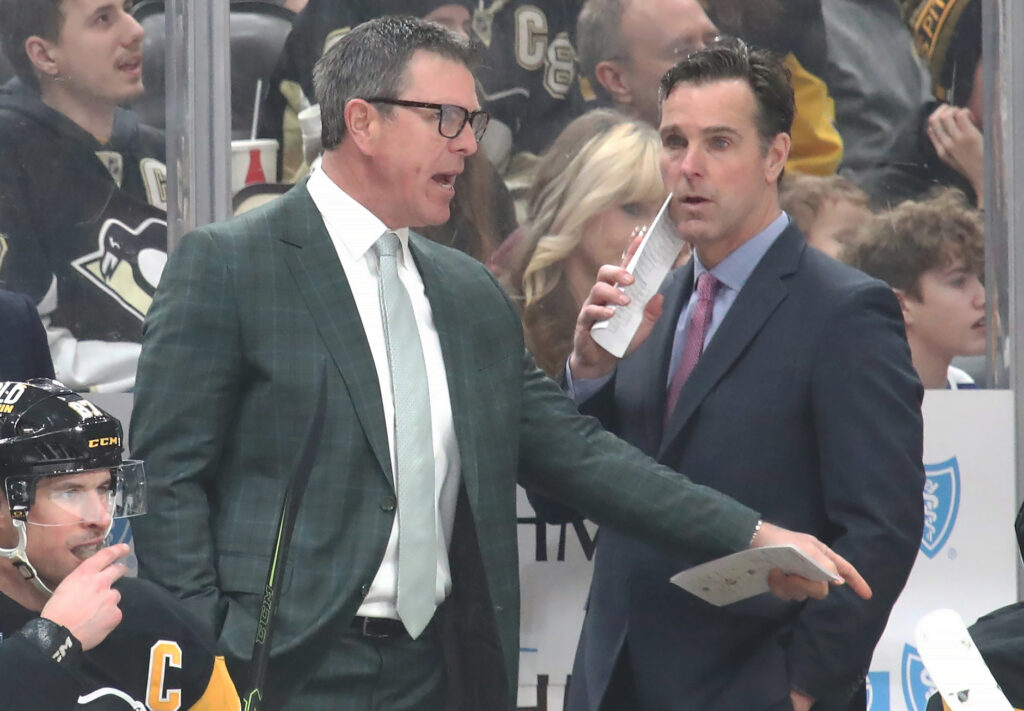

David Quinn And Joe Sacco Join Rangers Coaching Team

Jun 06, 2025

David Quinn And Joe Sacco Join Rangers Coaching Team

Jun 06, 2025 -

Harry Enten Deconstructs Mike Lindells Business And Political Career On Cnn

Jun 06, 2025

Harry Enten Deconstructs Mike Lindells Business And Political Career On Cnn

Jun 06, 2025 -

The Unique Demands Of Clay Why Roland Garros Is Different

Jun 06, 2025

The Unique Demands Of Clay Why Roland Garros Is Different

Jun 06, 2025 -

Is Coca Cola Ko Stock A Buy Analyzing The Investment Potential

Jun 06, 2025

Is Coca Cola Ko Stock A Buy Analyzing The Investment Potential

Jun 06, 2025 -

Madeleine Mc Cann Case Still Unsolved After 18 Years

Jun 06, 2025

Madeleine Mc Cann Case Still Unsolved After 18 Years

Jun 06, 2025