MPs Fight For Farmers: Call To Postpone Inheritance Tax Changes

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

MPs Fight for Farmers: Urgent Call to Postpone Inheritance Tax Changes

Farmers across the UK face a critical juncture as MPs from across the political spectrum unite in a powerful call to postpone the upcoming changes to inheritance tax (IHT). The proposed alterations, set to take effect in [Insert Date], threaten the viability of many family-run farms, a cornerstone of the British countryside and a vital part of the nation's food security. This move has sparked outrage and prompted a concerted effort from parliamentarians to protect the agricultural sector.

The proposed IHT changes, primarily focused on [Specifically mention the changes, e.g., the valuation of agricultural property, the inclusion of certain assets, etc.], are causing widespread concern. Many fear that these changes will force farmers to sell their land, breaking up generations of family legacies and potentially leading to a decline in domestic food production. This isn't just about money; it's about preserving a vital part of British heritage and ensuring food security for future generations.

The Impact on Family Farms

The implications for family farms are particularly severe. For generations, these farms have been passed down through families, often relying on careful financial planning to manage IHT liabilities. The new rules, however, drastically alter the playing field, creating unforeseen financial burdens that many simply cannot afford. This could lead to:

- Forced land sales: Farmers might be forced to sell off parts or all of their land to cover the increased IHT bill, fragmenting agricultural holdings and impacting efficiency.

- Loss of generational knowledge: The sale of family farms means the loss of invaluable agricultural knowledge and expertise passed down through generations.

- Reduced food production: The consolidation or sale of farms could negatively impact the UK's ability to produce its own food, increasing reliance on imports.

MPs' Response: A Cross-Party Coalition

Recognizing the devastating potential impact, MPs from both the Conservative and Labour parties, among others, are joining forces to lobby the government for a postponement. They argue that the current economic climate, coupled with the ongoing challenges facing the agricultural sector (e.g., Brexit, climate change, rising input costs), makes the timing of these changes exceptionally damaging.

"This isn't about giving farmers a tax break," stated [MP's Name and Party], a vocal advocate for the postponement. "It's about recognizing the unique challenges faced by family farms and ensuring the long-term sustainability of this vital sector. A rushed implementation of these changes will have catastrophic consequences."

The Path Forward: A Plea for Delay

The MPs' call for a postponement is not about permanently halting the changes, but rather about buying time. They are urging the government to conduct a thorough review of the impact assessment, taking into account the specific needs and vulnerabilities of the farming community. This review should consider alternative approaches that protect family farms while still ensuring a fair and equitable tax system.

This situation highlights the urgent need for a comprehensive agricultural policy that supports the long-term viability of family farms. The government must engage in meaningful dialogue with the farming community and address these concerns before irreversible damage is done. The future of British farming, and our food security, hangs in the balance.

What are your thoughts on the proposed IHT changes? Share your opinion in the comments below.

(Note: Remember to replace bracketed information with accurate details.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on MPs Fight For Farmers: Call To Postpone Inheritance Tax Changes. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Better Deal Eu Agreement And Winter Fuel U Turn Key Details Explained

May 18, 2025

Better Deal Eu Agreement And Winter Fuel U Turn Key Details Explained

May 18, 2025 -

Transparency Concerns State Officials Rome Travel And Corporate Funding

May 18, 2025

Transparency Concerns State Officials Rome Travel And Corporate Funding

May 18, 2025 -

Mps Fight For Farmers Call To Postpone Inheritance Tax Changes

May 18, 2025

Mps Fight For Farmers Call To Postpone Inheritance Tax Changes

May 18, 2025 -

Dodgers Dominant Win Ohtanis Two Home Runs Rushings Promising Start

May 18, 2025

Dodgers Dominant Win Ohtanis Two Home Runs Rushings Promising Start

May 18, 2025 -

Nine Killed In Russian Attack On Civilian Bus In Eastern Ukraine

May 18, 2025

Nine Killed In Russian Attack On Civilian Bus In Eastern Ukraine

May 18, 2025

Latest Posts

-

Atlantic Meridional Overturning Circulation Amoc Weakening Us Sea Level Rise Impacts

May 18, 2025

Atlantic Meridional Overturning Circulation Amoc Weakening Us Sea Level Rise Impacts

