Moody's Downgrade Unshakes Market: S&P 500 Extends Winning Streak, Dow & Nasdaq Climb

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Moody's Downgrade Unshakes Market: S&P 500 Extends Winning Streak, Dow & Nasdaq Climb

Wall Street shrugs off Moody's downgrade, defying expectations and extending its recent rally.

In a surprising turn of events, the U.S. stock market continued its upward trajectory on Tuesday, extending its winning streak despite Moody's Investors Service downgrading 10 small and midsize banking companies and placing several more on review for downgrade. The S&P 500 closed higher, adding to its recent gains, while the Dow Jones Industrial Average and the Nasdaq Composite also saw significant climbs. This resilience showcases a market seemingly unfazed by the credit rating agency's negative outlook on the banking sector.

This unexpected market strength has left analysts scrambling to explain the disconnect between Moody's warnings and the robust market performance. Several factors may be contributing to this seemingly contradictory trend:

Why the Market Remains Resilient Despite Moody's Downgrade

-

Positive Earnings Reports: Strong second-quarter earnings reports from major corporations have fueled investor confidence. Companies across various sectors have exceeded expectations, boosting overall market sentiment and overshadowing concerns about the banking sector. This positive earnings momentum has likely played a significant role in mitigating the impact of Moody's downgrade. [Link to a reputable source on Q2 earnings reports]

-

Resilient Consumer Spending: Despite persistent inflation and rising interest rates, consumer spending remains relatively strong. This indicates a resilient economy, which is bolstering investor confidence and supporting the upward trend in the stock market. [Link to a reputable source on consumer spending data]

-

Federal Reserve's Stance: The Federal Reserve's recent pause in interest rate hikes has also contributed to the positive market sentiment. While further rate increases are anticipated, the pause suggests a potential slowing of the aggressive monetary tightening that had previously weighed on the market. This provides a degree of stability that investors seem to be responding to positively. [Link to a reputable source on Federal Reserve decisions]

-

Market's Short-Term Focus: The market's reaction may also reflect a short-term focus, with investors prioritizing the immediate positive news from earnings reports over the long-term concerns raised by Moody's. This short-term perspective could lead to a temporary disconnect between the credit rating agency's warnings and the market's overall performance.

What does this mean for investors?

The market's resilience in the face of negative news highlights the complex and often unpredictable nature of the stock market. While the Moody's downgrade raises valid concerns about the banking sector's stability, the broader market's positive performance suggests underlying strength in the economy. However, investors should remain cautious and closely monitor developments in both the banking sector and the broader economy. Diversification remains crucial for mitigating risk.

Looking Ahead:

While the current market trend is positive, it's crucial to avoid complacency. The long-term impact of Moody's downgrade, as well as potential future economic headwinds, remain to be seen. Investors should continue to monitor key economic indicators and carefully consider their investment strategies. Consulting with a financial advisor is always recommended for personalized guidance.

Keywords: Moody's, Downgrade, S&P 500, Dow Jones, Nasdaq, Stock Market, Banking Sector, Economy, Federal Reserve, Interest Rates, Earnings Reports, Investor Confidence, Market Volatility, Investment Strategy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Moody's Downgrade Unshakes Market: S&P 500 Extends Winning Streak, Dow & Nasdaq Climb. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Right Time To Wean Your Child From A Pacifier Or Thumb

May 20, 2025

The Right Time To Wean Your Child From A Pacifier Or Thumb

May 20, 2025 -

Commuters Fury The Rise Of Bare Beating On Public Transit Systems

May 20, 2025

Commuters Fury The Rise Of Bare Beating On Public Transit Systems

May 20, 2025 -

Exclusive Bbcs Insight Into The M And S And Co Op Cyberattack

May 20, 2025

Exclusive Bbcs Insight Into The M And S And Co Op Cyberattack

May 20, 2025 -

20 Run Loss For Scranton Analyzing The Yankees Prospect System

May 20, 2025

20 Run Loss For Scranton Analyzing The Yankees Prospect System

May 20, 2025 -

Balis Stricter Tourism Guidelines Curbing Bad Behavior

May 20, 2025

Balis Stricter Tourism Guidelines Curbing Bad Behavior

May 20, 2025

Latest Posts

-

Wall Street Rebounds S And P 500 Extends Winning Streak Despite Moodys Negative Outlook

May 20, 2025

Wall Street Rebounds S And P 500 Extends Winning Streak Despite Moodys Negative Outlook

May 20, 2025 -

The Last Of Us Proves Less Is More Heartbreak Without Nonstop Action

May 20, 2025

The Last Of Us Proves Less Is More Heartbreak Without Nonstop Action

May 20, 2025 -

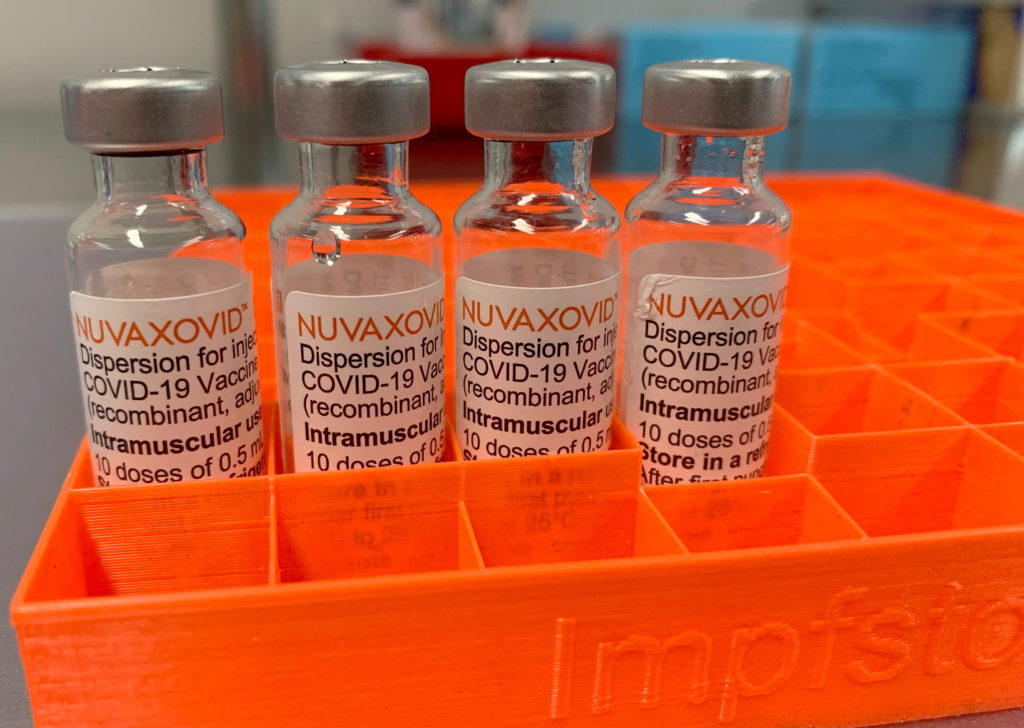

Conditional Fda Approval Novavax Covid 19 Vaccine Faces Usage Limits

May 20, 2025

Conditional Fda Approval Novavax Covid 19 Vaccine Faces Usage Limits

May 20, 2025 -

Fan Fury Over Jon Jones Strip The Duck Comment Aspinall And The Future Of The Ufc Heavyweight Division

May 20, 2025

Fan Fury Over Jon Jones Strip The Duck Comment Aspinall And The Future Of The Ufc Heavyweight Division

May 20, 2025 -

Death Of The Herd Investigating A Canadian Pachyrhinosaurus Fossil Bed

May 20, 2025

Death Of The Herd Investigating A Canadian Pachyrhinosaurus Fossil Bed

May 20, 2025