May 18, 2025 -

Beyond The Velvet Rope Analyzing Guest Behavior And Red Carpet Rules

May 18, 2025

Beyond The Velvet Rope Analyzing Guest Behavior And Red Carpet Rules

May 18, 2025 -

Istanbul Da Stres Seviyesi Alarm Verici Duezeyde Ibb Den Kritik Uyari

May 18, 2025

Istanbul Da Stres Seviyesi Alarm Verici Duezeyde Ibb Den Kritik Uyari

May 18, 2025 -

Minnesota Twins Extend Win Streak To 13 Games Behind Dominant Pitching

May 18, 2025

Minnesota Twins Extend Win Streak To 13 Games Behind Dominant Pitching

May 18, 2025 -

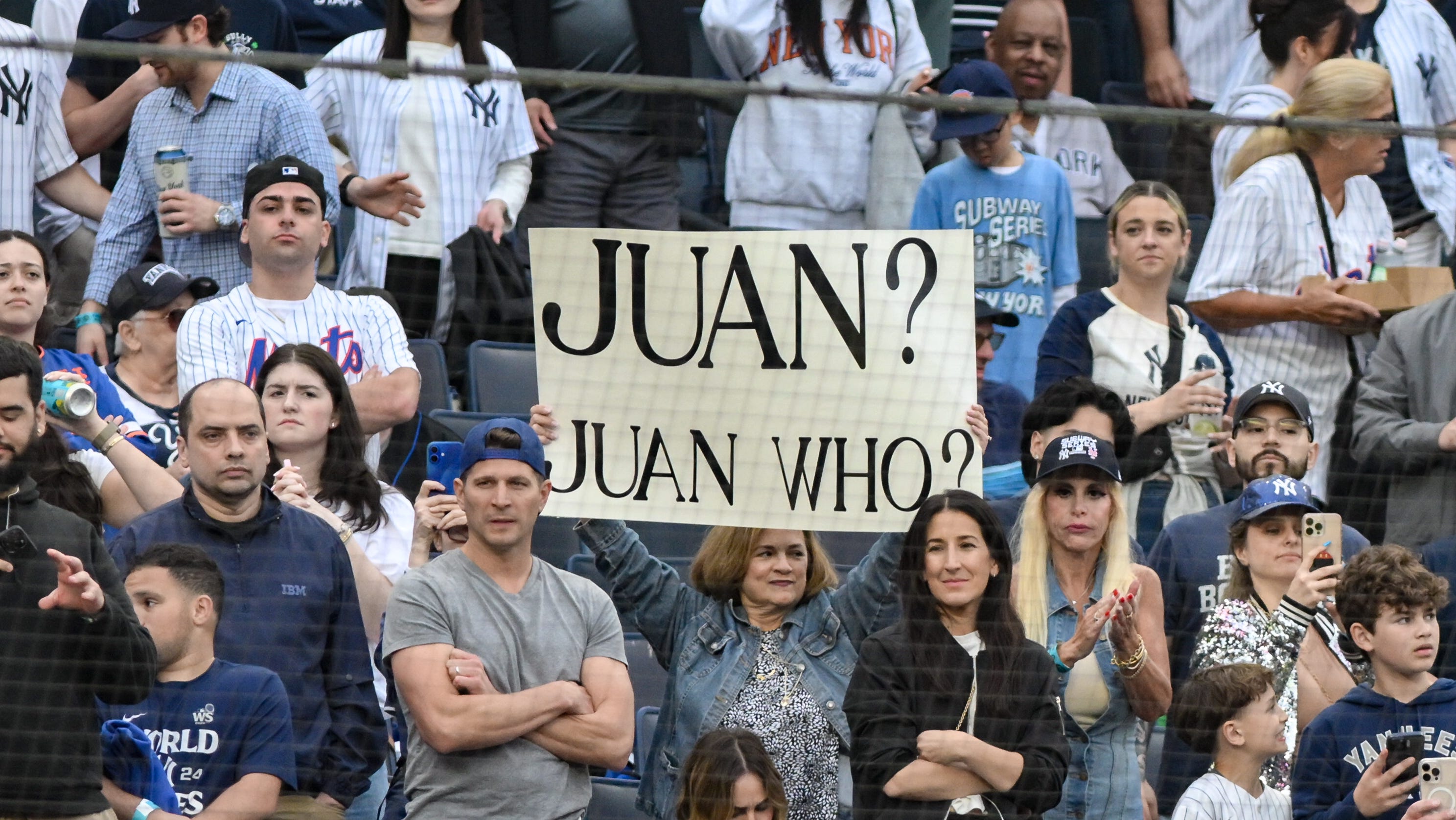

2025 Subway Series Stunning Images From The Yankees Mets Rivalry

May 18, 2025

2025 Subway Series Stunning Images From The Yankees Mets Rivalry

May 18, 2025